The best time to buy Bitcoin isn’t anytime you feel like it. If you doubt the statement, you can ask anyone who bought Bitcoin near the top in late 2021 and had to patiently wait for the market to recover.

Table of Contents

Aside from broader market conditions, many also wonder if there is a ‘best’ time of the day to buy bitcoin in the UK. Should it be in the morning, afternoon, or evening hours? Can one make more profit by buying bitcoin on certain days of the week?

We will answer those questions in this article and explain why the timing may not necessarily matter in the long run.

Ready?

Let’s go!

Why is finding the best time to buy Bitcoin essential?

There are two main reasons why knowing the best time to buy Bitcoin is essential.

For one thing, it means anyone buying bitcoin (stacking sats) for long-term holding can get more bitcoins for their money by placing their buy orders at the right time. Getting perhaps 2% extra than you usually do would mean greater rewards in the future.

The second reason is that knowing the best time of the day or week to buy Bitcoin prevents an investor from yielding to the fear of missing out (FOMO). Many buy Bitcoin at high prices because they fear they could miss out on possible short-term gains.

On the other hand, finding the best time to buy and sticking to the schedule protects one from the losses usually associated with panic buys.

Now that we know the possible benefits of timing Bitcoin buys, let’s consider how one can make the most of the opportunity.

How to find the best time to buy Bitcoin

Day of the week

Statistical evidence shared by Capriole digital asset manager Charles Edwards supports that the best day of the week to buy bitcoin is Sunday evening.

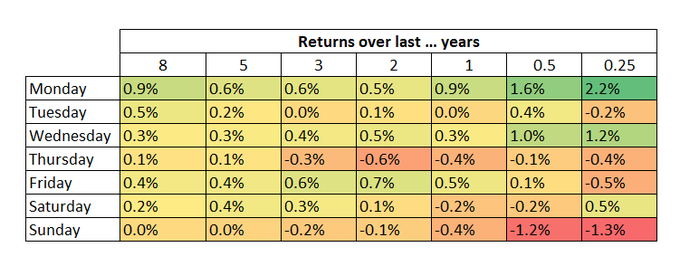

The chart below shows that those who buy BTC during the said period see higher returns on their investment than purchases made during weekdays.

(Source: Charles Edwards)

A simple way to understand the chart above is that the daily average bitcoin return on each weekday is best on a Monday after the investor buys his stack. The returns in the last eight years have usually been around 0.9%.

One possible reason why Sunday evenings are the best time to buy BTC is that trading volumes on crypto exchanges usually drop over the weekend. Few active traders are in the market and there are more sell than buy orders.

The dip in buy orders and general trading volume means prices become more volatile at the start of the new week. While prices usually dip over the weekend, reopening many exchanges will drive volume back up, impacting prices positively.

US derivatives giant CME Group, which also contributes significantly to bitcoin’s global volume (over $500 million daily) traded by institutional investors, also goes on a break during the weekend.

CME's Sunday reopening at 5:00 pm (CT) or 11:00 pm GMT (UK Time) increases the chances of a volatile opening at the start of a new week and a possible price increase for BTC.

So, although the bitcoin market trades 24/7 globally, reducing the number of active traders and volume at the weekend typically pushes the BTC price up, barring any negative mainstream news.

Buying your stack at the weekend (Sunday evenings precisely) gives you a shot at being a fraction up when the markets start to reopen for a new week.

Time of the Month

Retail investors constitute a significant percentage of Bitcoin investors. For instance, buyers on PayPal and Square’s cash app reportedly consume a substantial amount of bitcoins compared to daily network issuance.

A common practice among these armies of retail investors is to set up recurring buys that go off once they receive their paycheck towards the end of the month. Barring black-swan events such as the market crash caused by the COVID-19 pandemic, these buys typically cause the price of BTC to go up.

In simpler terms, buying Bitcoin near the end of the month, when the DCA army are out in full force, means you’d usually buy it at a higher price. On the other hand, completing your purchases mid-month or anytime before the month-end rush would allow you to get them for better prices.

The worst time and day to buy coins

The bitcoin market’s dynamic nature makes it almost impossible to pinpoint the worst time and day to make purchases. However, by going by the principle of “buying low and selling high,” one could find the worst time and day for a particular period in a week, day, or month.

The above chart considers the period between December 9 to Dec 16, 2023. A close observation showed a patterned bitcoin dip approaching a new day at UTC for several days the same week. This could suggest that purchases during the end of the day provide a chance to buy BTC cheaper.

The above chart covers another week from Dec 8 to Dec 16, 2020, where we notice a different trend of price dropping around mid-day, barring a different price action on December 15th when prices spiked around noon. Observing this trend makes it easier to buy Bitcoin when it is likely to be on a downtrend.

Granted, the above charts do not provide a definite pattern for determining the best time of the day to buy bitcoin. However, it shows how one can time their purchases based on consistent price action for a specified period.

Conclusively, the worst day to buy BTC is any day when prices are on an uptrend. Such rapid price growth only brings short-term gains and climaxes with a period of consistent losses. Making it a principle to buy BTC only on days when it is down to a certain percentage (-6% or more) is a better way to get more sats for your money.

What impacts the best time to buy BTC?

Several factors include Bitcoin’s market price and, thus, the best time to make new purchases. Here are some of the most prevalent

- Market Sentiment

Markets are irrational. Price swings may occur for no tangible reason and change the market sentiment and outlook from bullish to bearish quickly. Then, almost everyone will literally be burning their money by selling at a low price.

That is when being a disciplined investor becomes your greatest asset.

Using the “buy low, sell high” principle mentioned earlier, it is easy to see that the best time to buy BTC is when the market is bearish, and coins are available at discounted prices. A good example was the crypto bear market that pushed BTC near $3200 and the 2020 March crash that saw BTC slump slightly above $4,000.

Another example is the Bitcoin decline to the $15,000 region after several multi-billion dollar crypto-related projects such as Terra, Celsius, and FTX collapsed in 2022. Fears over the industry's future led to a market sell-off that was eventually erased after just one year in (2023).

While one cannot accurately predict when or whether we’ll see another Bitcoin black-swan event, keeping cash handy to invest at such times could be the best bitcoin purchase you’ve ever made.

- Media Reports

Media reports are another factor that adversely affects the price of BTC. Events such as a significant exchange security breach, the possibility of a Bitcoin ETF, and the involvement of large institutional investments affect prices either way.

Capitalising on adverse media reports that suppress the price of Bitcoin may be another approach to scooping up coins at great prices. For instance, news of interest rate hikes by central banks contributed largely to Bitcoin's price slump in 2022.

The decline was eye-catching even though Bitcoin's core fundamental properties didn't change, and the network effect probably became stronger. Media reports exacerbate investor fears and present opportunities for savvy investors to scoop up cheap assets.

- Key Events

Key industry events such as Bitcoin halving historically pushed the price of BTC up in the months leading up to it and then eventually dropped in the aftermath.

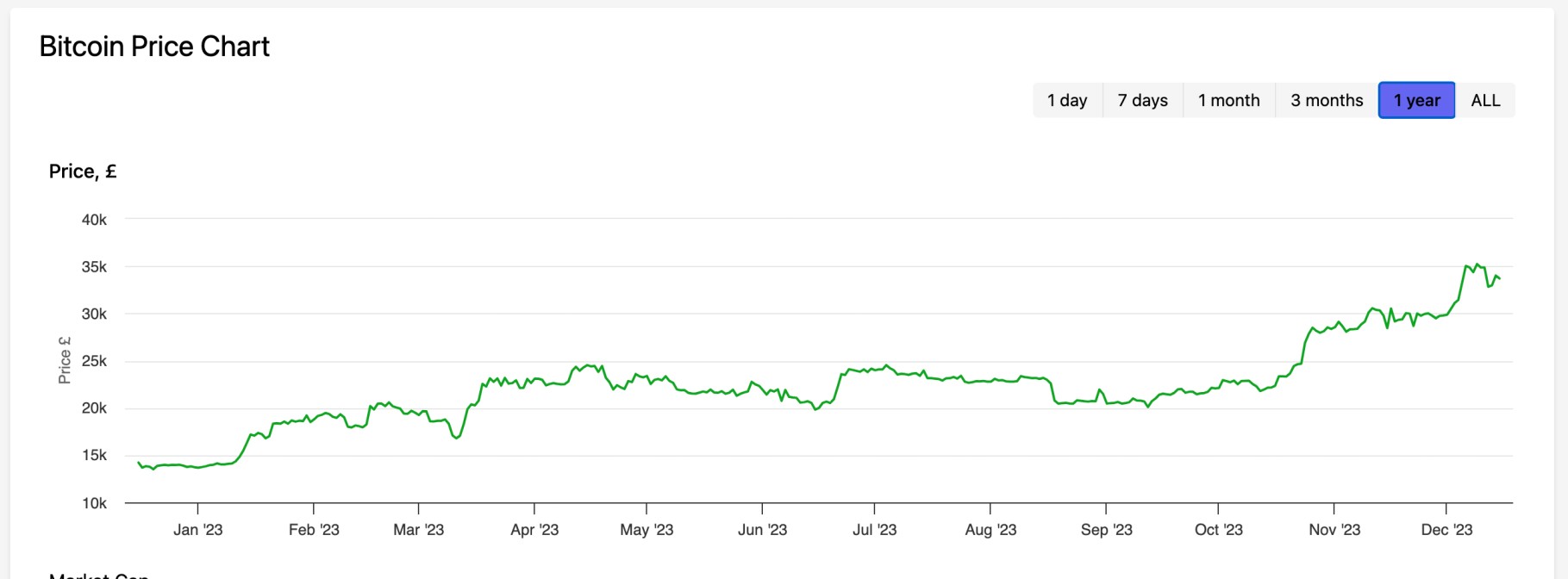

For instance, the chart below shows the BTC price wave from April to the May 2020 halving event. Prices moved from around $6300 to just below $10,000 in the build-up to the halving, while a significant price dip occurred on May 12th, the actual halving date.

The effect of the Bitcoin halving that reduces the cryptocurrency’s supply is usually felt in the long term. For instance, the 2020 halving also led to the price of BTC reaching $69,000 in 2021.

However, buying in the months leading up to it allows investors to price in on the event and reap quick short-term gains. You can sell in the buildup to the Bitcoin halving and then sell again to repurchase at a lower price once the initial hype fades.

Should I buy Bitcoin now?

The best time to buy bitcoin was years ago. The second best time is right now. Bitcoin has been the best-performing asset of the last decade and has inherent properties that almost guarantee a price increase in the years ahead.

Many notable investors, including Robert Kiyosaki, Paul Tudor Jones, Stanley Druckenmiller, and Mexican billionaire Ricardo Salinas Pliego, recommend at least 1% exposure to bitcoin and tip the cryptocurrency to become the 'digital version of gold eventually.’

If Bitcoin were to achieve half of what its proponents believe, it could overcome its volatile nature and reach numbers beyond the current $400 billion market cap. Will each bitcoin be worth $100,000 eventually? Time will tell.

You can get started with bitcoin by signing up on reputable exchanges like OKX and Bitget.com to make your first purchase. See our step-by-step guide on how to buy bitcoin in the UK.

Conclusion

Knowing the best time to buy bitcoin is beneficial and healthy for every investor's portfolio. It allows you to get more coins for your money and saves you from falling into the usual FOMO. In this article, we reviewed different times to buy bitcoin at lower prices and revealed the factors that adversely move the market to create great buy opportunities.

Time and again, bitcoin has defied the odds to bring in great results for investors. Only time will reveal whether the asset can become ‘digital gold’ and redistribute wealth to those who buy into the vision now.

usdt

usdt xrp

xrp