If there was a way to earn multiple times the amount you invested in a certain crypto within a few hours or days, would you seize the opportunity? Crypto launchpads offer almost a guarantee of such returns, albeit with risks that potential investors must understand before putting their money on the line.

If you’ve ever bought into a launchpad project and either lost or made money, then you’ll understand why people search for the best crypto launchpads. If you only buy penny cryptocurrencies and haven’t participated in the launchpad, then you’ll gain valuable insight from reading this article.

Table of Contents

First, we try to explain crypto launchpads in the simplest way possible.

What are Crypto Launchpads?

These are platforms that allow investors to buy into new cryptocurrency projects before the tokens are publicly released. Launchpads are usually operated by a crypto exchange or a different project dedicated to that purpose.

To fully understand how launchpads work, you need to understand how new crypto projects raise money for their product or service.

- A new project comes up with a product or service they want to develop.

- They will create a token that will form an integral part of their planned platform

- They sell these tokens first to early investors to raise money.

- The token is then released in the public market

- As the project grows and the token’s price increases, investors make money, but earlier investors who got in at a cheaper price make even more.

In 2017 and earlier, most new projects conducted their token sales directly on their website, distributing tokens to investors that buy their tokens at a specified price. The process was known as an initial coin offering (ICO), and investors would have to hold the token until it gets listed on an exchange.

However, after 99% of ICOs turned out to be scams and the crypto market crashed, investors were no longer confident in investing in such projects. The underlying problem was that most new investors lacked the knowledge and expertise to analyse new crypto projects and thus were putting money into literally anything that looked flashy.

Meanwhile, crypto exchanges saw the revenue opportunity and grabbed it with both hands. They would take on the job of researching many new projects, and based on their findings, they partner with the project to conduct a token sale on their exchange platform.

The method worked out since the exchange already had users and potential investors looking to buy into new projects. Investors also relied on the vetting process used by the exchange, thus reducing the risks of them investing in apparent scams.

The new process of conducting token sales on centralized exchanges (CEXes) like Binance was then called initial exchange offering (IEO), and the platform used by the exchange to handle such sales was called launchpad.

In recent times, decentralized exchanges (DEXes) have emerged and also offer opportunities for investors to buy into new crypto projects. This token sales process is called initial DEX offering, and the platform or service that DEXes uses to provide this is also called a launchpad.

In summary, any platform that raises funds for new crypto projects by allowing you to buy tokens before they’re publicly released is known as a crypto launchpad.

With that clear understanding, we’ll now go offer some of the best crypto launchpads on the market today. This list includes token sales platforms from both centralized and decentralized exchanges.

Best Cryptocurrency Launchpads

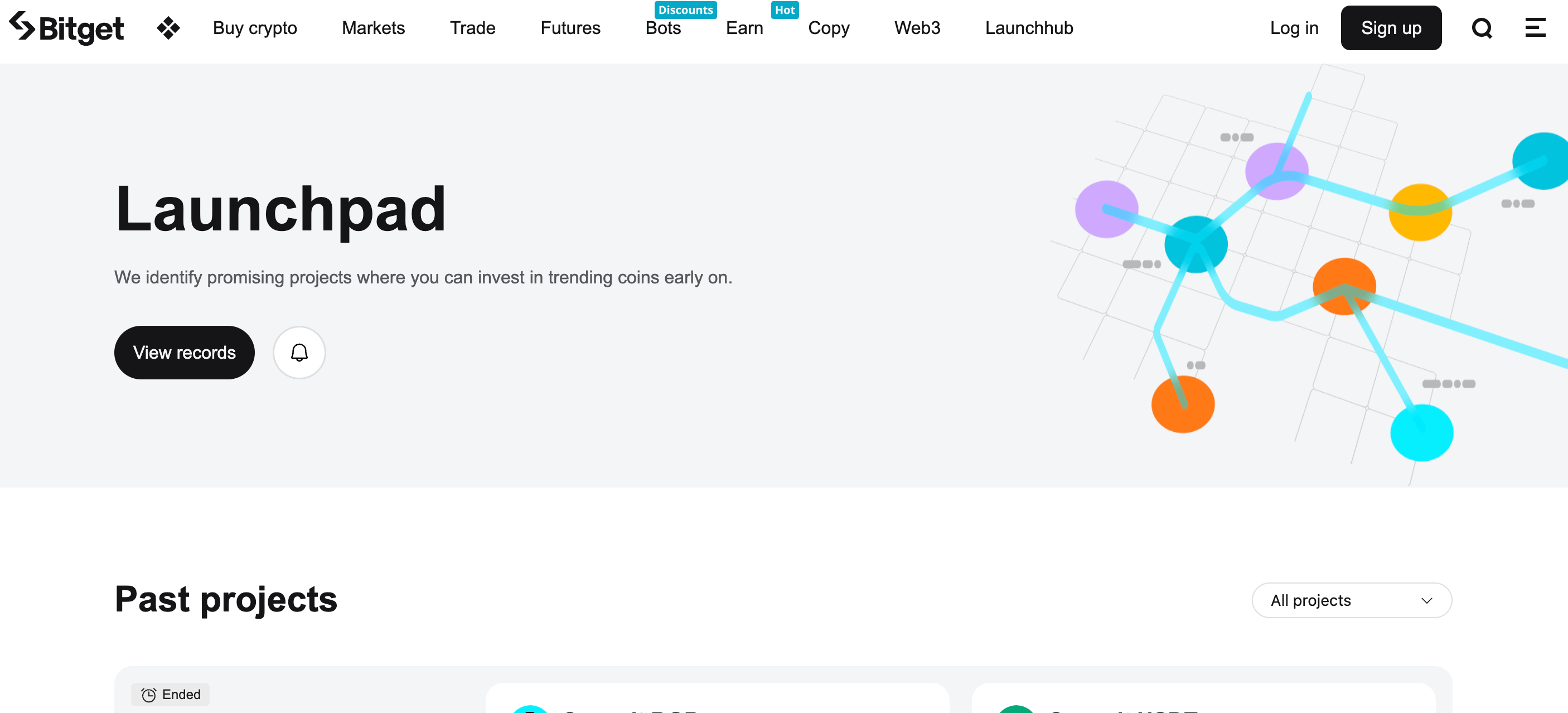

Bitget Launchpad

Bitget, a widely known crypto exchange, introduced the first project in its launchpad in January 2022. Like most launchpads, Bitget Launchpad allows users to gain exposure to promising crypto projects in their early stages. Participants purchase the new project’s native token with the hopes of potential growth over time.

To participate in an IEO on Bitget Launchpad, users must complete the Know Your Customer (KYC) procedure and purchase Bitget’s native cryptocurrency, BGB.

Bitget Launchpad features various projects, including MyShell (SHELL), Panda Farm (BBO), T2T2 (T2T2), TonUP (UP), and Typelt (TYPE).

Pros

- Instant access to liquidity upon token listing.

- The process of participating in the launchpad is easy.

- Bitget has an operational license under the UK’s FCA.

Cons:

- Users cannot participate without holding Bitget’s BGB token.

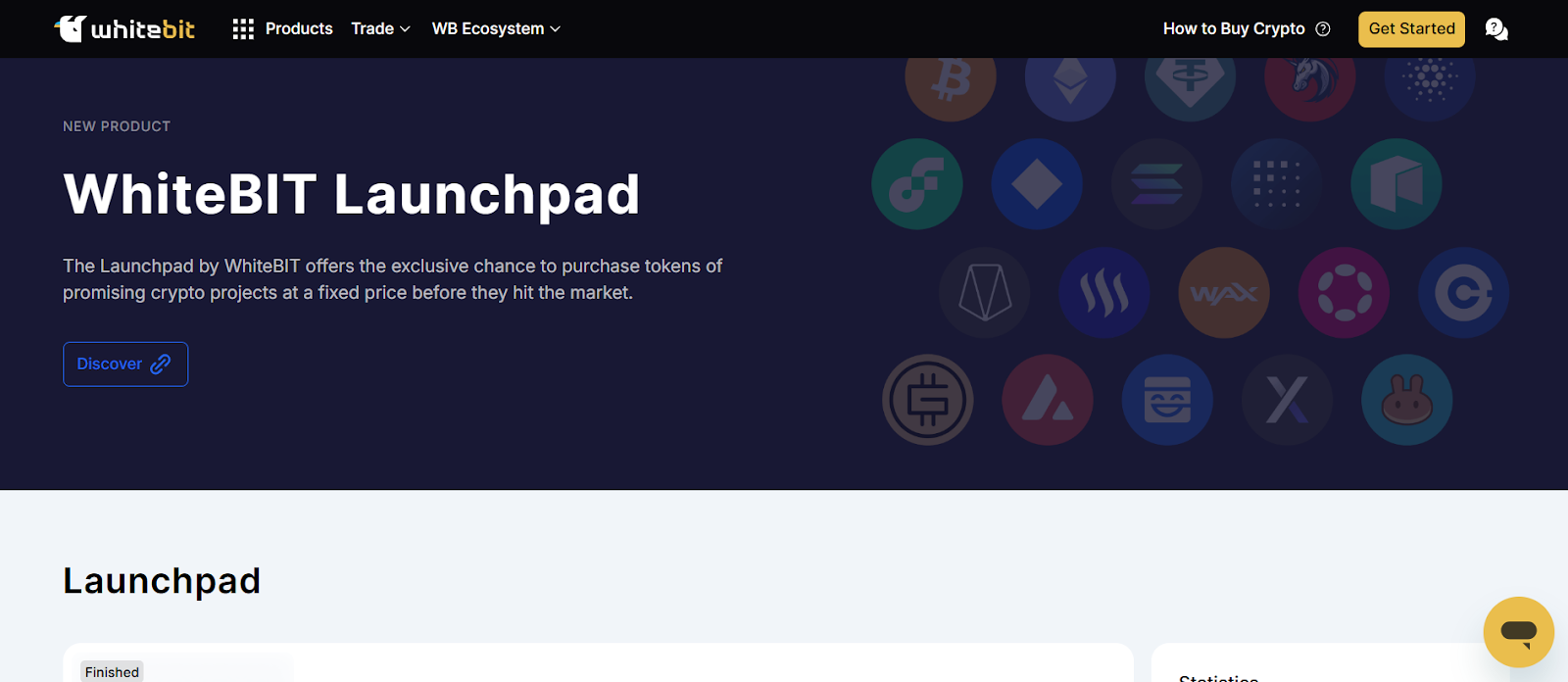

WhiteBIT Launchpad

WhiteBIT, a well-known European cryptocurrency exchange, offers its Launchpad platform to support emerging crypto projects raising funds through token sales. The initiative provides users early access to new tokens before publicly listing them.

To participate in WhiteBIT Launchpad events, users must hold at least 200 WBT (approximately £4,290) in their Holding account, which qualifies them for Level 2 Holding. Holding more WBT increases the USDT allocation a user can commit during the voting process, allowing for greater participation.

Since its inception, WhiteBIT Launchpad has featured several projects, including Scamfari (SCM), ivendPay (IVPAY), and Lecksis Token (LEKS). For context, Scamfari tracks fraudulent wallets, ivendPay enables crypto payments, and Lecksis Token supports secure messaging and anonymous transactions.

Pros

- WhiteBIT conducts thorough due diligence to ensure only credible and promising projects are featured on its launchpad.

- Participants also gain early access to promising tokens at a fixed price before they become available on the open market.

- Tokens from successful launchpad projects are listed on WhiteBIT, boosting credibility and confidence for potential investors.

Cons

- Due to regulatory constraints, WhiteBIT’s services may not be available in certain jurisdictions.

- WhiteBIT’s imposition of 200 WBT (appr. £4,290) as a minimum participation requirement is high for investors with limited funds.

- Some projects implement vesting schedules, meaning participants receive their tokens gradually over a set period rather than immediately.

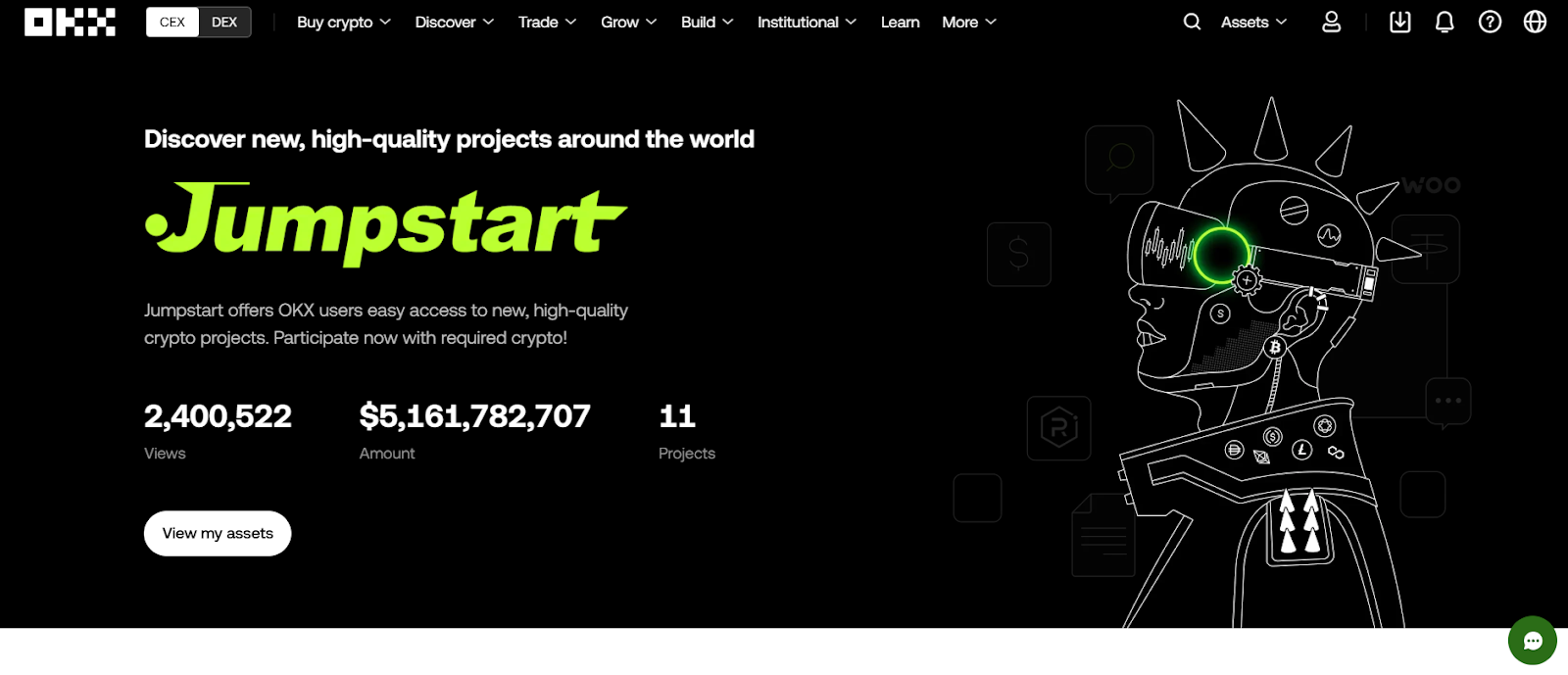

OKX Jumpstart

OKX, one of the leading crypto exchanges globally, offers its launchpad services through the OKX Jumpstart. This feature enables users to access early-stage cryptocurrency and NFT projects. OKX offers two primary launchpad services: OKX Jumpstart and OKX NFT Launchpad.

Launched in March 2019, OKX Jumpstart is designed to help new blockchain projects raise funds from the community of investors on the OKX exchange. The platform allows users to acquire tokens of promising projects before they are officially listed on the exchange.

Participation typically requires users to hold OKB tokens and complete identity verification (KYC). The platform has supported various projects, including Sui Network (SUI), Taki (TAKI), and Element.Black (ELT).

Similarly, the OKX NFT Launchpad platform focuses on the initial offerings of NFTs. Users can discover curated projects involving artists, creators, and celebrities.

The NFT Launchpad supports various event types, such as allowlist raffles, flash sales, minting events, and auctions. To participate, users need to connect their wallets and may be required to complete specific tasks, especially for allowlist events.

In March 2024, OKX partnered with Immutable to launch a GameFi NFT platform, integrating OKX Wallet with Immutable’s zkEVM chain for wider NFT access.

Pros

- Users can acquire tokens and NFTs before public listings.

- KYC verification and project screening reduce scam risks.

- Supports token (OKX Jumpstart) and NFT (OKX NFT Launchpad) sales.

- Simple user interface makes participation easy.

Cons

- Some launches require staking tokens or completing tasks, which can be time-consuming and complicated for users.

- Limited allocations due to high demand make participation difficult.

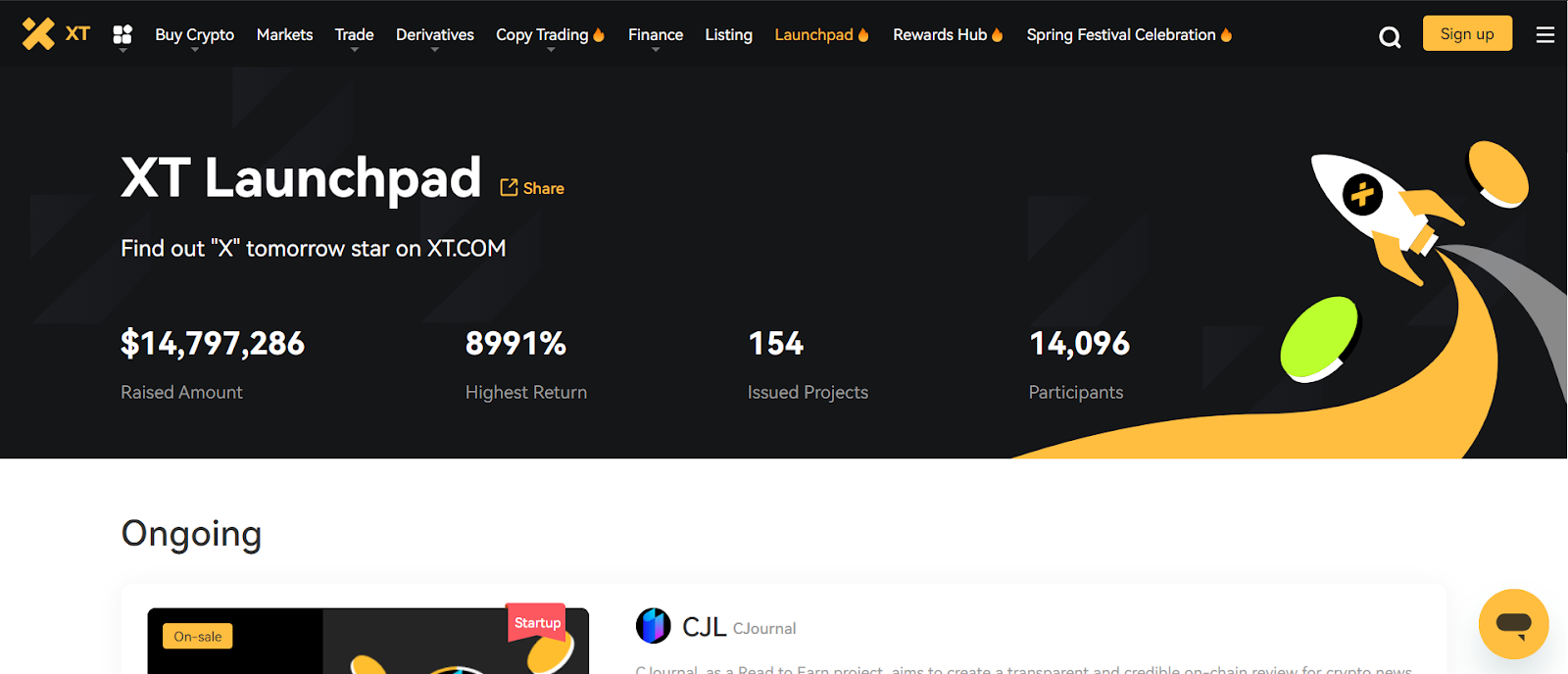

XT Launchpad

The XT Launchpad is a platform developed by XT.com, a global cryptocurrency exchange designed to offer project launches and token sales for new blockchain and crypto projects. It is a launchpad for new projects, giving them exposure and access to a community of crypto enthusiasts and investors.

The platform enables blockchain projects to raise funds through token sales and IEOs, offering them exposure. It also connects crypto enthusiasts and investors with early-stage projects, allowing users to participate before they are listed on the exchange.

Remarkably, XT Launchpad has issued projects like ALITA GOLD (ALITA), FUFO CAT (FUFO), EverValue Coin (EVAL), and Grabway (GRAB). Meanwhile, the platform ensures security and transparency by protecting users' funds and vetting projects to reduce risks.

Pros

- Ensures users’ funds and data are protected during token sales.

- Helps new crypto projects gain visibility and funding.

- Features a variety of tokens from different sectors.

- Provides a simple interface for participating in token sales.

Cons

- Some regions may have restrictions on using the platform.

- It may not have as much history or reputation as top-tier launchpads.

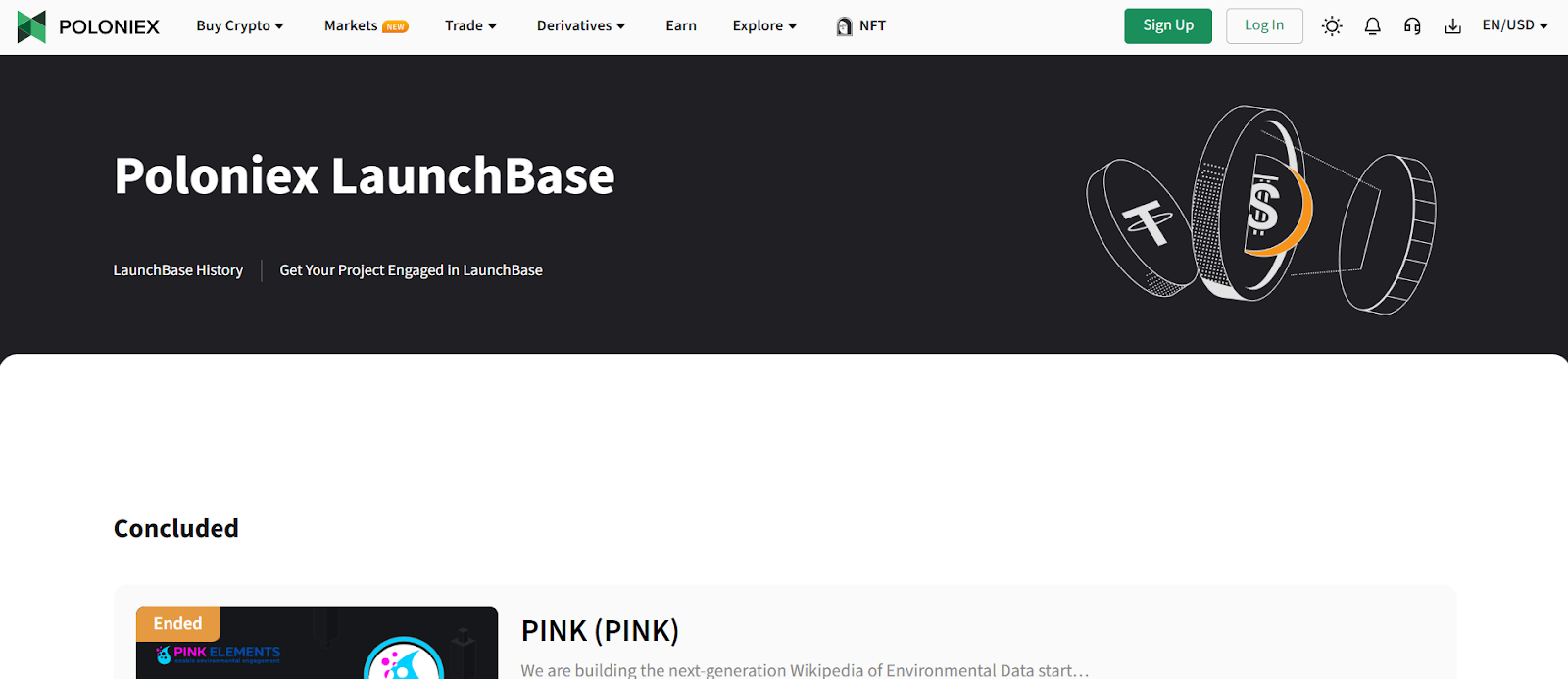

Poloniex LaunchBase

Poloniex LaunchBase is a platform the Poloniex cryptocurrency exchange developed to support early-stage blockchain projects. It provides these projects with exposure, growth tools, and a platform to connect with potential investors. Users can also participate in token launches and pre-sales.

LaunchBase hosts token sales, where early investors can purchase tokens before they are publicly listed. It offers users early access to promising projects while helping them raise capital and build their communities.

Poloniex LaunchBase's key features include transparency, security, and community engagement. The platform ensures that all projects undergo thorough evaluations and provides users with detailed project roadmaps, fostering trust and involvement.

LaunchBase has supported notable projects such as TRON and BitTorrent. These projects benefit from Poloniex’s large user base and ecosystem, gaining exposure and strategic partnership opportunities.

Pros

- LaunchBase offers early access to blockchain projects through token sales before public listings.

- The platform ensures transparency by thoroughly evaluating projects and providing detailed roadmaps.

- It connects projects with a large crypto community, boosting exposure and fostering growth.

Cons

- The focus on early-stage projects can lead to volatility and uncertainty for investors.

- Token sales may be oversubscribed, limiting access and causing frustration.

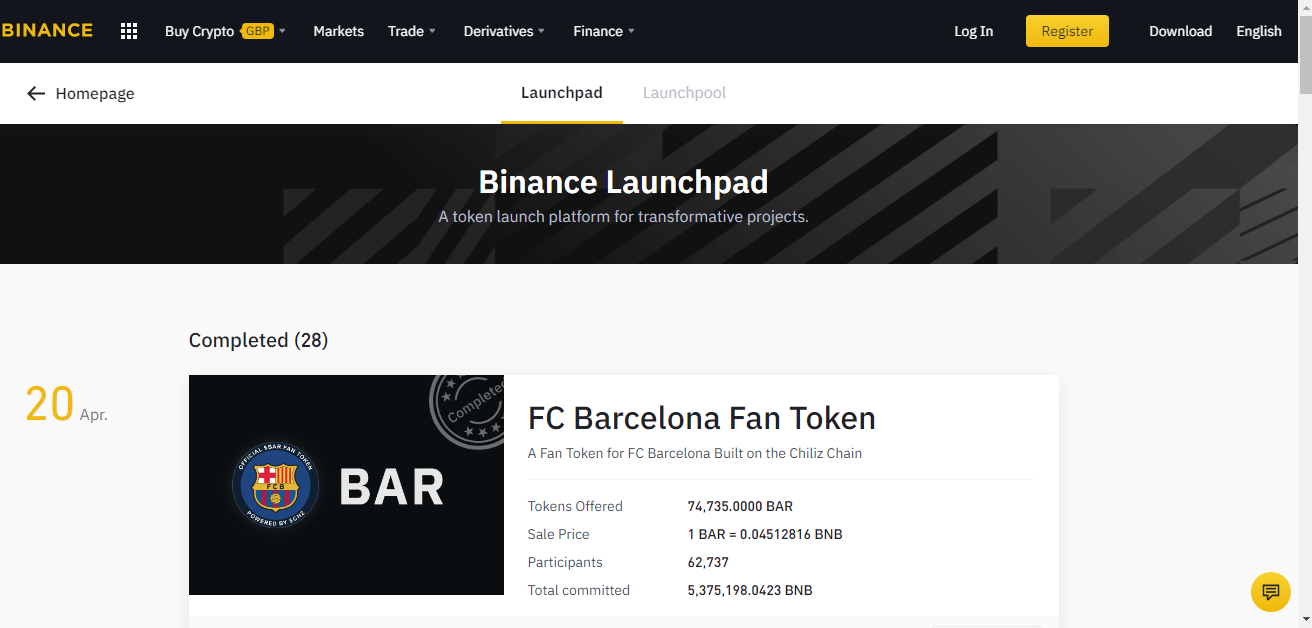

Binance Launchpad

Binance is the world’s largest cryptocurrency exchange in terms of trading volume and number of users. Binance was among the pioneers of the IEO process, launching its launchpad platform to help new crypto projects raise money from token sales.

As with the majority of its products, Binance incorporated its native token, BNB, into the token sales process. Interested participants hold BNB in the days leading up to the token sale, while payment for the newly purchased tokens must also be made in BNB at the end of the subscription period.

Projects that have successfully raised funds on Binance’s Launchpad include Polygon (MATIC), Perlin (Perl), Kava Labs (KAVA), Axie Infinity (AXS), WazirX (WRX), FC Barcelona fan token (BAR), and many more.

Pros

- Binance is a fairly trusted crypto exchange, and users believe they have a strict due diligence process for handpicking Launchpad projects.

- The minimum amount to participate is 0.1 BNB (appr. £24), making it considerably cheaper for anyone to get in on new projects.

- Some of the high-profile projects on the market today have their roots in Binance Launchpad, having generated massive gains for investors. The most prominent ones are WRX, MATIC, AXS, etc.

- Investors get instant access to liquidity as coins get listed on Binance post-Launchpad raises.

Cons

- Binance.com is not available to investors in the US and some other jurisdictions.

- Binance is strongly affiliated with some of the launchpad projects, meaning that overexposure to them might become the same as having a poorly diversified portfolio.

Kucoin Spotlight

‘Spotlight’ is Kucoin’s version of the Binance launchpad and gives investors early access to projects that subsequently get listed on the exchange. The process isn’t much different, with users needing to hold Kucoin’s native token, KCS, to participate in the token sales.

Users will have to lock their KCS in the days leading up to the sale, and then sign back into their account during the activity to make the purchase.

At the time of writing, Kucoin has conducted ten token sales on its launchpad with the most notable projects including Chromia (CHR), Trias (TRY), Bitbns (BNS), and Coti (COTI). While the returns on Kucoin Spotlight projects are not as explosive as Binance’s, investors have made a decent return from participating.

Pros

- Instant access to liquidity upon token listing.

- The process is relatively easy for anyone to understand and participate in.

- Fairly good projects based on Kucoin’s vetting metrics.

- Users only need to hold 10 KCS (appr. £90) to participate in Spotlight token sales.

Cons

- The majority of Kucoin’s Spotlight projects have underperformed to date.

- Kucoin is not available in the U.S. and other countries.

MakerDAO Pad

MakerDAO is a popular lending and borrowing decentralised application built on the Ethereum blockchain. In 2019, the MakerDAO project launched its Launchpad, allowing upcoming projects to sell ERC-20 tokens to interested investors.

To get an allocation for token sales, users must lock the project's native token, DAO, in a vault on their account.

The token sale process could happen in two ways, including Strong Holder Offering (SHO) and SEED (special seed rounds through which investors can increase their allocations).

SHO targets all holders of the DAO token while SEED seeks to allow more people to participate in the fundraising.

To date, several projects have reportedly raised a combined $40M on the Maker DAO pad. Notable ones include Elrond Network, My Neighbor Alice (ALICE), Orion Protocol (ORION).

Pros

- Many projects that raised funds on MakerDAO Launchpad have generated massive returns for participants.

- Users get instant access to token sales as soon as they stake DAO in their vault. There is no stipulated lock-up period.

- Users earn a decent 0.23% APY on their DAO holdings in addition to possible proceeds from participating in token sales.

Cons

- Users must lock up to 500 DAO tokens (app. £1100) to participate in token sales.

- Users require advanced knowledge of the Ethereum network and wallets to participate in DAO Maker and its offerings.

Bybit Launchpad

Bybit is one of the largest crypto exchanges by user base and trading volume globally. Among its top features is Bybit Launchpad, a platform that allows eligible users to participate in initial token presales of new cryptocurrency projects. The launchpad hosts Initial Token Offerings (ITOs), focusing on listing tokens on the crypto exchange.

Interested users will use the Mantle Network Token (MNT) to stake in the launchpad or hold a portion of the stablecoin Tether USD (USDT) to participate in the allocation.

Moreover, the launchpad has been built with a lottery system to share tokens among participants to ensure fairness. Additionally, users are assigned a tier based on their account balance, trading volume, and other relevant factors. Thus, users on higher tiers have greater chances of winning the lottery.

Pros

- Users get early access to new tokens via the Bybit Launchpad

- Users acquire tokens at a discounted price from the expected market or listing price.

- Bybit Launchpad helps to increase liquidity for newly launched cryptocurrencies, making it easier for users to trade.

Cons

- Token prices may fluctuate rapidly due to crypto market volatility, resulting in massive losses.

- Not all new projects succeed. Thus, their tokens may become worthless after launch.

PolkaStarter

Polkastarter allows crypto projects to raise funds by launching pools that investors can buy into. The process is unique since PolkaStarter is a protocol and thus does not control the listing or vetting process, but the communities that launch the pools do.

The price for the token can either be fixed or dynamic and anyone can participate in most offerings.

However, just like most launchpads reviewed so far, Polkastarter also has a native token. There is a 3000 POLS requirement to buy into certain projects marked as exclusive to POLS-holders.

At the time of writing, Polkastarter is already live on the Ethereum and Binance Smart Chain networks. As per the project’s roadmap, more features are planned for release as soon as the protocol is launched on Polkadot, the main network for which it was designed.

Popular projects that have raised funds via Polkastarter include Ethernity, Convergence, and Blockchain Cuties. At the time of writing, around 111 projects have raised a combined $50 million from token sales on Polkastarter.

Pros

- The entire process runs on the blockchain and thus there are no KYC requirements.

- Projects with strong communities can fundraise without relying on the rigorous voting process to exchange launchpads

- Despite being fairly new, Polkastarter has attracted over 200,000 investors, with many projects achieving remarkable success.

Cons

- Investors must have sufficient knowledge of decentralised finance (DeFi) to participate.

- The 3,000 POLs (appr. £3000) to participate in certain pools makes it unfavourable for small investors.

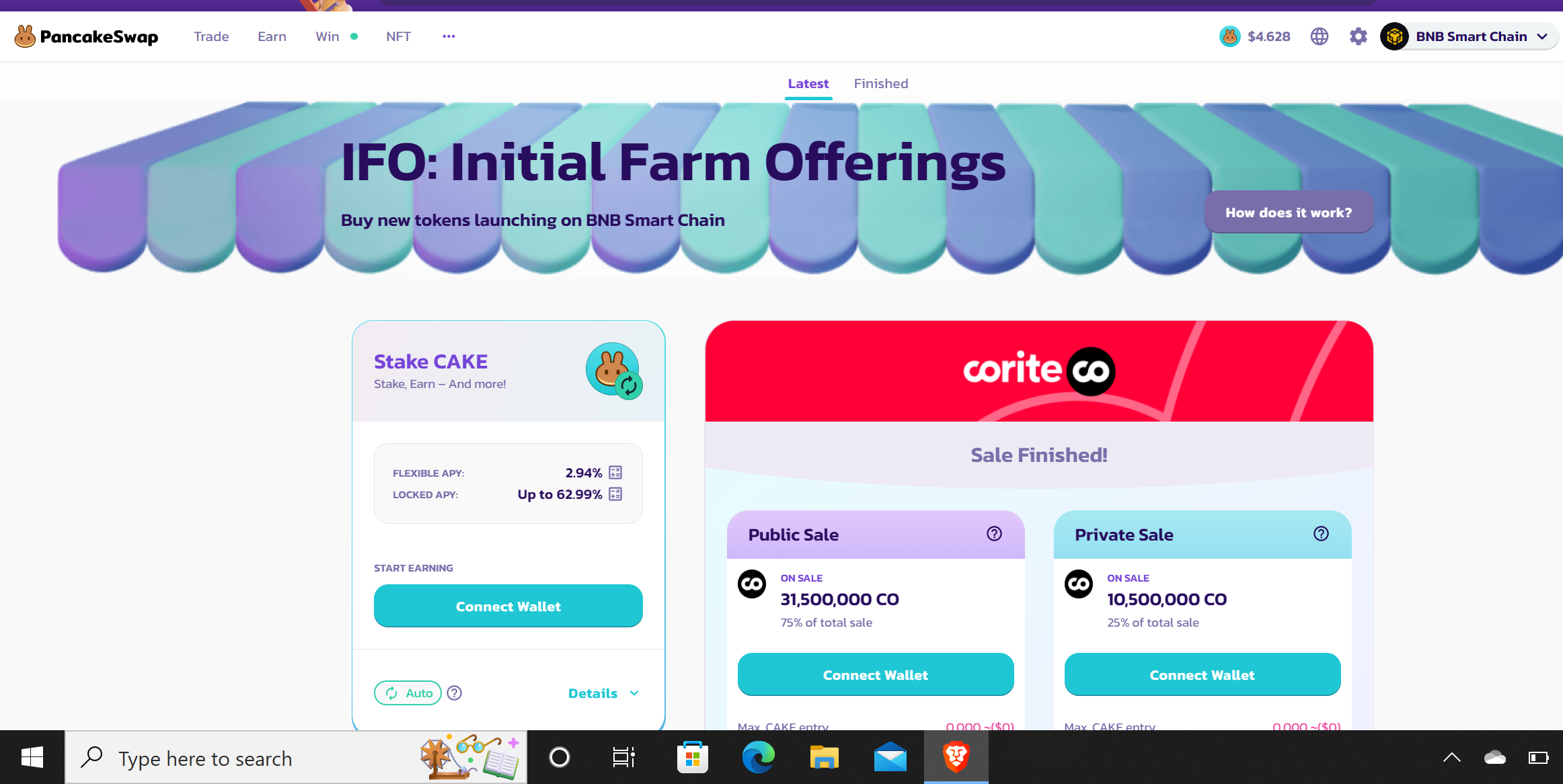

PancakeSwap IFO

Pancakeswap is a decentralized exchange platform built on the BNB Chain (BSC). The project primarily allows the trading of tokens and liquidity mining. However, it also has a launchpad platform to help BSC-based startups raise funds for their products.

To participate in a token sale or initial farm offering (IFO), users have to lock CAKE tokens in the Fixed Staking pool to receive iCAKE tokens. The longer the lock period, the more tokens a user can receive on IDO sales. However, the user still needs additional CAKE tokens to complete the purchase of tokens.

Upon completion of the token sale, the amount allocated to the user will be deducted and the remaining funds refunded as soon as users claim the new tokens allocated to them.

Projects that have completed a token sale on Pancakeswap’s IFO include Horizon Protocol (HZN), and Helmet Insure (HELMET).

Pros

- No KYC process required

- Users are guaranteed an allocation.

- Projects often yield significant returns within the first few hours after listing.

- Being a DEX, users get instant access to liquidity as tokens are promptly added to the platform for trading.

Cons

- Users require advanced knowledge of DeFi to participate.

- There is also the risk of losing money as the price of CAKE fluctuates based on market demand.

- There is a one-time fee of 1.5 CAKE (appr. £10) to make a profile on the exchange so you can participate.

Launchpool

Launchpool is a community-centric pre-IDO platform that was launched in February 2021. The investment platform prides itself on being a fair Launchpad that works for all stakeholders, providing users with a guaranteed allocation of a project.

Users wanting to utilise the Launchpool platform to invest in projects can use the LPOOL token. The LPOOL token is required to participate in Allocation Mining Events (AMEs), which is how Launchpool provides investors with a percentage of project tokens based on their initial investment.

The Launchpool team heavily vets projects before they are allowed on the platform to ensure that only the highest quality projects get access to their community of investors.

The platform is cross-chain and allows projects to be raised across multiple networks such as Ethereum and BNB Chain (BSC)

Pros:

- Over $5 million raised over 20 projects

- Over 15,000 KYC’d investors

- Community of over 35,000

Cons:

- Early project age (released Feb 22, 2021)

How to use crypto launchpads

- Understand the Basics: To use a crypto launchpad, you first need to acquaint yourself with the rules governing the platform. This might include the minimum required amount to participate, the token lockup period, and the distribution schedule. Such information is usually available on the Launchpad page and will also let you know if the exchange supports your jurisdiction.

- Get Ready: Once you’re familiar with the process for the platform you want to use, then you can purchase the tokens required to be eligible for participation. Ensure that you purchase the tokens well ahead of schedule to avoid buying at a high price or missing out.

If you’re going to participate on a DEX-based launchpad, then you’ll probably need to set up a Metamask wallet and connect it to the appropriate network (either Ethereum or Binance Smart Chain.)

After setting up the wallet, you’ll need to send some ETH or BNB to the address to pay for network fees.

- Participating: On the set date and time for the token sale, connect your wallet or log in to your wallet to stake your tokens if applicable. Otherwise, claim the tokens allocated to you and withdraw the excess funds as is usually the case.

FAQs

What is the difference between Launchpad and Launchpool?

For Launchpads, users are exchanging their tokens for a new one released during the token sale. For Launchpools, though, users have to lock their tokens in a pool for a specified period to earn the new tokens being distributed. The number of tokens to be allocated to each user isn’t predetermined but is often based on the stipulated APY provided by the host platform.

Is a Launchpad Token Sale Different from a Pre-Sale?

Yes. In a pre-sale, a project normally sells tokens to very early investors (can include venture capital firms) to cover the basic costs of setting up their business. The pre-sale price is usually lower than the launchpad price, which in turn is expected to be lower than the price when the token begins to trade in the open market.

Is it advisable to Invest in Launchpad Projects?

Like investing in any other crypto, participating in token sales is also risky. For one thing, the price of the newly released coin is usually very volatile, meaning that money can be made or lost within a few minutes, hours, or days,

Users must weigh their risk appetite and decide what part of their crypto portfolio to allocate to participating in launchpad token sales.

How Much Can I Make from Crypto Launchpads?

Once again, the amount to be made isn’t fixed and can be up to multiple times the amount invested. One can also lose funds from investing in crypto projects, although this is unlikely if one commits to selling their allocation just after the sale is complete

Conclusion

This article reviewed the best crypto launchpads, highlighting their pros and cons, as well as discussing how to use these platforms. It also addressed common questions about token sales via launchpad.

Undoubtedly, crypto launchpads are an innovation to the traditional fundraising method which often features a lengthy and rigid process. These days, new projects can raise millions of pounds within a few minutes and go on to yield excellent results for early investors.

However, the relatively easy nature of these fundraising mechanisms doesn’t come without risks, and investors must do due diligence and weigh their risk appetite before putting money on the table.

usdt

usdt xrp

xrp