Introduction

The rise of cryptocurrencies introduced new possibilities in finance, challenging traditional systems and pushing industries to adapt. While some companies embraced blockchain’s potential, others remain skeptical, choosing to operate within familiar frameworks.

Table of Contents

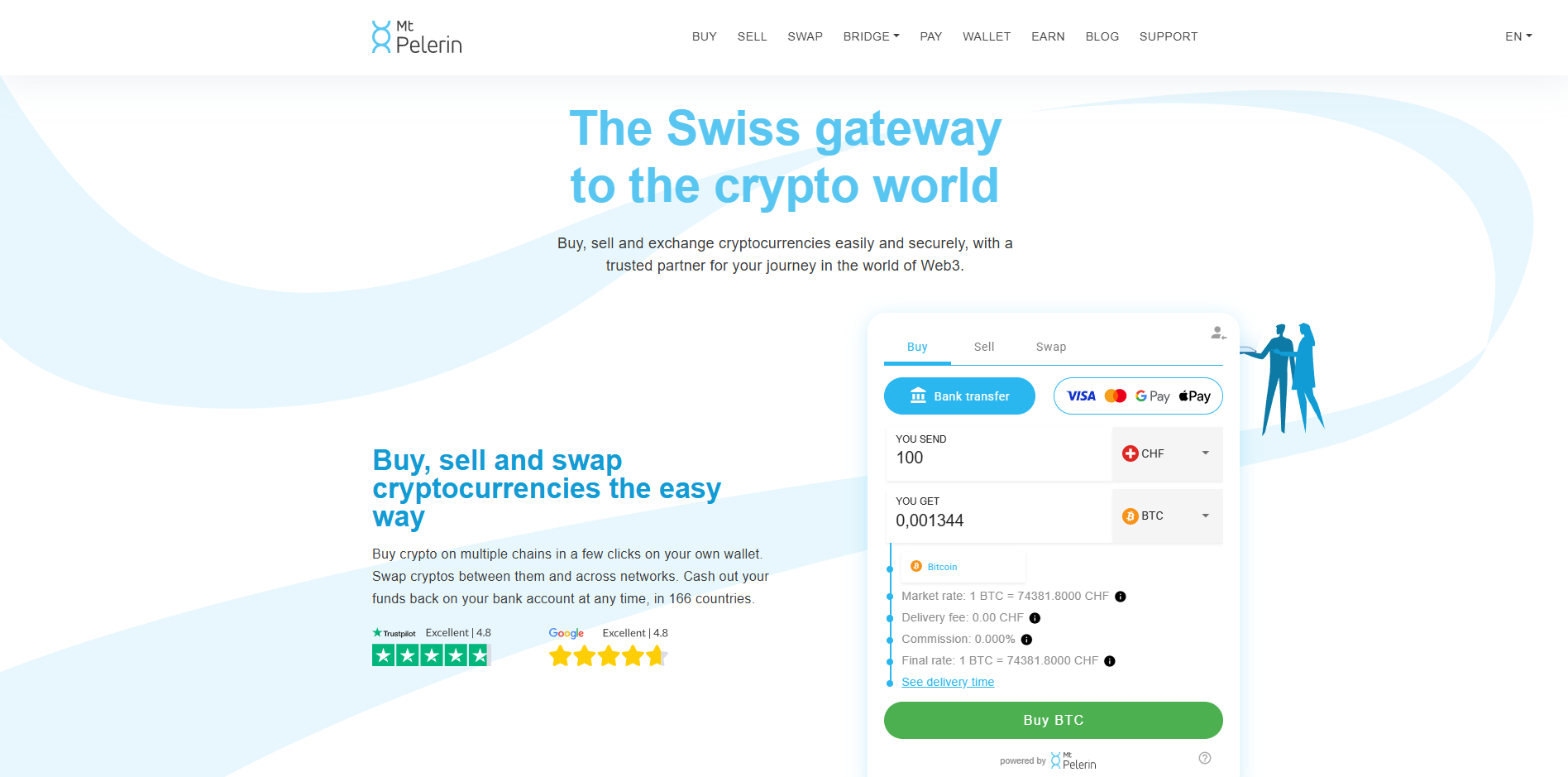

Mt Pelerin is among the firms that fully embraced blockchain and integrated it into the foundation of its business. Unlike traditional exchanges, it operates as a non-custodial service, giving users complete control of their funds and reducing counterparty risk. With KYC-free crypto transactions, seamless swaps across multiple chains, and efficient off-ramp solutions, the platform takes a unique approach to simplifying digital asset transactions.

What is Mt Pelerin?

Mt Pelerin is a Swiss fintech company that simplifies access to digital assets through a seamless, user-controlled experience. The platform enables users to buy, swap, and sell cryptocurrencies while maintaining full ownership of their funds through a self-custodial wallet. By offering low fees and a straightforward process, Mt Pelerin makes it easier for individuals to engage with crypto without intermediaries.

One of the platform’s standout features is its on-ramp service, allowing users to purchase crypto directly into their self-custodial wallets at some of the lowest fees available. The process is designed to be simple and efficient, ensuring that users can acquire digital assets without friction.

In addition to buying crypto, users can swap digital assets, including cross-chain transactions with unique routes that few services support. For example, users can swap Bitcoin directly from a Bitcoin wallet to USDC on Arbitrum, expanding their flexibility in managing crypto holdings.

Mt Pelerin also specializes in off-ramps, making it easy to convert crypto to fiat, whether for small transactions or large transfers reaching up to eight figures. The platform ensures smooth coordination with destination banks, minimizing delays and complications. For high-net-worth users, Mt Pelerin assists in opening accounts with Swiss private banks, allowing them to deposit their cash-outs or access Lombard loans.

Beyond transactions, the platform offers a bill payment service. Users can pay their bills directly with crypto, covering fiat expenses in EUR and CHF through Mt Pelerin’s service. Notably, this feature makes it easier to use digital assets for everyday financial needs.

At the core of Mt Pelerin’s ecosystem is its self-custodial mobile app. Designed for beginners and experienced users, it allows users to securely store, swap, and spend digital assets while maintaining complete control of their funds.

As a Swiss-regulated company, Mt Pelerin prioritizes compliance and transparency. It offers a secure and efficient way for users to interact with digital assets in their daily lives.

Key Features

Robust Security Measures

Mt Pelerin prioritizes the security of its platform and users’ assets, implementing a multi-layered approach to protection. The exchange employs a multi-layered security framework that includes:

- Swiss Regulatory Compliance: The company operates under strict Swiss regulations, ensuring adherence to the latest security and compliance standards.

- Secure Infrastructure: Its systems are hosted in high-security data centers with robust physical and cybersecurity measures to prevent unauthorized access.

- End-to-End Encryption: The platform encrypts all data transmitted and stored on it using advanced protocols to protect sensitive information.

- Multi-Factor Authentication: Users must complete multi-factor authentication to access their accounts, adding an extra layer of security.

- Regular Security Audits: Independent experts conduct routine security audits to identify and address potential vulnerabilities.

User Privacy

Mt. Pelerin is committed to protecting user privacy and has implemented measures to safeguard personal information. These include:

- KYC-Free Transactions: Users can buy and exchange cryptocurrencies without going through a Know Your Customer (KYC) process, allowing them to maintain their privacy.

- Data Protection: Mt. Pelerin follows strict data protection regulations to ensure that personal information is securely stored and handled.

- Privacy Policy: The company maintains a transparent privacy policy explaining how user data is collected, used, and protected.

Founders’ Insight

Mt Pelerin was founded in 2018 as a Swiss financial technology company by a team of professionals with backgrounds in finance, technology, law, and marketing. The company set out to build a blockchain-based financial ecosystem, offering services for buying, selling, and managing cryptocurrencies and fiat currencies.

The exchange takes its name from the Mont Pèlerin Society, a group of economists and intellectuals who championed free markets, personal and political liberty, and freedom of expression. The society was established in 1947 during a conference organized by economist Friedrich Hayek on Mont Pèlerin, a mountain overlooking Lake Geneva.

Founder and CEO Arnaud Salomon leads the company with a strong background in financial markets. Yann Gerardi, the Chief Marketing Officer (CMO), drives its marketing and expansion efforts. Sébastien Krafft, the Chief Technology Officer (CTO), oversees technological developments, while Reynald Besson, the Chief Operating Officer (COO) and Chief Compliance Officer (CCO), handles legal and regulatory matters.

Pros and Cons

Pros

- The platform is easy to use and convenient.

- Security measures and audits ensure asset protection.

- It is licensed and regulated in Switzerland.

- Users can trade cryptocurrencies without KYC verification.

- The platform allows the tokenization of shares and other assets.

- Users have more privacy and control over their finances.

Cons

- Supports a limited range of assets.

- Fees are higher compared to some traditional exchanges.

Conclusion

Mt Pelerin stands out as a Swiss-regulated platform that combines blockchain technology with financial services. Offering non-custodial crypto transactions and KYC-free trading gives users greater control over their assets.

usdt

usdt xrp

xrp