As the UK continues to grapple with inflation, rising living costs, and low interest rates on traditional savings accounts, more people are turning to alternative ways to grow their wealth, and Bitcoin (BTC) is increasingly becoming a viable option. Beyond simply holding Bitcoin for long-term price appreciation, many are now leveraging it to earn passive interest, offering a new dimension to crypto ownership.

According to Finder, the average instant access savings rate in the UK was 2.46% as of April 2025, and the average variable cash ISA savings rate was 1.8% as of the same month. Both rates fell short of the inflation rate, which stood at 2.6% as of May 2025. This means that even when saving, money might be losing value in real terms. On the other hand, some crypto interest platforms offer annual percentage yields (APYs) of 5% to 15%, or even more on Bitcoin deposits, and higher for stablecoins. This stark difference is why many are now exploring crypto interest accounts as a hedge against inflation and a wealth-building tool.

Table of Contents

What does Earning Interest on Bitcoin Mean?

Earning interest on Bitcoin involves depositing the asset on platforms, centralised, decentralised (DeFi), or custodial that lend it to borrowers or use it in liquidity pools to generate returns. Instead of leaving Bitcoin idle in a wallet, holders can earn passive income, typically paid in BTC or stablecoins, with interest rates varying by platform and market conditions. This approach mirrors traditional savings but often yields higher returns. It allows long-term holders to grow their assets without active trading, offering capital efficiency while preserving exposure to Bitcoin’s value. Given Bitcoin’s liquidity, broad adoption, and fixed supply, it remains a strong candidate for income generation within modern, yield-focused digital investment strategies.

The List of Options with the Potential to Earn Interest on BTC

Through CEX

Centralised (CeFi) Crypto Lending

In CeFi crypto lending, users deposit Bitcoin into centralised platforms like Binance, Nexo, or Crypto.com, which lend it to institutional clients or margin traders. These platforms manage the loan and repayment process, offering interest rates typically between 3% and 6% annually. While returns can be attractive, risks include platform insolvency, borrower default, lack of deposit insurance, and fixed-term commitments ranging from 30 to 90 days.

Crypto Interest Account

A crypto interest account functions like a traditional savings account, but users deposit Bitcoin instead of fiat currency. Platforms such as Nexo or Bitget lend out these assets or use them in liquidity pools, sharing a portion of the returns with depositors, offering annual yields from 2% to 5%. Interest accrues daily or weekly, with flexible or fixed-term options. However, centralised fund control and regulatory risks remain key concerns.

Crypto Savings Account

A crypto savings account, offered through centralised exchanges (CEXs), allows users to deposit Bitcoin and earn interest via flexible or fixed-term programs. Flexible options offer lower returns, around 1.5% to 3% annually, but allow withdrawals anytime, while fixed terms offer higher yields up to 4% for locked deposits. Interest is paid weekly or monthly. Since funds are held custodially, users should assess platform security, reputation, and insurance coverage before depositing.

Through DEX

Decentralised Finance (DeFi) Lending

Bitcoin holders can earn interest by lending tokenised Bitcoin (wBTC) on blockchain-based platforms like Aave and Compound. Since Bitcoin isn’t native to Ethereum, it’s converted to wBTC, pegged 1:1 to BTC, for compatibility. Interest rates range from 1.5% to 6% annually, paid in real time. Risks include smart contract vulnerabilities, platform failure, and market volatility. Users should also account for Ethereum network gas fees during transactions.

Liquidity on Decentralised Exchanges (DEXs)

An alternative way to earn with Bitcoin is by providing liquidity on decentralised exchanges like Uniswap or Curve. This involves converting BTC to wBTC and depositing it into a pool with another token, such as ETH or USDC. Earnings come from trading fees and potential governance token rewards, with returns ranging from 3% to over 20%. However, risks include impermanent loss, smart contract vulnerabilities, and market volatility.

Staking Wrapped Bitcoin (wBTC)

Staking tokenised Bitcoin, such as wBTC, involves locking assets into protocols that offer fixed or variable returns for supporting network security or DeFi participation. Platforms like Lido and select Layer 2 solutions provide annual rewards between 2% and 5%. The process is relatively passive; convert BTC to wBTC, stake it, and earn rewards, though risks include smart contract vulnerabilities, market volatility, and platform reliability.

Bitcoin Lightning Network Node

Running a Bitcoin Lightning Network node allows holders to earn small fees by facilitating fast, low-cost Bitcoin transactions. This involves locking a portion of Bitcoin into payment channels using compatible software such as Umbrel or RaspiBlitz. Users receive a small fee for every transaction their channel processes. While potential returns are modest, often below 1% annually, they can accumulate over time with efficient channel management. However, this method requires technical knowledge, constant uptime, and active monitoring to remain profitable. Key risks include mismanagement, hardware or software failure, and network fees that may reduce earnings.

6 Best Platforms to Earn Interest on Bitcoin in the UK

Nexo

Nexo is a leading centralised exchange (CEX) and crypto lending platform that offers users a simple way to earn interest on Bitcoin and other cryptocurrencies. It primarily functions as a crypto-backed lending service and savings platform, enabling users to deposit their Bitcoin and receive daily interest payments. The platform stands out for its regulatory compliance and insurance on custodial assets, making it a secure and reliable option for UK users. As a CEX, Nexo manages user assets on its platform, simplifying the interest-earning process without requiring technical knowledge.

Pros

- Regulated and insured custodial assets.

- Daily interest payouts for assets held in Flexible Savings.

- No minimum deposit requirement.

- User-friendly mobile and web apps.

Cons

- Custodial model means less control over assets.

- Interest rates can fluctuate based on market conditions.

Interest rate

Nexo offers up to 6% APY on Bitcoin deposits through its Flexible Savings platform.

Ledn

Ledn is a reputable centralised crypto lending platform focused on Bitcoin lending and savings products, allowing users to earn interest on BTC deposits while maintaining easy access to funds through flexible terms. Security and compliance are central to Ledn’s model, which uses custody-based solutions to simplify how users earn interest. Its lending and savings accounts attract Bitcoin holders looking for reliable passive income without complex DeFi interactions. The platform’s transparency and insurance coverage make it a trusted choice for UK investors.

Pros

- Competitive interest rates on Bitcoin.

- Simple account setup and user experience.

- Transparent and insured custodial platform.

Cons

- Limited asset variety compared to some competitors.

- Custodial setup restricts users’ full access to their assets.

Interest rate

Ledn offers around 3% APY on Bitcoin deposits, subject to market dynamics.

Bitstamp

Bitstamp is one of the longest-standing centralised cryptocurrency exchanges, widely used for trading and now offering crypto savings products, including Bitcoin interest accounts. Operating as a CEX, Bitstamp provides UK users with a trusted, regulated environment to safely earn interest on Bitcoin while maintaining high liquidity. The platform is known for its strong security practices, transparent fees, and ease of use. For UK investors, Bitstamp offers the advantage of combining a reputable trading platform with interest-earning capabilities, providing a versatile crypto experience.

Pros

- Highly regulated and trusted exchange.

- Robust security infrastructure.

- Integrated trading and interest services.

Cons

- KYC verification might be cumbersome for some users

Interest rate

Bitstamp offers up to 6% APY on crypto through its Earn Lending program.

Kraken

Kraken is a major centralised exchange known for its solid security measures and wide crypto offerings, including options for crypto holders to generate interest from Bitcoin with a combination of lending services and staking for supported assets. Its well-established reputation and advanced features make it a reliable choice for both novice and professional investors.

Pros

- Strong regulatory compliance and security.

- Competitive interest and staking options.

- High liquidity and market depth.

- Straightforward interest-earning features.

Cons

- Some services require higher minimum deposits

Interest rate

Kraken offers 0.15% APY on BTC through its Opt-In Rewards program.

Aave

Aave is a leading decentralised finance (DeFi) protocol that allows users to lend and borrow cryptocurrencies, including wrapped Bitcoin (WBTC), to earn interest. Unlike centralised platforms, Aave runs on smart contracts on the Ethereum blockchain, providing users full control over their assets without intermediaries. UK users comfortable with DeFi can leverage Aave to earn variable interest rates driven by market demand, often yielding higher returns than traditional platforms. However, it requires some understanding of blockchain wallets and DeFi risks, making it better suited for intermediate to advanced users.

Pros

- Non-custodial, full control over assets.

- Transparent and open-source smart contracts.

- Potentially higher interest rates due to market-driven liquidity.

Cons

- More complex to use for beginners.

- Exposure to smart contract risks and gas fees.

Interest rate

Interest rates on Aave fluctuate but are currently less than 0.01% for Bitcoin-based tokens like wBTC.

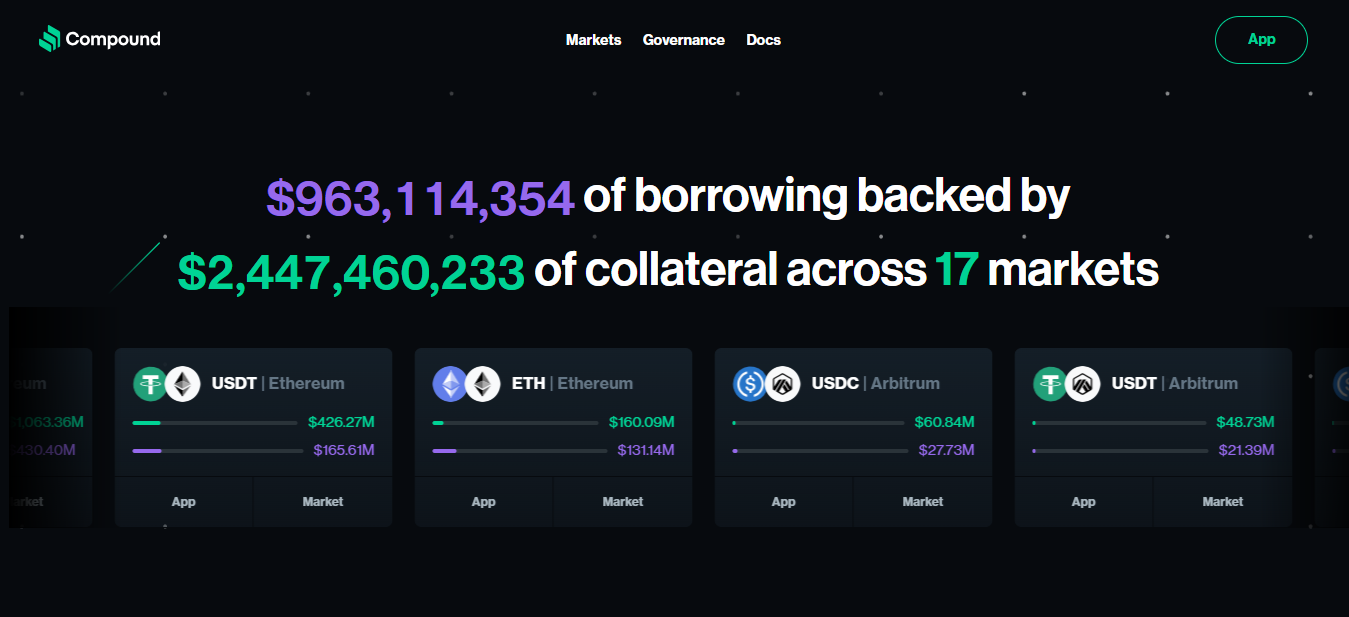

Compound

Compound is another prominent DeFi protocol facilitating decentralised lending and borrowing on the Ethereum blockchain. Users can supply wrapped Bitcoin (WBTC) and receive interest, determined by automated supply and demand protocols. The platform offers UK users a non-custodial way to earn interest on Bitcoin without intermediaries. It appeals to users seeking greater autonomy and potentially higher yields.

Pros

- Fully decentralised with no custodians

- Algorithmically adjusted interest rates.

- Transparent and community-governed.

Cons

- Complex for beginners unfamiliar with DeFi.

Interest rate

Compound’s wBTC lending rate varies dynamically based on pool demand.

How is Bitcoin Interest Taxed in the United Kingdom?

In the United Kingdom, interest earned on Bitcoin is generally treated as income and may be subject to Income Tax. According to HMRC guidelines, if crypto asset owners earn interest through lending platforms or staking, this income must be declared and taxed accordingly. Furthermore, disposing of Bitcoin may trigger Capital Gains Tax.

FAQs

What is the Easiest Way to Earn Interest on BTC in the UK?

The easiest way to earn interest on Bitcoin in the UK is through centralised platforms like Nexo or Bitstamp. These services offer user-friendly interfaces, regulated environments, and flexible savings options, allowing users to deposit BTC and earn passive income without needing technical expertise or exposure to complex DeFi systems.

How to Ensure My BTC Stays Safe While Generating Passive Income?

To ensure Bitcoin remains safe while earning passive income, use reputable platforms with strong security protocols, insurance coverage, and regulatory compliance akin to those highlighted previously. Enable two-factor authentication (2FA), use cold wallets when not actively lending, and conduct regular due diligence to assess platform credibility and smart contract risks, especially with DeFi options.

Where Can I Earn the Highest APY on my Bitcoin Safely?

Platforms like MEXC, Nexo and Bitstamp currently offer some of the highest APYs on Bitcoin, up to 6%, within a regulated and secure environment. These centralised platforms combine strong compliance measures, custodial protection, and ease of use, making them suitable for users seeking high returns with lower risk exposure.

Which Option Mentioned in this Post Allows me to withdraw my Funds Anytime?

The crypto savings account option offered by centralised exchanges allows users to withdraw their funds at any time through flexible savings programs. While these typically offer lower interest rates than fixed-term options, they provide greater liquidity and accessibility, making them suitable for users who prioritise flexibility over maximum yield.

Conclusion

Over time, Bitcoin interest-earning avenues are becoming more accessible and diverse. However, while the benefits are significant, they come with varying levels of risk. This guide has outlined several pathways to consider, each with its own mechanics, profiles and security considerations. As such, prospective investors are encouraged to assess their risk tolerance, understand the nature of each platform, and stay informed about evolving regulations and tax obligations. Adopting a proactive approach to research (DYOR) will position BTC holders to take advantage of Bitcoin’s earning potential without compromising safety. In a fast-moving digital economy, those who adapt early and wisely stand to benefit the most.

usdt

usdt xrp

xrp