Blockchain technology seems like a very complex concept for anyone learning about it for the first time, and rightly so. Blockchains barely existed at the start of the last decade, and until today, the technology has not seen sufficient real-world application.

Being ‘complex,’ though, doesn’t mean there’s no way for an amateur to understand blockchain technology basics and how it works.

Table of Contents

In this article, we try to explain blockchain technology in the simplest way possible, thus providing a complete blockchain guide for anyone seeking to understand this revolutionary invention.

What Is Blockchain?

A blockchain simply refers to an online database or collection of data stored in a manner that allows anyone to review and access the stored information.

It is a slightly higher version of a spreadsheet that you use to arrange data on your computer system or a database that a company uses to store customer information.

A company may store large amounts of information and customer data on powerful computer servers in a typical database and enable access for employees to find, filter quickly, and use the data for day-to-day operations.

However, a blockchain is vastly superior because it is not stored and managed on a central server such as that used by a company.

Instead, blockchain data is stored on a decentralised network that allows many participants to review the information and verify its authenticity in real-time. These participants are also mostly responsible for ensuring that any data added to the database in the future is accurate and reliable.

How Does Blockchain Work?

The word blockchain is a combination of two words, block and chain, and understanding their significance is the key to know how blockchains work.

Instead of a spreadsheet arranged in rows and columns, or databases usually stored in a table format, information on a blockchain is organised in a block format. Every block has a fixed storage capacity (measured in bytes), and if filled, any additional information is compiled to a new block. Meanwhile, each newly filled block is chained onto the last known block on the network, with this compilation of blocks making up what we call the blockchain.

Although the Bitcoin network popularised blockchain technology to record and store financial transactions, one can literally store any information on a blockchain.

For instance, a patient’s health history, records for supplying agricultural produce, and legal documents can all be logged onto a blockchain for safe-keeping.

The beauty of data stored on a blockchain network is that anyone running the software anywhere in the world can access the information and verify that it is authentic and hasn’t been tampered with.

As noted earlier, the inventor of Bitcoin also introduced the world to blockchain technology by using it as the digital ledger for storing financial transaction records on the network. Since then, many companies and even the government have adopted blockchains for different purposes.

In 2015, Nasdaq Chief Executive Bob Greifeld called Blockchain “the biggest opportunity set we can think of over the next decade or so.”

Now that we have a clearer understanding of what a blockchain is and its superiority to existing storage structures, we’ll now examine the technology’s key features.

Key Features of a Blockchain

Consensus Mechanism

Every public blockchain has a consensus mechanism or protocol. Don’t let the big words confuse you.

A consensus mechanism simply refers to a pattern that network participants (peer computers) must follow to verify or decide whether the information contained in a block is accurate before adding it to existing blocks on the chain.

A consensus mechanism process is vital for a peer-to-peer network since bad actors on the network may at times want to mislead everyone else. So, think of consensus protocols as a way that the blockchain network protects itself from being manipulated or hijacked by malicious users.

Proof-of-Work (PoW), the consensus mechanism publicised by bitcoin, is the most popular today. However, blockchain developers have also devised other systems including, Proof-of-Stake (PoS), Delegated Proof-of-Stake (DPoS), etc. (more on this later).

Immutability

By design, no one can reverse or rewrite information stored on a blockchain. This feature is called immutability and one of the things that makes blockchain networks valuable for keeping records.

For instance, users can not go back in time to edit records of bitcoin transactions that they did in the past to inflate their sum, thus misleading other users. No one can manipulate voting results stored on a blockchain in favour of one candidate or another in a similar manner.

The record is ‘almost’ eternally stored and uneditable. Any updates to the existing information will be added as a new block that will eventually co-exist alongside older blocks on the chain.

Decentralisation

When an individual stores data on a spreadsheet, they do so on their computer. When companies create a database, they store it on a central server operated by the company or a third-party.

However, public blockchains such as that which powers the Bitcoin network are sufficiently decentralised. There is no central server that stores the transaction data.

Instead, copies of the stored data are simultaneously updated and stored by each peer computer (node) on the network. This decentralisation level ensures no central point of attack for bad actors who may wish to steal, manipulate or even destroy the data.

Note that there are private blockchains where all nodes or peers on the network are perhaps employees or divisions of a particular organisation, e.g. banks.

These chains are not adequately decentralised and are almost in the same zone as centralised databases that could get hacked or lost if malicious actors attack its infrastructure.

Transparency

Any peer on a public blockchain has access to every information stored on the network, a level of transparency not found with other data storage systems. Recall that every peer’s version of the database is updated in real-time, and as more information is added to the blockchain.

One can view all Bitcoin transactions blocks since the network’s founding by running their node or using a blockchain explorer. Thus, they can determine the number of coins held at each address, the transaction history, and other pertinent data.

Transparency is why experts can track bitcoin that is stolen from a cryptocurrency exchange if the hackers transfer them to a different platform and attempt to cash out.

The same thing applies if an educational institution chooses to store student certificates on a public blockchain. The students and future employers can transparently review such information and determine whether the job seeker qualifies for a role or not.

Transactions on a private blockchain are only transparent to approved members on the network, not the public.

Security

Combining the other features we’ve discussed so far means that using a blockchain is fast becoming the most secure way to store information for public use.

After someone broadcasts a transaction and peers verify and add it to existing blocks, there is no risk of anyone (including the originator of the transaction) to manipulate it.

At the same time, the fact that each peer on the network has a real-time copy of the blockchain means that no one can steal the information from all sources simultaneously. Any attempt to mislead the network also fails since most peers have the same copy, and can easily pick out the bad actor and kick them out of the network.

At its peak performance, blockchains are unhackable and will preserve information almost indefinitely.

Types of Blockchain

Three main types of blockchains exist today. They include:

- Public blockchains

- Private blockchains

- Consortium blockchains

- Hybrid blockchains

Public Blockchain

A public blockchain, as the name suggests, is one that is open to public participation. The Bitcoin and Ethereum networks are a typical example, allowing anyone, anywhere across the globe to become a peer and transact with others freely.

Other core contributors to a public blockchain include developers, miners, node operators, and general users.

Features of Public Blockchains

- Public blockchains are sufficiently decentralised. No single entity moderates the addition of blocks on the chain or how they’re recorded.

- The decentralisation of public blockchains also makes them censorship-resistant and costly to attack or shutdown.

- The code for public blockchains is usually open-source, allowing independent developers to modify the code and implement changes approved by a majority of users.

- Network activities are transparent, and any peer can review it by either running a node or using a block explorer provided by the community.

- Public blockchains typically have participants actively participating in adding new blocks to the existing chains. These persons earn rewards for doing so and are usually called miners or validators.

- Most public blockchains have a native currency, such as BTC for Bitcoin, and ETH for Ethereum.

Private Blockchains

Private or permissioned blockchains describe a blockchain network owned by an entity and used to share data among selected participants.

Unlike public blockchains where anyone can join, all participants on a private blockchain are known by the administrator and often have little to no influence on the network’s governance.

Private blockchains represent an excellent option for enterprises who wish for employees to collaborate and share data without disclosing the information.

Features

- Private blockchains are typically centralised and controlled by a single entity or organisation, e.g., a bank.

- Intending participants need approval from the administrator to join the network.

- Only approved persons can view transactions on a private blockchain.

- A private blockchain may or may not have a native currency.

- Private blockchains are usually not censorship-resistant. An attack on the infrastructure of the company that manages the solution may be just enough to shut down the network.

Consortium Blockchain

A consortium blockchain is a slightly different version of a private blockchain. The primary difference is that instead of a single entity, a consortium or group of companies manage the blockchain.

The group could be companies working in the same industry. For instance, agricultural companies in a county could create a consortium blockchain to track the distribution of produce from the farm to storage facilities and then to the market.

Features

- Members of a consortium blockchain could include enterprises, commercial banks, central banks, etc.

- Enrolled entities can view data shared by other participants, but such data is not available to outsiders.

- Consortium blockchains foster collaboration among peer companies who may at the same be competitors.

Hybrid Blockchain

A hybrid blockchain is often described as “the best of both worlds.” The idea behind this type of blockchain is to combine the privacy and speed benefits of private blockchains, with the security and transparency of the public blockchain.

In simpler terms, network participants can choose which information they want to keep public or private, while at the same time not compromising on security. DragonChain and XDC are excellent examples of a hybrid blockchain solution.

Features

- Hybrid blockchains offer near the same speed as private blockchains and information stored on them is as secure as that stored on public chains.

- Members on a Hybrid blockchain decide which members can join the network and what data is made publically available.

- neMost networks of this kind are primarily for data sharing purposes and may not necessarily require a native currency.

Different kinds of blockchain technology solutions today make it convenient for any organisation to choose one that aligns with their business needs.

However, it is worth mentioning that public blockchains still largely dominate the market. Decentralised networks popularised by cryptocurrencies makes them an exciting trend to watch

The cryptocurrency market boasts a $1.4 trillion market cap at the time of writing and counts millions of users as either users or developers of existing blockchain networks.

Blockchain Consensus Mechanisms

As noted earlier, a consensus mechanism or protocol is a critical component of a public blockchain. This protocol determines how users on the network can identify and add only valid and accurate information to any block that will be added to the existing chain.

Although many new blockchain projects are experimenting with a range of consensus protocols, let's briefly consider the three most popular one that exists today.

- Proof-of-Work (PoW)

- Proof-of-Stake (PoS)

- Delegated Proof-of-Stake (DPoS)

Proof-of-Work (PoW)

The Bitcoin blockchain pioneered the PoW consensus mechanism.

It requires that a peer (miner) on the network completes a preset computational problem, and then broadcasts to others that its solution to the problem is accurate. The computation problem involves generating a hash (a string of numeric codes) lower than or equal to a target number known by all miners.

If other peers verify that the solution provided by a peer is accurate, then they approve the addition of the block of transactions to the blockchain. On the other hand, if the peer’s calculation is wrong, it is almost likely that another peer has found the solution, and the latter is used to add a new block of transactions to the chain.

The successful miner receives the transaction fee for all bitcoin transactions included in the block, and also a block reward which currently stands at 6.25BTC/block.

Note that the process described above does not happen manually, but between dedicated mining hardware connected to the bitcoin network for this purpose. Miners can pool their computing resources to increase their chances of finding the hash for a new block.

The entire process to solve the proof-of-work and add a new block to the Bitcoin blockchain takes ten minutes (it takes less on a blockchain like Ethereum that slightly improved on Bitcoin’s technology.)

51% Attacks on PoW Blockchains

A PoW blockchain is by design susceptible to a 51% attack. This simply means that if a single entity or group of miners controls 51% of computing power on the network, then they could create fraudulent transaction blocks and manipulate the system.

However, since an unimaginable amount of money and infrastructure is required to pull off such an attack, it is almost impossible to carry out such an attack on a decentralised network such as Bitcoin’s.

Other smaller chains, though, have reported such attacks in the past, with the instigators minting or double-spending coins.

Meanwhile, since adequate electricity is required to power the machines engaged in cryptocurrency mining, many critics believe that PoW is not the best consensus mechanism for securing data on a blockchain.

Other models have emerged since, and we’ll consider them next.

Proof-of-Stake (PoS)

The PoS consensus mechanism demands that peers only validate blocks based on the total coin supply they control. It replaces the concept of miners with validators and places a greater emphasis on the number of coins that a peer holds.

To become a validator on the network, a user has to stake a specified number of coins. The user will then be given a chance to add new blocks to the blockchain and receive new coins as a reward.

The higher the number of coins a validator holds, the more blocks they can validate, and the more rewards they can receive.

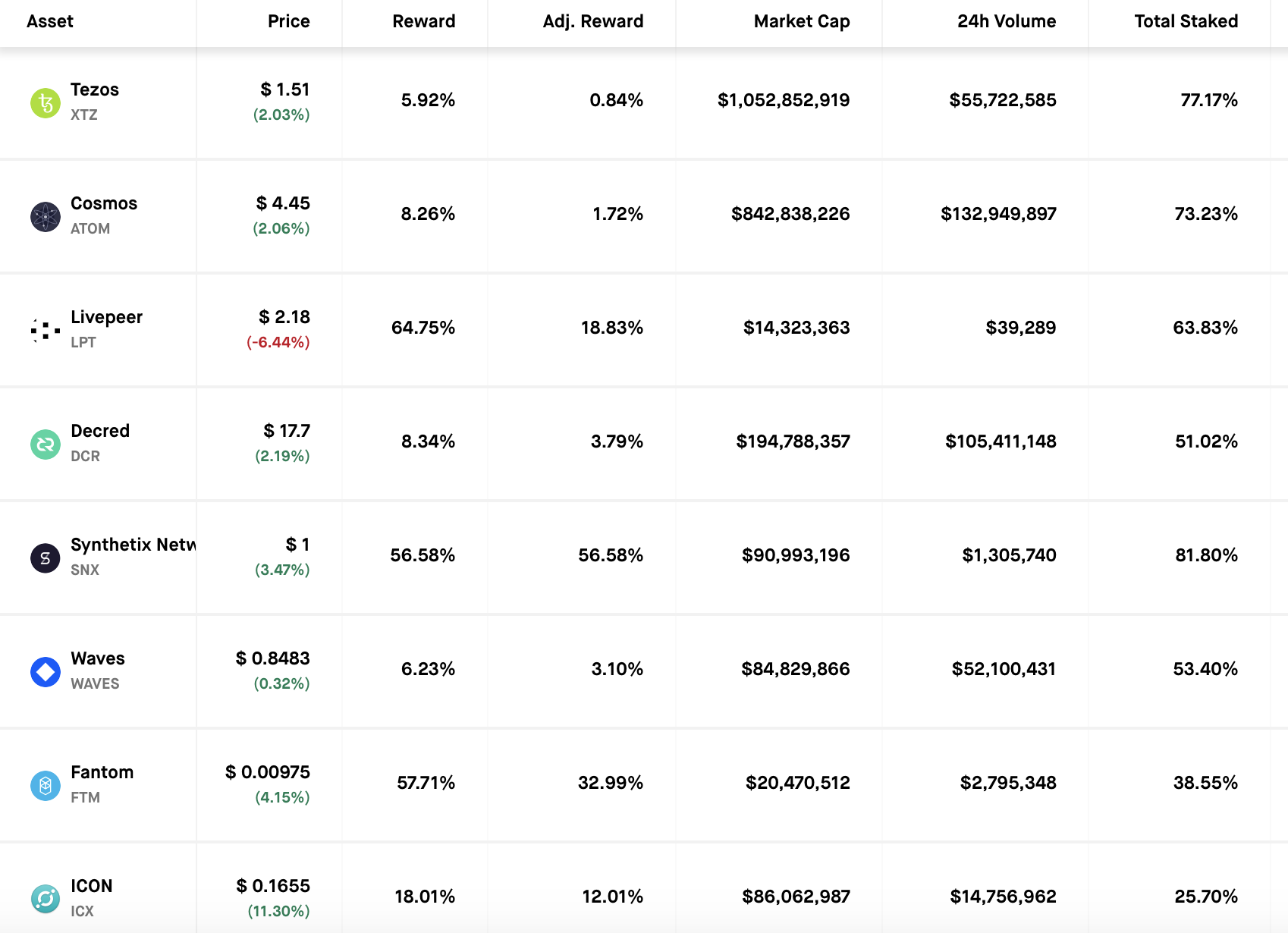

Users can also choose to stake the PoS coins they hold, in exchange for partaking in a periodic distribution of new coins to stakers. All of these further strengthen the network and reward users with a decent APY.

Table showing annualised rewards (APY) for staking popular PoS coins.

PoS blockchains use the model to mitigate the chance of a 51% attack. A peer holding large amounts of coins is disincentive from attacking the network. If they did, the market would panic, causing the value of the assets being held to drop sharply.

Note that this model also means that the network could not be as decentralised as PoW blockchains. Hence, the saying that “a perfect consensus model for public blockchain” only exists in theory.”

The Ethereum network is on the verge of migrating from PoW to PoS, while many existing blockchains like Cardano, Zilliqa, Cosmos use the same model.

Delegated Proof of Work (DPoS)

DPoS is a modified version of PoS that claims to be more democratic. The primary idea is for stakeholders on the blockchain to outsource the work of verifying and adding new blocks to the chain.

The work is assigned to “delegates” or “witnesses”, and they are mainly responsible for securing the network. Each delegate’s voting power to validate a block depends on the number of coins they manage to sway in their favour from the community during periodic elections.

When the delegate receives a reward for verifying and successfully adding a block to the network, the model ensures that they distribute these rewards to their electors. This way, everyone directly benefits and indirectly participates in securing the network.

EOS founder, Dan Larimer developed the DPoS model, and it is now being used by other networks such as Steem and Lisk.

Although running a DPoS protocol allows for faster transactions, it also has the inherent centralisation issues that face PoS systems. One party may control most of the voting power and enforce network rules in their favour.

How Secure is Blockchain

By design, blockchains are more secure than existing data storage systems.

However, public blockchains’ security depends on the number of users and the volume of resources protecting it. This principle applies especially to proof-of-work blockchains, where different peers’ computing power contributes to the network’s strength.

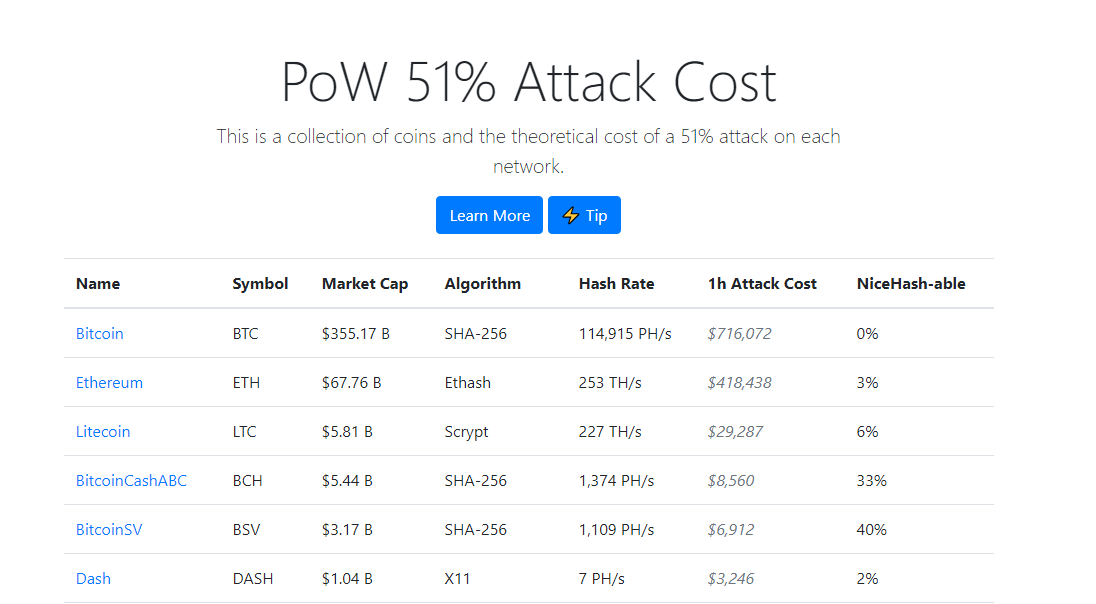

The below data from Crypto51 provides a theoretical cost of attacking some of the most popular PoW blockchains for an hour.

While another research puts the cost of successfully attacking the bitcoin network at $5.5 billion conservatively, it is worth noting that it would also require a lot of time and effort to set up an infrastructure to execute such an attack.

At the same time, since such an attack will likely cause a market panic and decline in asset price, any malicious attacker would be better off spending less to mine new coins and generate profit instead of losing all that money.

The theoretical response of a secure blockchain like Bitcoin would be for honest miners to split (fork) into a new chain and abandon the old chain now dominated by the attacker.

For private blockchains, the security element stems from the expertise of the developers. Being generally closed-end means there is little chance of hackers wanting to find a way like they usually attempt to attack less secure public blockchains.

Blockchain Use Cases

Blockchains could find application in almost any field of human endeavour. However, the following are some examples of use cases that are already taking shape in the real world.

Financial Transactions

Bitcoin showed the world how possible it could be to move value across borders without the need for a central authority such as a financial institution. Thus, it is not surprising that the most prominent use of blockchain has been to ensure the near-instant settlement of financial transactions.

Many central banks worldwide are working towards the possible launch of a blockchain-based version of their local currencies, all in a bid to tap into the speed and fast settlements offered by these systems. Banks like JP Morgan Chase have also launched in-house blockchains to improve transaction times.

Digital Voting

The use of blockchain technology could further enhance digital voting’s introduction to ease the load on voters. This solution would help bring transparency to the voting process and significantly lower the odds of election fraud. Everything is tracked in real-time on a system that everyone can access.

Jurisdictions within Switzerland and Japan have tried blockchain-based voting systems, and it may not be long until we see it become widely adopted for mainstream electoral processes.

Supply Chain Tracking

Experts believe that blockchain technology could help restore retail investors’ confidence in the quality of goods and services and consume. Producers can use a public blockchain to track produce from the factory or farm and update the products every step of the way until it reaches the final consumer.

Enterprise-focused blockchain, VeChain, and tech giant IBM are leading research and roll-out blockchain solutions to boost supply chain tracking.

Decentralised Finance

The existence of blockchains like Ethereum has already birthed an entire industry of financial services powered by computer codes (smart contracts).

Users can trade, lend, borrow, and earn interest on their cryptocurrency holdings without relying on any major party to approve them. These products’ suites are known by an umbrella term ‘decentralised finance’ and currently have over $40 billion worth of value locked in them.

Learn more about DeFi on our dedicated page.

Advantages and Disadvantages of Blockchain

Like every technology that man has invented, blockchains have advantages and disadvantages. First, let’s talk about the positives.

Advantages of Blockchain Technology

- Decentralisation: The advent of blockchains was a remarkable achievement in the quest to build decentralised systems.

Today, we have robust mini-financial systems controlled by peers worldwide who have little or no real-life information regarding who is at the other end. Like the internet, blockchains unlocked a new world of collaboration that unites the globe at a time when there are very few common grounds to bring individuals together.

- Faster and Cheaper Settlements: By removing the need for a third-party, blockchains introduced near-instant final settlements that financial institutions could only dream of before the end of the last decade.

Fast forward to the present, and one can move enormous amounts of value and reach finality within seconds or minutes. Simultaneously, these transactions cost little to nothing compared to fees associated with transferring funds via traditional payment platforms.

- Transparency and Security: Blockchains are a great way to preserve data for the long-term, and at the same time give as many people as possible access to the said information. Given that existing storage systems offer lower security and transparency levels, more enterprises will likely adopt blockchain soon.

- Lower Costs and Efficiency: Since blockchains eliminate the need for middle-men, it can help companies save on operation costs without compromising on efficiency. For instance, there may be little to no need to regularly review transaction documentation or place excessive trust in your business partners. Instead, both parties can rely on transparent data for making sound decisions.

Disadvantages of Blockchain Technology

- Irreversible Transactions: The immutability of a public blockchain record is a two-edged sword and one that could hinder the technology’s adoption.

For instance, a centralised payment merchant could reverse a transaction if the sender could prove that they sent it to the wrong recipient. However, the immutability of blockchains means that such users' errors are not reversible.

It is challenging to modify public blockchain data, which is not ideal, especially for retail and enterprise users.

- Permanent Loss: It is not unheard of individuals losing millions of pounds because they lost access to their bitcoin private keys. In one story, Bitcourier reported that a Welsh Council denied a programmer’s request to dig for $300 million worth of BTC lost in 2013.

While the whole point of blockchain systems is to give back power to users, a loser who loses their keys without a backup has no chance of recovering their funds forever.

- Energy Consumption: One of the standard arguments against PoW blockchains like Bitcoin’s is the amount of energy and resources required to keep the network running. Most of bitcoin’s energy consumption comes from producers’ surplus power, and a large chunk of mining operations is done via renewable energy sources.

Still, the Bitcoin network alone consumes as much power as most small nations make critics question whether this energy consumption will not get out of hand as the network expands globally.

- Extreme Anonymity: Solutions are currently in place to track public blockchain transactions and weed out bad actors. Despite that, privacy-focused coins like Monero remain highly untraceable and provide cybercriminals with an outlet to carry out illicit activities.

The level of anonymity offered by cryptocurrency has recked havoc on businesses victimised by ransomware attackers that request payments using this channel.

Conclusion

Blockchain technology is one of the most remarkable inventions of the last decade. It remains on track to see widespread adoption by both retail users and enterprise in the coming years.

This article explained what blockchain is, the types that exist today, and how public blockchains secure themselves to reach consensus on what transactions peers can add to the existing chain.

We also covered its advantages and disadvantages, hoping that developers will eventually come up with solutions to make blockchains the ‘perfect’ data storage system that it has the potential to become.

usdt

usdt xrp

xrp