Key Takeaway: Monzo does not offer cryptocurrency trading services or wallets. However, Monzo users can transfer GBP to platforms authorised by the FCA, like eToro, to invest in digital currencies such as Bitcoin, Ethereum, and Solana.

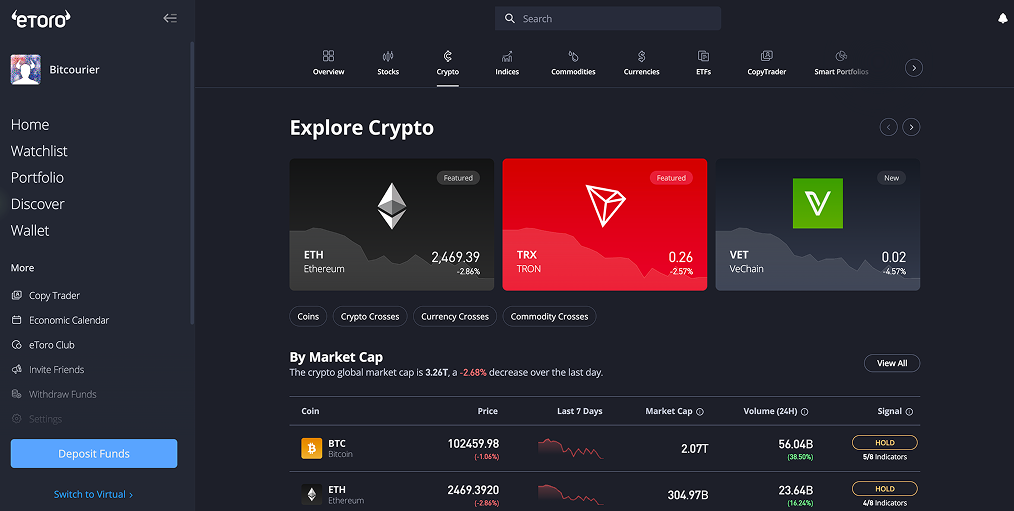

eToro is fully registered with the Financial Conduct Authority (FCA), supports trading over 70 crypto assets, and offers a secure trading environment with competitive fees for British investors.

How to Buy Bitcoin with Monzo Bank

Monzo clients interested in buying Bitcoin can easily fund their investments by transferring British Pounds (GBP) to a crypto exchange compliant with the Financial Conduct Authority (FCA) regulations.

An excellent choice is eToro, an FCA-registered trading platform offering access to more than 70 crypto assets, alongside traditional investment options like shares and ETFs.

Below is a quick guide for Monzo users to purchase Bitcoin through eToro:

- Create an eToro Account: Visit the eToro website, sign up for a free account, and complete the identity verification process (KYC) required by UK regulations.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Money: After logging into your eToro account, select "Deposit Funds" and choose "Bank Transfer" as your payment method. Send your desired amount of GBP and complete the deposit.

- Select Bitcoin: Navigate to the eToro trading dashboard, type “Bitcoin” or “BTC” into the search bar, and select the cryptocurrency to open its trading page.

- Buy Bitcoin: Enter the amount you wish to invest, carefully verify all transaction details, and finalise your Bitcoin purchase by confirming the trade.

Monzo’s Policy on Crypto Transactions

Monzo does not provide direct crypto trading or custody services but facilitates transfers to FCA-registered exchanges. Customers can fund accounts using debit cards or bank transfers directly from their Monzo account, but cannot use credit cards to make deposits.

The bank enforces a cryptocurrency transaction allowance of £5,000 within a rolling 30-day period to safeguard customers from the increasing risks of crypto-related scams and fraud. This allowance resets progressively as older transactions fall outside the 30-day window.

Monzo actively monitors all customer transactions, including crypto purchases, and may occasionally block high-risk payments, particularly if sent to unregulated or FCA-flagged platforms. The bank specifically blocks payments to Binance following a consumer warning issued by the Financial Conduct Authority (FCA).

Crypto Trading Fees

Monzo Bank account holders purchasing cryptocurrencies on platforms like eToro should fully understand trading costs. Here's a clear breakdown of eToro’s fees for crypto transactions:

- Trading Fee: eToro applies a set 1% fee on all crypto trades, which is built directly into the quoted price displayed when buying or selling digital currencies.

- Market Spreads: Although eToro doesn't add extra charges for spreads, investors need to consider the typical market spread, the difference between the buying and selling price, which fluctuates depending on asset liquidity and market conditions.

- Withdrawal Costs: Monzo customers benefit from eToro's free withdrawals when transferring GBP or EUR back into their bank accounts, simplifying the process of accessing funds.

eToro’s transparent fee structure enables Monzo Bank customers to invest in digital currencies without hidden charges or unexpected expenses.

Best GBP Deposit Methods for Monzo Bank

Funding your eToro crypto account from Monzo Bank is straightforward, with various reliable GBP deposit options available:

- Faster Payments Service (FPS): Monzo customers can deposit GBP instantly using FPS, free of charge. This option allows quick transfers without additional transaction fees or restrictions imposed by eToro.

- Debit Card (Visa and MasterCard): Deposits made via Monzo debit cards appear instantly in your eToro wallet. Each card transaction allows deposits of up to £30,000.

- eToro Money: Ideal for larger transactions, eToro Money enables Monzo users to make substantial deposits swiftly, supporting individual transfers of up to £400,000.

When withdrawing funds, Monzo account holders can easily receive GBP transfers at no extra cost through Faster Payments.

What is Monzo Bank?

Monzo Bank, founded in 2015, is a UK-based digital bank that operates entirely through a mobile app, offering a modern alternative to traditional banking. With over 9 million customers as of 2024, the bank provides various services, including personal and business current accounts, savings options, loans, and budgeting tools.

Monzo's user-friendly app features real-time spending notifications, budgeting insights, and the ability to create savings pots, making financial management more accessible.

Conclusion

While Monzo doesn’t offer crypto trading directly, it bridges traditional banking with cryptocurrency investments by facilitating secure transfers to FCA-registered platforms like eToro.

To invest safely, always verify fees, transaction limits, and the latest policies. Staying informed and choosing trusted exchanges helps protect your funds and ensures a safe crypto investment experience.

usdt

usdt bnb

bnb