What if there was a way to make money from a drop in the price of Bitcoin? Well, there is and it is called shorting or short selling. Most investors do not know how to short Bitcoin and only think it's a smart move to hold the cryptocurrency and wait for a price increase.

In this article, you will learn how to short sell Bitcoin, when to do it, and the risks associated with doing so. Acquiring this knowledge puts you in a rare class of investors and traders who make money regardless of Bitcoin’s price direction.

Table of Contents

To begin, let’s consider what shorting means in the crypto space.

What does shorting mean in crypto?

Shorting in crypto means borrowing an asset from an exchange to sell at the current market price. The seller does this with the hope that the market price of the coin will drop. If that happens, they can repurchase the asset at a lower price, pay off the number of coins borrowed and retain the profit.

Here’s what a simple Bitcoin short selling trade looks like:

- Borrow and short sell 2 BTC at a market price of $5,000 = $10,000 trade size

- Wait for the price of BTC to drop to $4,500

- Buy back 2 BTC at $4500 per coin, thus returning the 2 BTC you originally borrowed.

- Your profit will be the difference between the position size and the amount you spent in repurchasing the BTC.

- Hence we have $10,000 minus $9000 = $1,000 profit.

Although the above process may seem really simple, there is a complex underground setup powering the system that allows such trades.

For instance, traders may sometimes have to deposit a certain amount as collateral before they can open a position. This collateral is called margin and they could lose it if Bitcoin consistently goes up in price to a level that their collateral cannot cover potential losses.

Can you short Bitcoin?

Yes. Anyone with capital and knowledge on how to short sell Bitcoin can do so using their preferred crypto exchange or broker. The process is relatively straightforward and can be rewarding if things go as planned.

At the same time, it might be best to trade a smaller amount until you’re comfortable with how the entire process works. Once figured out, you can then commit short with large funds to further maximise profit.

How to short sell Bitcoin

There are a number of ways to short sell bitcoin. Here are some of the most common:

Contract-for-Differences (CFDs)

Contract-for-differences (CFDs) are investment products that allow you to pay the difference between the price of an asset from the time you purchase it and the time you choose to sell it. This means you are buying exposure to the underlying asset, but cannot withdraw it to your personal Bitcoin wallet.

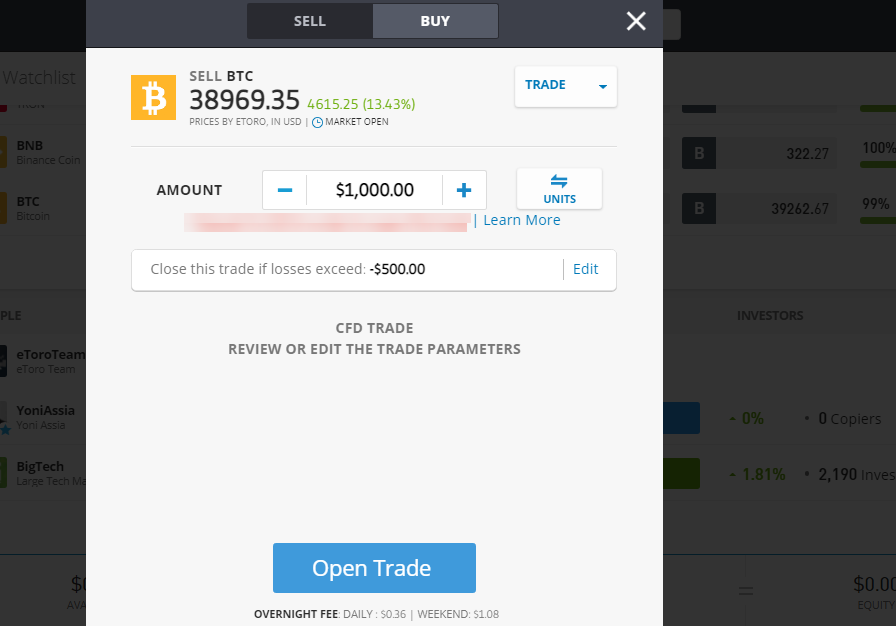

To short Bitcoin using a CFD product is simple and often follows the same process irrespective of the brokerage.

How to do it:

- Fund your crypto brokerage account, e.g eToro, Robinhood, and other stock trading apps.

- Find the BTC/USD pair or the corresponding fiat currency pair you want.

- Click Trade instead of Order

- Change the order type to Sell

- Enter the trade size, either in BTC or USD.

- Set a stop loss (range at which the trade is closed to prevent further losses)

- Review the trade parameters and take note of the overnight fee.

It is worth noting that exchanges and brokers are banned from selling CFDs and other crypto-based derivatives to UK customers. Hence, if you choose to trade them, confirm from your preferred platform that they support customers from your jurisdiction.

Futures Trading

A futures trading contract is an agreement to buy or sell an asset based on a future market price. If you want to short sell bitcoin, you can use a futures trading platform to purchase and sell bitcoins at its current market price, with the hope of buying them back at a lower price and returning the purchased bitcoins to the exchange.

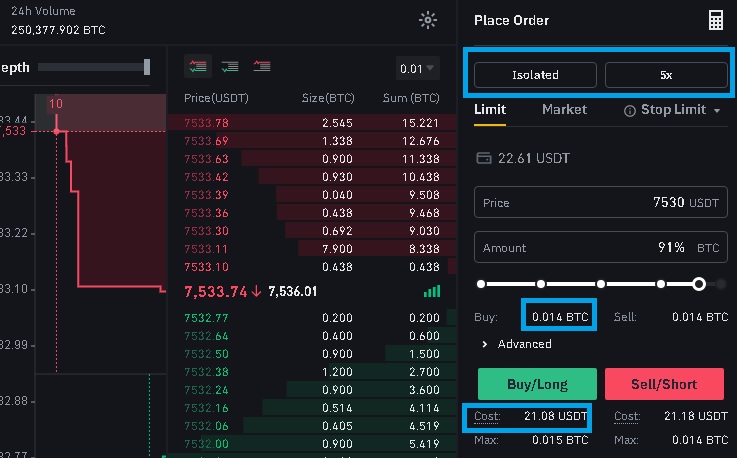

To short Bitcoin via a futures product, you can deposit either BTC or USDT as collateral for the position you want to open. Popular cryptocurrency exchange platform Binance offers futures trading products and here’s a guide on how to do it after depositing USDT on your account.

How to do it:

- Go to Futures from your Binance dashboard and carefully read and approve the risk warnings.

- Switch to USD-M margined futures.

- Click on Transfer to move USDT from your spot wallet to your futures account.

- Select the amount to transfer.

- Find the BTC/USDT pair

- Reduce leverage to 1x (for beginners).

- Switch the Orders tab to Sell

- Based on the amount of collateral deposited, you can enter the amount to buy

- Click Sell short to open the position.

- Once opened, you can monitor your position, set a stop loss, and take profit ranges.

Please note that futures trading, especially with any leverage, is risky and requires adequate trading experience. You can read Binance’s full guide and watch tutorial videos to further understand how it works.

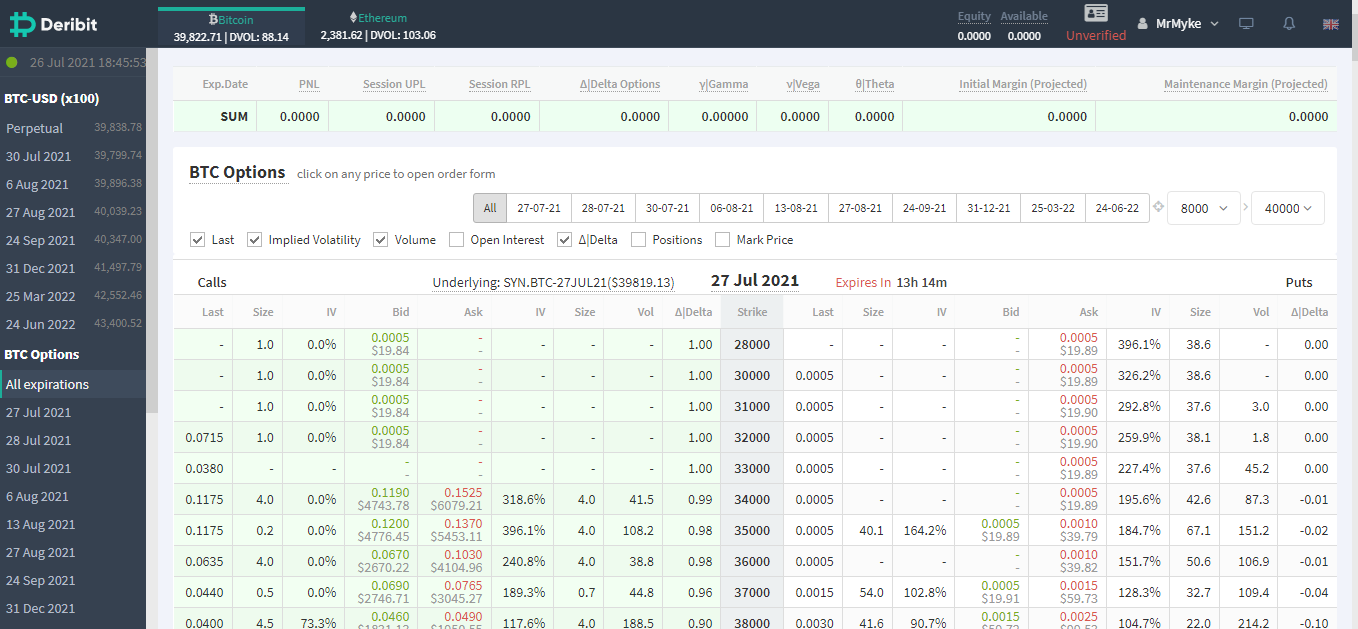

Bitcoin Put Options

The put option gives you the right to sell Bitcoin at a certain price and on a specific future, date called the expiry date. Put options are typically traded within a time range, e.g., weekly, bi-monthly, monthly, annually, etc.

Unlike futures, you can decide whether or not you want to exercise the right to purchase or sell the asset on the said date. If you choose to exercise that right because your prediction was correct, then you have to pay what is called a premium. The premium typically falls within 5-10% of the trade size and must be paid at the time you enter the position.

To short Bitcoin via a put option, you need to buy a contract with a strike price that is less than the BTC market price at the time of the purchase.

If the price of Bitcoin drops to the price you predicted, then you have made a profit. Your profit represents the difference between your entry price and the price of Bitcoin at the expiry date. On the other hand, if the price fails to hit the strike price, then you’ve lost your money. The good thing is that you only lose the amount you paid as a premium, although you could have made so much more if the price hit your target.

Options are widely regarded as complex products and are primarily used by institutional and sophisticated investors.

Open Market Selling

Selling your Bitcoins is perhaps the simplest way to go short. This approach comes in handy if you’re anticipating a price drop and simply want to buy back lower. If that happens, then you get more BTC than you initially had before the initial sale.

The downside is that Bitcoin may fail to drop to the price you hoped to buy back in, and then you miss out on potential profits.

Crypto exchanges that allow shorting

When should you short sell?

Investors are more likely to profit by shorting Bitcoin when the following market conditions happen:

Bearish News: The crypto market is highly responsive to either negative or positive mainstream news developments. If you want to short sell Bitcoin, then it might be best to do so when large-scale negative reports create a bearish sentiment in the market. If you’re able to get access to such news either before or after it becomes widespread, then you have an even greater chance.

For instance, the price of Bitcoin dropped by more than 10% within a few hours after Tesla CEO Elon Musk tweeted that the company would no longer accept the cryptocurrency over environmental concerns. Anyone who opened a short Bitcoin position just after the tweet realised considerable profits.

After a Massive Price Increase: Shorting Bitcoin can be a great short-term move after the cryptocurrency has recorded a significant price increase. Experienced traders rely on indicators such as where prices might hit resistance, and then open up a short-position at that level.

Anyone who short Bitcoin after it crossed the $69k mark in November 2021, made considerable gains within a few days after the cryptocurrency began its steady decline in the months thereafter.

Hedging: A short Bitcoin position provides a means for you to hedge losses on your Bitcoin holdings. If you hold Bitcoin through a bull market and feel like it is due for a price correction, but still do not want to sell your assets, then you can open a short position. If the short-term price drop happens as you predicted, then you wouldn’t have missed out on the profits, and can still use the proceeds to buy more bitcoins.

Risks

Here are the risks you could incur if you choose to short Bitcoin:

Market Volatility: Even the most significant Bitcoin price drops eventually recover and sometimes, faster than you may have imagined. If that happens, then you could lose your money in a short position.

Market volatility is also one of the reasons why most investors simply hold Bitcoin. Therefore, if you cannot manage the emotional swings associated with regular trading, you may want to consider simply holding BTC

Overnight Fees: Unless you’re buying put options, then you’re likely to incur overnight or funding fees for holding short bitcoin positions. The fees are usually around 0.1-0.5 percent depending on the brokerage.

These fees affect your potential profits and may become even more significant when you hold the position for several days or weeks. If you eventually have to close your profit at a loss, then these fees will also add up to the lost amount.

Platform Risks: There are rare cases where the platform used to short bitcoin suffers a technical glitch that causes the price to move incorrectly on that specific exchange. For instance, a glitch on Binance US once saw Bitcoin's price drop to $8.2k even though the market price on other exchanges was around $60,000. In such rare cases, you might lose significant funds if the platform operator fails to compensate affected traders.

F.A.Qs

Is It Advisable to Short Bitcoin?

Based on Bitcoin’s historical price performance, a short BTC position is only ideal as a short-term bet. The leading cryptocurrency has often found a way to bounce back from losses, leaving short traders scratching their heads.

What is the Minimum Amount to Short Bitcoin?

On crypto exchanges and CFD brokerage platforms, you can open a short position for as little as £10. For Bitcoin put options, the contracts are usually priced in BTC and often start as low as 0.1 BTC depending on the expiry date.

How Can I Long Bitcoin?

Longing Bitcoin is the opposite of shorting the asset. You long Bitcoin if you simply buy and hold the cryptocurrency with the goal of selling it at a higher price. You can also open margined long positions on exchanges or buy BTC option contracts predicting a higher strike price than the current market value.

Conclusion

Historically, holding a long-term short Bitcoin position is not a good idea. However, experienced investors and traders can capitalise on predictable short-term price drops to make profits from shorting Bitcoin.

This article explained how to short Bitcoin using three of the most popular methods. It also provided an overview of the risks associated with shorting Bitcoin and answered common questions you may have had.

Investors must weigh market conditions and their risk appetite before choosing whether or not to short Bitcoin. Also, profits may need to be taken at the right time since Bitcoin often always finds a way to recover from price drops.

usdt

usdt xrp

xrp