Key Takeaway: Royal Bank of Scotland (RBS) does not provide direct crypto trading services. However, RBS customers can transfer GBP from their bank accounts to a trusted exchange licensed by the Financial Conduct Authority (FCA).

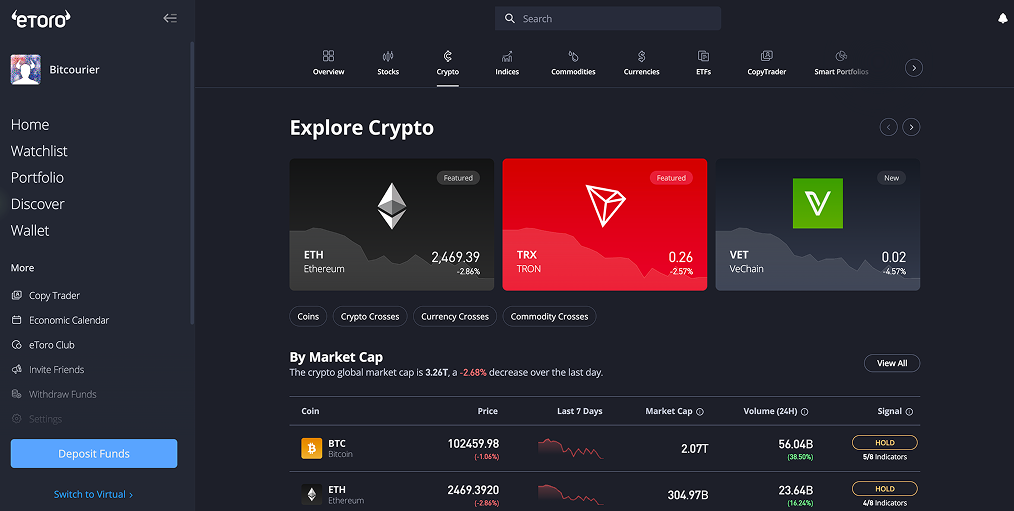

eToro is an FCA-registered exchange that supports over 70 cryptocurrencies and also offers access to other financial instruments, including thousands of shares and ETFs.

How to Buy Bitcoin with Royal Bank of Scotland

Royal Bank of Scotland clients can buy cryptocurrencies like Bitcoin by transferring funds to crypto trading platforms authorised by the Financial Conduct Authority (FCA).

One of the top picks is eToro, an FCA-registered exchange supporting cryptocurrencies, shares, and ETFs. Depositing GBP to your eToro account from RBS is simple through options such as bank transfer, debit cards, or the Faster Payments service.

Follow this guide to buy Bitcoin using Royal Bank of Scotland and eToro:

- Open Account: Visit the official eToro website, sign up for a new account, and verify your identity through standard Know Your Customer (KYC) procedures.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Deposit Funds: Log into your eToro account, click the "Deposit Funds" option, select your preferred deposit method, and initiate the GBP transfer from your RBS account.

- Select Bitcoin: Use the search function, type in "Bitcoin" or "BTC," and choose it from the list provided.

- Make Your Purchase: Enter the GBP amount you’d like to invest, carefully check the details of your transaction, and finalise the purchase to add Bitcoin to your portfolio.

Royal Bank of Scotland’s Policy on Crypto Transactions

RBS explicitly warns customers about the potential risks associated with cryptocurrency investments. Although cryptocurrencies have grown increasingly popular, RBS emphasises these digital assets are not protected by the Financial Services Compensation Scheme (FSCS).

To protect customers from fraud, RBS restricts certain crypto transactions, such as cryptocurrency purchases made with credit cards issued by the bank. Additionally, transactions made through debit cards or Faster Payments to certain crypto exchanges may be subject to temporary blocks to verify authenticity and mitigate potential fraud.

The bank encourages customers to thoroughly research and independently verify any cryptocurrency-related investment. Customers should ensure they retain full personal control over their digital currency wallets and confirm the legitimacy of cryptocurrency exchanges by checking if their chosen platform is registered with the Financial Conduct Authority (FCA).

Crypto Trading Fees

Before investing in crypto through exchanges, RBS account holders should consider the associated fees. Here’s a breakdown of eToro’s fees for investors:

- Transaction Fees: eToro applies a clear fee of 1% per cryptocurrency trade. This charge is automatically factored into the displayed transaction price.

- Price Spreads: Although eToro does not levy additional spreads, investors should understand market spreads, which are the difference between the buying and selling prices. These market spreads can fluctuate based on market volatility and liquidity.

- Withdrawal Charges: RBS account holders benefit from zero withdrawal fees when transferring funds back from eToro into their British pounds (GBP) accounts.

By clearly communicating fees upfront, eToro ensures RBS customers have complete clarity on costs, enabling confident and informed cryptocurrency investing without hidden charges.

Best GBP Deposit Methods for RBS

RBS clients looking to fund cryptocurrency purchases on eToro can use multiple convenient deposit methods in GBP:

- Faster Payments: Users can securely deposit funds into eToro via Faster Payments. This method typically processes transactions swiftly, often within a few hours.

- Debit Card: Instant deposits are also available for RBS customers using debit cards (Visa or MasterCard). This method enables immediate availability of funds on eToro.

For withdrawals, transferring funds from eToro back into an RBS account is free through bank transfers, ensuring a seamless experience when cashing out your cryptocurrency investments.

What is Royal Bank of Scotland (RBS)?

The Royal Bank of Scotland (RBS), established in 1727, is one of the UK's oldest and most prominent financial institutions. Headquartered in Edinburgh, RBS operates primarily as a retail and commercial bank, serving individuals, businesses, and corporations across the United Kingdom.

In 2000, RBS expanded its footprint by acquiring National Westminster Bank (NatWest), and in 2020, the group rebranded as NatWest Group, with RBS continuing as a key brand within the group.

Conclusion

Royal Bank of Scotland does not directly offer crypto trading or custody services. However, customers can securely access cryptocurrencies through regulated FCA-licensed exchanges like eToro.

To safely invest, always verify exchange legitimacy, understand all associated fees clearly, and use secure payment methods such as Faster Payments or debit cards. By taking these steps, RBS account holders can confidently diversify their portfolios and manage potential risks involved with cryptocurrency investing.

usdt

usdt xrp

xrp