Cryptocurrencies have gained popularity in the UK, with Bitcoin being the most widely used. While no laws prohibit its use, the government has implemented crypto regulations to protect consumers and prevent financial crimes.

Table of Contents

- Is Bitcoin Legal in the UK?

- Cryptocurrency Regulations in the UK

- Stablecoin Regulation in the UK

- Staking and Other Crypto Services

- How the FCA Classifies Cryptocurrencies

- Crypto exchanges

- Buying and Selling Bitcoin in the UK

- Bitcoin Mining in the UK

- Crypto Trading in the UK

- Bitcoin ATMs in the UK

- Spending Bitcoin in the UK

- Conclusion

If you're in the UK and want to understand Bitcoin regulations, this guide will explain everything in simple terms.

Is Bitcoin Legal in the UK?

Yes, Bitcoin is legal in the UK. No laws prohibit people from buying, selling, or holding it. If it were illegal, millions of UK residents who own Bitcoin would be committing a crime. Instead, the UK government focuses on regulating businesses that deal with cryptocurrencies to ensure safety and transparency.

The Financial Conduct Authority (FCA) oversees crypto businesses in the UK, ensuring they comply with regulations designed to protect consumers and prevent financial crime. Companies offering cryptocurrency-related services, such as exchanges and wallets, must register with the FCA and follow its rules.

As cryptocurrency adoption increases, regulatory oversight becomes even more essential. In August 2024, 12% of UK adults (about 7 million people) owned crypto, up from 10% (5 million) in 2022 and 4.4% (2.2 million) in 2021. The trend highlights the need for clear regulations to improve public understanding, manage risks, and create a safer crypto market. Meanwhile, the FCA warns that investing in cryptocurrencies carries risks, as prices can change quickly.

Cryptocurrency Regulations in the UK

Crypto regulation in the UK is not governed by a single law. Instead, different government agencies create rules to manage various aspects of the industry.

The FCA regulates crypto companies and requires them to follow anti-money laundering (AML) and know-your-customer (KYC) rules. This means businesses must verify their users' identities and report suspicious activities.

The UK government is also developing new regulations to make the crypto market safer for users. In October 2023, HM Treasury announced a plan to regulate crypto following traditional financial services. This would mean stricter rules for companies and better protection for consumers.

Stablecoin Regulation in the UK

Stablecoins are cryptocurrencies designed to maintain a stable value by being linked to assets like fiat currency (e.g., the British pound). The UK government initially planned to regulate stablecoins separately from other cryptocurrencies. However, it later decided to regulate all crypto assets under a single framework.

The government does not currently regulate stablecoins as part of the UK's payments system. However, officials recognize their potential in financial markets and want to allow innovation while ensuring consumer protection.

Staking and Other Crypto Services

The UK government is reviewing how different crypto services should be regulated. Staking, a process where users earn rewards by locking up their crypto, has been debated. Recent updates suggest that staking may not be classified as a collective investment scheme, meaning fewer restrictions for businesses offering these services.

The government is also considering feedback from industry experts on key issues, such as how existing crypto firms should transition to the new regulatory framework.

How the FCA Classifies Cryptocurrencies

The FCA divides cryptocurrencies into three main categories:

Exchange Tokens: These are cryptocurrencies used for payments or trading. They are not considered legal currency and are not regulated. Examples include Bitcoin (BTC) and Ethereum (ETH).

Utility Tokens: These tokens provide access to specific services or products within a blockchain network. They do not represent ownership in a company and are not regulated. Examples include Basic Attention Token (BAT) and Filecoin (FIL).

Security Tokens: These tokens represent ownership in an asset, like shares in a company. They fall under the UK’s financial regulations and require approval from the FCA.

Crypto exchanges

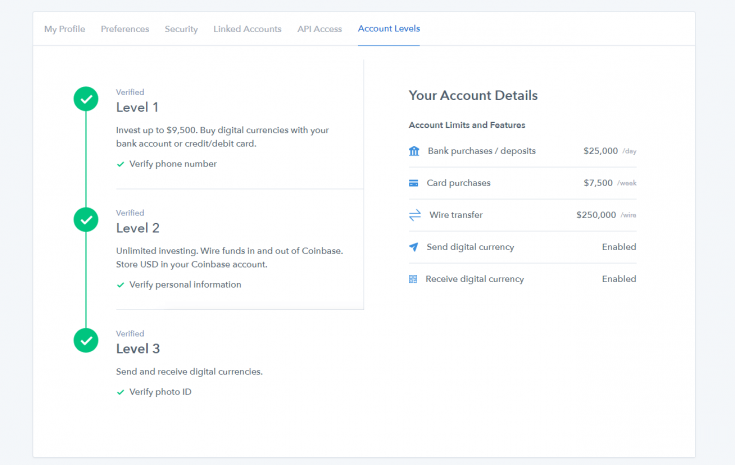

Coinbase Account Levels for Verified Users

Coinbase Account Levels for Verified Users

Crypto exchanges allow people to buy, sell, and trade cryptocurrencies. The FCA requires UK-based exchanges to follow AML and KYC rules, and users must provide identity verification before using these platforms.

In 2023, the FCA introduced new rules requiring crypto exchanges to obtain a license or approval before promoting their services. Some exchanges, like Binance and CEX.io, temporarily left the UK due to these changes. However, many platforms have adjusted their policies to comply with the new regulations.

Buying and Selling Bitcoin in the UK

Anyone in the UK can buy and sell Bitcoin through regulated exchanges. The FCA acknowledges that people often purchase cryptocurrencies for speculative purposes, hoping prices will rise. However, depending on factors like frequency and purpose, their transactions might be subject to tax.

While individuals can freely buy and sell Bitcoin, businesses issuing tokens classified as securities face stricter regulations. They must publish financial details and obtain FCA approval.

Crypto Taxes in the UK

- Buying Bitcoin: No tax applies when purchasing Bitcoin.

- Selling Bitcoin: If you sell Bitcoin for a profit, you may need to pay Capital Gains Tax if the profit exceeds the tax-free allowance.

- Crypto Payments: If you receive Bitcoin as payment for services, it is considered taxable income, and you may owe Income Tax and National Insurance.

Notably, HM Revenue & Customs (HMRC) provides detailed guidelines on how crypto activities are taxed in the UK. You can review these guidelines for more information.

Bitcoin Mining in the UK

Bitcoin mining is legal in the UK, but miners must pay taxes on their earnings. Customs duties may apply when importing mining equipment.

Income from mining is subject to Income Tax and National Insurance. However, tokens received from airdrops (free cryptocurrency distributions) are usually not taxed unless the recipient provides services in exchange.

Argo Blockchain is one of the most notable UK-based mining companies. The firm’s stock, ARB, is listed on the London Stock Exchange (LSE).

Crypto Trading in the UK

Trading Bitcoin and other cryptocurrencies in the UK is legal using regulated platforms. If trading is your primary source of income, you may be taxed under Income Tax instead of Capital Gains Tax.

While general crypto trading is allowed, the FCA has restricted certain high-risk products. In January 2021, the regulator banned the sale of crypto derivatives, such as futures and options, to retail customers. Due to their price volatility, the FCA believes these products are too risky for inexperienced users.

Bitcoin ATMs in the UK

Bitcoin ATMs allow users to buy and sell Bitcoin with cash. However, in 2022, the FCA shut down unregistered Bitcoin ATMs. Currently, there are no Bitcoin ATMs in the UK.

Devon’s first Bitcoin ATM once located at the Kingsbridge Information Centre

Devon’s first Bitcoin ATM once located at the Kingsbridge Information Centre

Spending Bitcoin in the UK

While Bitcoin is not banned in the UK, it is not recognized as “legal tender” in the UK. This means that businesses are not required to accept it as payment. However, many companies and online merchants still accept Bitcoin.

Although Bitcoin can be used for purchases, it comes with tax implications. If you have held BTC for long before spending it, you may need to pay capital gains tax on any profits. However, tax rules differ when Bitcoin is donated.

Donating Bitcoin to charity is allowed, and in some cases, these donations are exempt from Capital Gains Tax, making them a tax-efficient way to give.

Conclusion

As mentioned earlier, Bitcoin is legal in the UK, and crypto regulations aim to protect consumers while allowing innovation. To enforce these rules, the FCA oversees cryptocurrency businesses, ensuring they follow anti-money laundering rules. While Bitcoin itself is not regulated, exchanges, payment services, and mining activities must comply with government policies.

If you’re in the UK and interested in Bitcoin, use registered platforms and stay updated on tax obligations. Understanding these regulations will help you navigate the crypto market safely.

usdt

usdt bnb

bnb