Key Takeaway: Interactive Brokers enables trading in popular S&P 500 ETFs such as SPDR’s SPY; however, its comparatively higher fees and less favorable spreads can erode returns over time.

Investors seeking to minimise costs would benefit from using eToro, which offers zero commission trading, tighter spreads, and maintains global regulatory compliance.

Can I Buy the S&P 500 with Interactive Brokers?

Yes, Interactive Brokers (IBKR) enables users to purchase S&P 500 ETFs. However, IBKR may not be the most affordable option for many traders as it charges trading commissions, currency conversion fees, depositing fees, and market data fees.

Investors aiming to lower fees, secure better spreads, and benefit from stronger platform security should consider alternative brokers such as eToro or DEGIRO, which provide commission-free trades, tighter spreads, and comprehensive trading options.

How to Buy the S&P 500 with Interactive Brokers

While Interactive Brokers provides access to popular S&P 500 ETFs like SPDR SPY and Vanguard VOO, the platform’s relatively high trading fees and wide spreads can diminish returns.

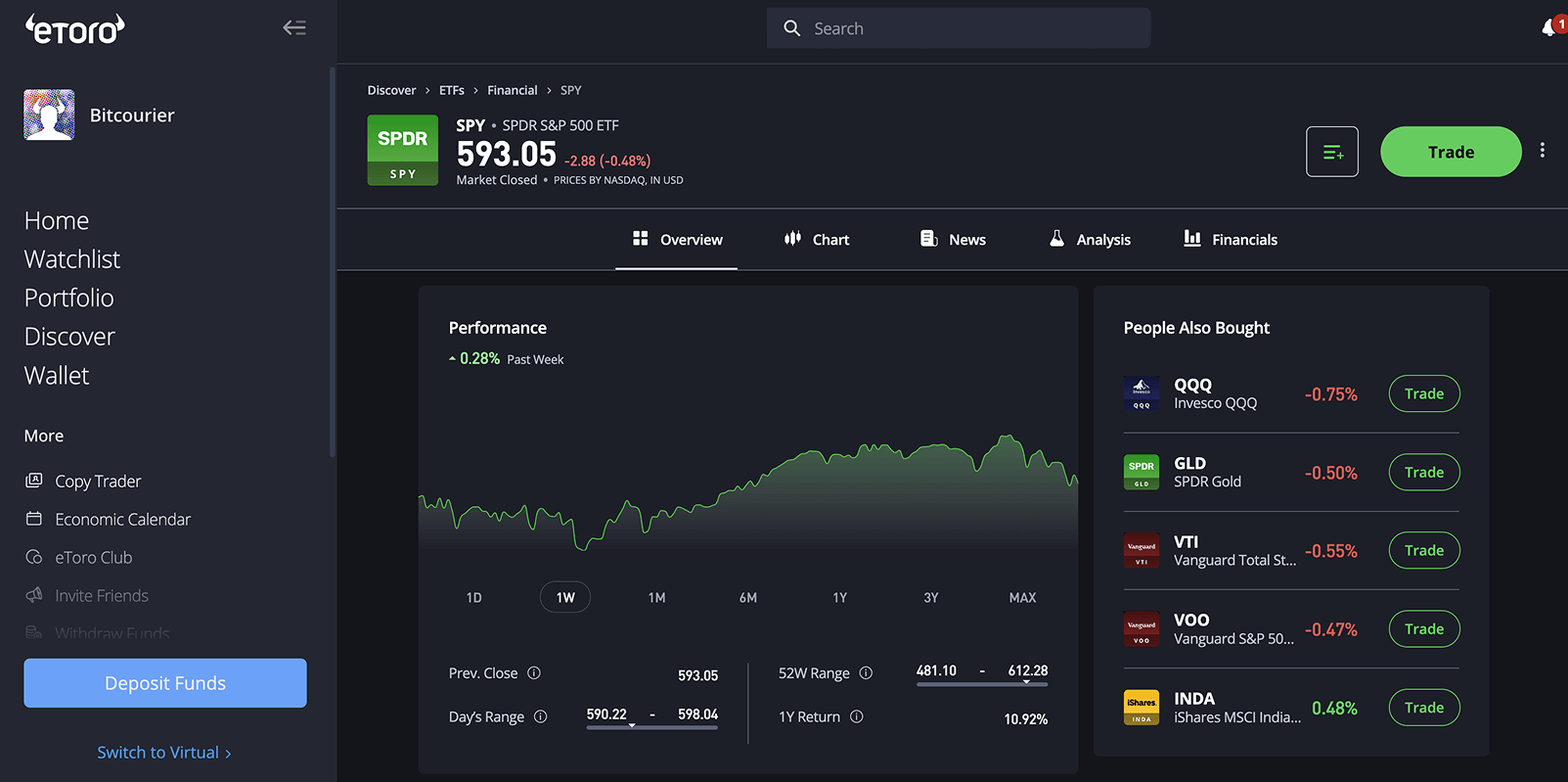

A smarter approach is to transfer funds to a lower-cost broker such as eToro. Regulated by the FCA in the UK, authorised across Europe, and trusted by millions of global investors, eToro offers a safer and more affordable way to invest in the S&P 500.

Follow these steps to buy the S&P 500 with eToro:

- Sign Up: Visit eToro’s website, open an account, and quickly verify your identity.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY - Fund Account: Deposit your investment funds via bank transfer, debit card, or alternative payment methods.

- Select an S&P 500 ETF: Use the search function to locate your preferred ETF.

- Complete Purchase: Choose the amount to invest, double-check your order details, and finalise your trade.

Interactive Broker Fees for S&P 500 ETF

Interactive Brokers (IBKR) fee structure can be less favorable for frequent or smaller investors. Here is a summary of the platform’s fees:

- Tiered Commission Pricing: For American ETFs, IBKR's tiered pricing charges between $0.0005 and $0.0035 per share, depending on monthly trading volume. A minimum commission of $0.35 per trade applies.

- Fixed Commission Pricing: Alternatively, a fixed rate of $0.005 per share is available, with a $1.00 minimum per order.

- Market Data Fees: Accessing real-time market data incurs additional monthly fees, depending on the exchanges and data packages selected.

- Currency Conversion Fees: IBKR typically adds 0.03% to the exchange rate that would otherwise apply for currency trades executed under the auto currency conversion service.

Investors seeking a more affordable and user-friendly platform might consider eToro. eToro offers commission-free trading on ETFs and provides a straightforward fee structure without additional charges for market data or currency conversions.

Is Interactive Brokers Good for Investing in ETFs?

IBKR offers access to a wide range of ETFs, including popular options like SPDR S&P 500 ETF Trust (SPY) and Vanguard S&P 500 ETF (VOO). For investors who prioritise advanced trading tools and global market access, IBKR provides a comprehensive platform.

For those seeking a more affordable and user-friendly platform, eToro presents an alternative. eToro offers commission-free trading on ETFs, including SPY and VOO, and provides a straightforward fee structure without additional charges for market data or currency conversions.

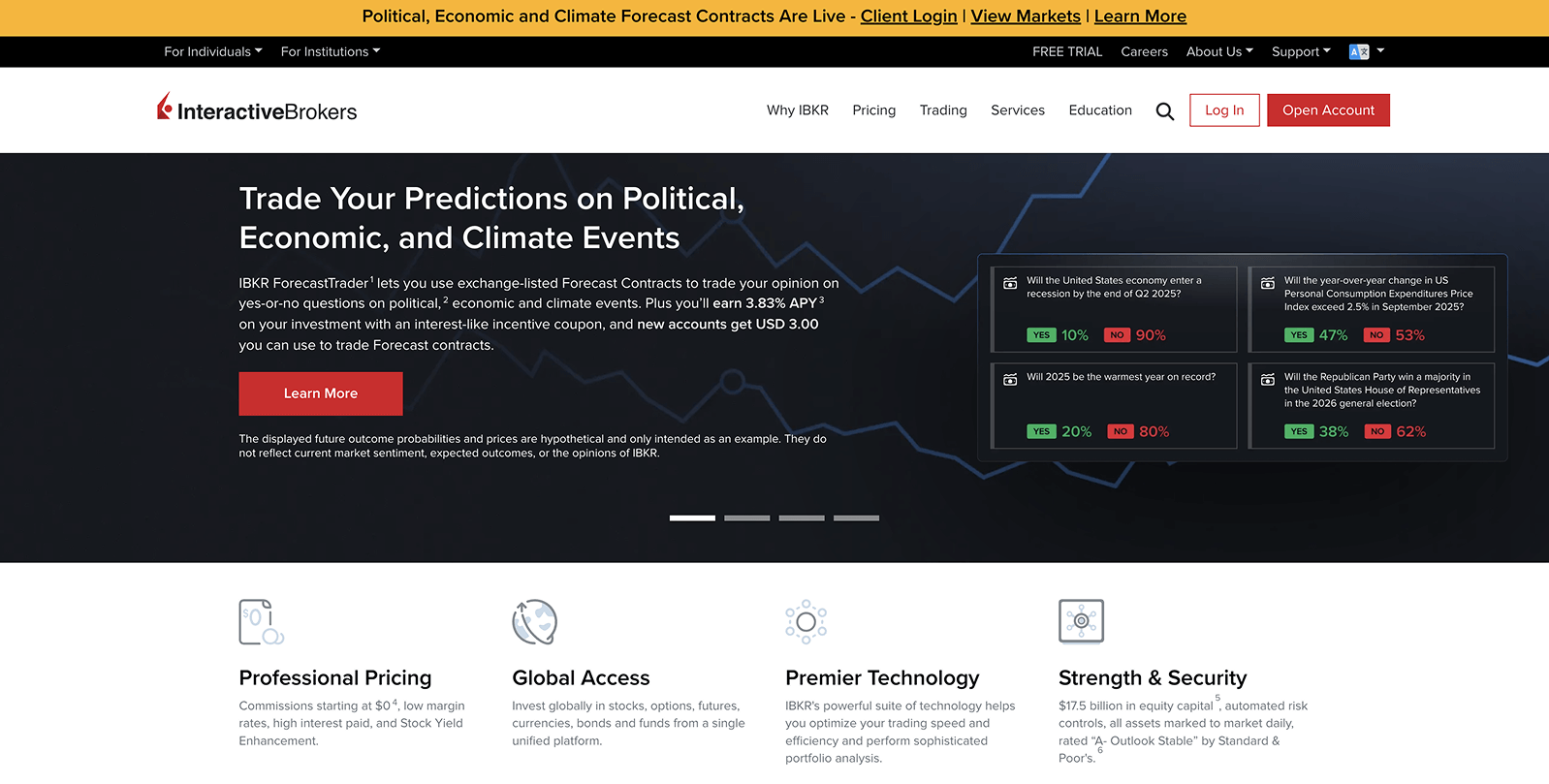

What is Interactive Brokers?

Interactive Brokers (IBKR) is a global brokerage firm renowned for its comprehensive trading platform. Established in 1978, IBKR offers access to over 160 markets across more than 200 countries, enabling clients to trade diverse assets, including stocks, options, futures, currencies, bonds, and funds from a single unified platform.

IBKR's advanced trading tools and technologies, such as the Trader Workstation (TWS), support sophisticated portfolio analysis and risk management, appealing to active traders and professionals. Additionally, the company maintains robust financial strength, with $17.5 billion in equity capital and an "A- Outlook Stable" rating from Standard & Poor's.

Conclusion

Interactive Brokers delivers extensive access to global markets and advanced trading tools, but its fees can quickly add up, impacting overall returns for investors in S&P 500 ETFs.

For those focused on reducing costs and simplifying their investment process, eToro is a stronger choice, offering commission-free ETF trading, tighter spreads, and comprehensive regulatory security. Carefully evaluating your trading frequency, budget, and investment strategy will guide you toward the platform best suited to maximise your financial outcomes.

usdt

usdt xrp

xrp