If you are in the UK and thinking about crypto trading you have probably noticed there are many platforms available. It can feel overwhelming very quickly especially if you are new to this. You need a platform that is safe, simple, and reliable. After all, getting started shouldn’t feel like you need a degree in finance. That's where eToro comes in. This eToro review UK will help you understand if eToro is a good fit for you.

eToro has grown in popularity worldwide. Many in the UK like it because it is beginner-friendly and adds a social aspect to trading. But what does that actually mean and how well does the platform work for users in the UK? This guide will cover everything you need to know, including key features and fees. It will also explain how to sign up, along with the advantages and disadvantages. This way, you can decide if eToro is right for your trading needs.

eToro in the United Kingdom: The latest updates for UK traders

First off, it’s worth mentioning that eToro is fully regulated by the UK’s Financial Conduct Authority (FCA). This means it has to follow strict rules to keep your money and data safe. For UK users, this is a big deal. You’re not just signing up to some random site. You are using a platform that meets high standards of security and transparency.

Building on this commitment to UK users, eToro has added Great Britain Pound (GBP) accounts. If you’ve ever traded on a platform that only uses US dollars, you’ll know how frustrating currency conversion fees can be. Now, with eToro’s GBP wallet, you can deposit, hold, and withdraw British pounds directly, saving yourself from those extra charges.

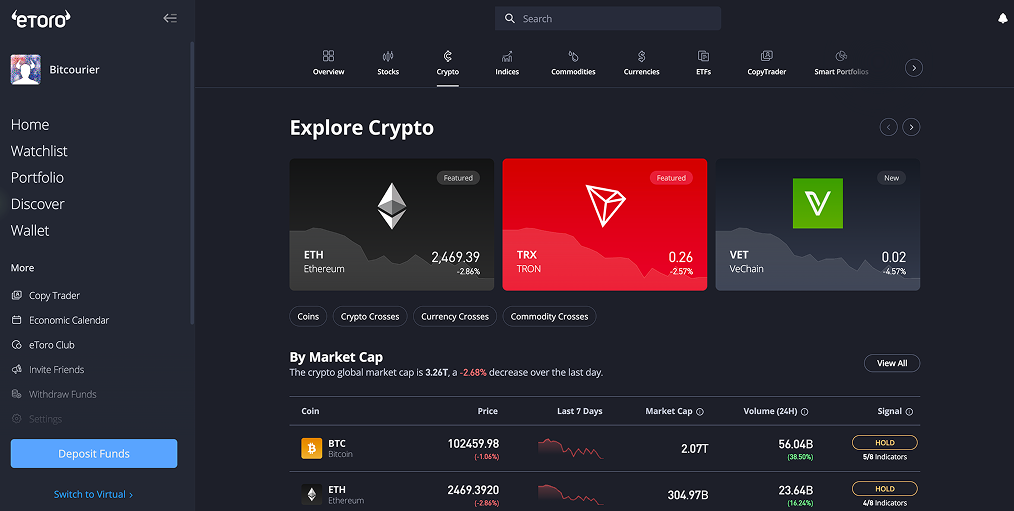

Alongside the GBP support, eToro also expanded access to markets that matter to UK users. You can trade a wide range of stocks from the London Stock Exchange. You also get access to major US markets like the New York Stock Exchange (NYSE) and NASDAQ. Plus, the platform offers exchange-traded funds (ETFs), popular cryptocurrencies such as bitcoin (BTC) and ether (ETH) , and commodities like gold and oil.

Since Brexit shook up financial markets, some platforms struggled to keep pace. However, eToro responded quickly to ensure UK users did not lose access or face new complications. The platform also supports common UK payment methods like Faster Payments. This makes it easier and faster to move money in and out of your account.

In short, eToro continues to improve its services with UK users in mind. The platform offers tailored features and smooth access that show it listens closely to local needs. This ongoing focus makes it a strong choice for anyone looking for a reliable and user-friendly platform based in the UK.

eToro features and offerings for UK users

eToro has quite a few features that make it stand out. It is especially good for people who don’t want to spend hours learning complicated charts and jargon. If you want an honest look on eToro, this platform offers a simple and user-friendly experience. Here’s a quick rundown of what you can expect:

- CopyTrader™: This is probably eToro’s coolest feature. It lets you pick experienced traders and automatically copy their moves in real time. So if you like the idea of following someone who’s been around the block, this makes it easy. It works well even if you don’t know much about trading yet.

- Smart Portfolios: Instead of picking individual stocks yourself, you can invest in ready-made portfolios focused on specific themes, like technology, clean energy, or crypto. It’s like buying a mini basket of assets that experts manage.

- Commission-Free Stock Trading: Buying stocks without commissions is great news for casual investors who only trade occasionally. You don’t get eaten up by fees, which means more of your money stays invested.

- Wide Range of Markets: eToro covers everything from stocks and ETFs to cryptocurrencies, forex pairs, and commodities. This means you can experiment with different markets all in one place.

- Simple and Clean Interface: The platform is designed so even beginners won’t feel lost. You won’t see an overload of confusing charts on your first day, just clear, easy-to-understand tools.

- Mobile App: If you’re on the go, eToro’s app works well for managing your investments. You can check your portfolio, follow traders, and make trades from your phone anytime.

- Learning Resources: eToro isn’t just about trading, it also provides educational content like webinars and tutorials. So if you want to get smarter about investing over time, there’s help available.

- Demo Account: Before putting real money on the line, you can try out a practice account with virtual cash. It’s perfect for testing strategies or just getting a feel for the platform.

How to sign up and verify an eToro account in the UK

Getting started with eToro is pretty straightforward, even if you’ve never traded online before. Here’s the usual process:

- Create Your Account: Head to eToro’s website or download their app and sign up with your email. You’ll be asked to fill in some basic info like your name, date of birth, and address.

- Verify Your Identity: Because of UK regulations, you’ll need to prove who you are. This helps keep the platform safe and prevents fraud.

- Fund Your Account: Once verified, you can deposit funds via local bank transfer, debit/credit card, or e-wallets like PayPal.

- Start Trading or Copying: Explore the platform, pick markets or traders to copy, and start your investment journey.

What documents are required to verify an eToro account in the UK?

When you create an account with eToro in the UK, one of the first things you’ll need to do is verify your identity. This is a standard requirement set by the Financial Conduct Authority to keep trading safe and secure. The process is straightforward but important. Without completing verification, you won’t be able to access all the platform’s features or start trading with real money.

Notably, eToro asks for two main types of documents:

- Proof of Identity: This is to confirm you are who you say you are. A valid UK passport is the most common option, but you can also use your UK driver’s license. The document must be current and clearly show your photo, full name, and date of birth. This helps eToro prevent fraud and comply with legal requirements.

- Proof of Address: This proves where you live and must be a recent document, usually dated within the last six months. Acceptable documents include a utility bill like gas or electricity, a council tax statement, or a bank or credit card statement. The document should clearly show your full name and address.

The good news is that the verification process usually only takes a few days. Once you upload your documents through the eToro platform, the team reviews them quickly. They then let you know if everything is approved or if anything else is needed.

eToro fees and charges explained for UK traders

Nobody likes hidden fees, so here’s what to keep in mind if you trade on eToro:

- Stock and ETF Trading: This is one of eToro’s best points. You won’t pay commission fees when buying or selling shares and ETFs.

- Cryptocurrency Trading Fees: When buying or selling crypto, eToro charges about a 1% fee. Keep in mind spreads which is the difference between buying and selling prices can fluctuate, too.

- Forex and Commodities Spreads: Instead of direct commissions, eToro makes money from spreads. For major currency pairs like EUR/USD, the spread usually starts at around 1 pip, but it varies.

- Withdrawal Fee: There’s a flat $5 withdrawal fee, roughly £4. That might seem small, but it can add up if you take out money often.

- Inactivity Fee: If you don’t log in or trade for 12 months, eToro will charge $10 (roughly £8) per month until you resume activity or close your account.

- Currency Conversion Fee: Even with GBP accounts, trades happen in USD behind the scenes. So deposits in GBP get converted, and you’ll pay a small fee of around 0.75% on that.

When you compare these fees to other UK platforms, eToro is competitive, especially for stock trading. Just watch out for those inactivity and withdrawal fees if you don’t plan to be very active.

Pros and Cons of Using eToro in the UK

Pros

- It’s really easy to use, which is great if you’re new and don’t want to get overwhelmed.

- Being regulated by the FCA means you can feel safer knowing your money is protected.

- You won’t pay commission on stocks, so it’s cheaper if you just want to invest casually.

- The CopyTrader™ feature lets you follow what others do, making it easier to learn and maybe grow your portfolio.

- You can access lots of different assets all in one place, from stocks to cryptocurrencies.

- Having a GBP wallet helps you avoid those annoying currency conversion fees.

- They offer webinars and tutorials, so you can keep learning as you go.

- There’s a demo account too, so you can practice before risking any real money.

Cons

- There’s a $5 withdrawal fee, which can add up if you’re making lots of small withdrawals.

- If you don’t use your account for a while, you might get hit with an inactivity fee which can be annoying.

- For advanced users, eToro might feel a bit simple since it doesn’t have in-depth charting or algorithm trading tools.

- Even though there’s a GBP wallet, you’ll still pay fees when your money gets converted to USD.

- If you’re used to platforms like MetaTrader 4 or 5, you might miss those here since eToro doesn’t support them.

FAQs

What is eToro best for?

If you’re new to trading or just want a simple way to get started, eToro is a great choice. It’s especially good if you like the idea of copying others or investing in diversified portfolios without too much hassle.

Is eToro regulated in the UK?

Yes, eToro is regulated by the FCA, so it follows UK laws to keep traders safe. This means your money is held in segregated accounts and the platform must meet strict standards.

How user-friendly is eToro’s customer service in the UK?

eToro offers customer support via live chat and email during UK business hours. They also have a comprehensive help center. While most users find support helpful, some have noted response times can vary.

What is the best alternative to eToro in the UK?

If you’re looking for an alternative to eToro in the UK, there are a few options worth considering. It depends on what you want from a platform.

For those who want more advanced tools and access to a wide range of markets, IG is a solid choice. It’s popular with users who like detailed charts and research, but it can feel a bit complex if you’re just starting out.

If simplicity is your priority, Plus500 might be a better fit. It focuses mainly on CFDs and offers competitive spreads, making it easy to use without a steep learning curve.

Then there’s Hargreaves Lansdown, which is well known for its in-depth research and support. The fees can be higher than some other platforms, but many users find the extra cost worth it for the quality of service.

Notably, each of these platforms has its own strengths. So, it really comes down to what suits your style and experience level best.

Conclusion

All in all, eToro offers a solid platform tailored for UK traders who want a simple, regulated, and versatile experience. Beginners will appreciate the easy interface, social trading features, and educational support. Casual investors can enjoy commission-free stock trades without fuss. There are some fees to watch out for such as withdrawal and inactivity charges. However, these are balanced by the value the platform provides.

More advanced users might find eToro a bit limited. Still, for most UK users, it is an excellent place to start or grow their trading journey. If you want to trade confidently without the headache of complicated tools, eToro is definitely worth considering.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more at https://etoro.tw/44JRWLY

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

usdt

usdt xrp

xrp