Key takeaway: First Direct Bank in the UK does not currently allow customers to buy, sell, or hold cryptocurrencies directly through its banking platform. The bank has set up certain controls to limit or block payments it identifies as related to digital asset trading, especially those involving high-risk or unregulated crypto exchanges. However, users can still buy crypto with First Direct in the UK through FCA-compliant platforms such as Bitpanda, which stands out as one of the most suitable alternatives. Users can fund their accounts through the platform using supported bank transfers and debit cards while staying fully aligned with UK financial regulations. Once their accounts are verified and funded, they can access over 400 digital assets, including Bitcoin, Ethereum, and Solana, alongside tokenised ETFs, precious metals, and commodities, all from a single, secure dashboard.

This article will help you understand how to buy crypto with First Direct Bank in the UK safely. It also explains what’s possible, what’s restricted, and the best ways to fund your crypto purchases using approved methods.

Can you Buy Crypto Directly with First Direct Bank in the UK?

First Direct Bank does not currently permit customers to buy or trade cryptocurrencies directly through its banking platform. The bank maintains a cautious policy toward digital assets, reflecting its commitment to protecting customers from potential risks such as fraud, volatility, and unregulated platforms. In practice, this means that while payments to recognised crypto exchanges may be allowed, they are subject to strict monitoring and transaction limits. According to publicly available information, First Direct, alongside its parent institution, HSBC UK Bank plc, imposes a £2,500 limit per transaction and a £10,000 rolling 30-day cap on payments it identifies as related to cryptocurrency activity. To sum it all up, although First Direct allows crypto-related transfers under specific conditions, it does not provide or directly support cryptocurrency trading, investment, or wallet services through its own platform.

How to Buy Crypto with First Direct Bank: 6 Simple Steps

- Choose a Trusted Crypto Exchange

Select an FCA-registered and reputable exchange such as Bitpanda, eToro, or Gemini. These platforms comply with UK financial regulations and are recognised for secure transactions and transparent operations. - Create and Verify Your Account

Sign up on the chosen exchange and complete the identity verification process. You’ll need to provide personal details and valid identification to meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. - Link Your First Direct Bank Account

Add your First Direct bank account as a payment method on the exchange. Depending on the platform, you may be able to connect it via bank transfer (Faster Payments) or debit card. - Fund Your Exchange Account

Transfer funds from your First Direct account to the exchange. Ensure the amount is within First Direct’s transaction limits. - Buy Your Preferred Cryptocurrency

Once your exchange account is funded, choose the cryptocurrency you wish to buy, such as Bitcoin (BTC), Ethereum (ETH), or Solana (SOL), and complete your purchase on the platform. - Store Your Crypto

After purchasing, transfer your digital assets to a safe crypto wallet, preferably a hardware or self-custody wallet, for added protection against online threats and exchange-related risks.

First Direct Bank’s Cryptocurrency Payment Limits

First Direct Bank has set clear limits on how much you can spend on crypto-related payments, mainly to keep transactions under control and reduce the risks linked to unregulated platforms or scams. At the moment, there’s a £2,500 cap per transaction and a £10,000 rolling 30-day limit on payments the bank flags as connected to crypto exchanges. These restrictions apply to both debit card and bank transfer payments made to digital asset exchanges. The purpose of these limits is to minimise exposure to high-risk or unregulated platforms, ensure transactions remain traceable, and reduce the likelihood of financial loss from scams or volatile market behaviour. So, if you plan to use First Direct for buying crypto, you can still move funds to recognised exchanges like Bitpanda, but you might run into restrictions if you make large or frequent transfers. It’s a good idea to space out your deposits and keep them within the set limits to avoid declined payments or delays.

Fees and Costs When Buying Crypto with First Direct

- For most cryptocurrencies, the premium ranges from 0.00% to 2.49%, while Bitcoin has a fixed rate of 0.99%.

- Free deposits and withdrawals in fiat currencies, including GBP, through supported payment methods like bank transfers and cards.

- There are also no custody or holding fees, meaning you can store your digital assets on the platform without extra costs. However, when you transfer crypto from Bitpanda to an external wallet, you’ll need to pay the standard blockchain network fee, which varies based on network traffic and the asset you’re sending.

- There might be a small difference between the quoted price and the live market rate, known as the spread.

- A 1% commission on every crypto trade, applied when buying and when selling.

- Free deposits for supported currencies, but fiat withdrawals from USD accounts come with a $5 fee per transaction.

- For UK users dealing in GBP, currency conversion fees of around 1.5% to 3.0% may apply when converting funds between GBP and USD, depending on your payment method.

- An inactivity fee of $10 per month if your account remains unused for 12 consecutive months.

- A 2% transfer fee when moving crypto between your trading account and the eToro Money Wallet. However, if you send assets from your eToro wallet to an external wallet, you’ll only pay the network fee required by the blockchain.

Best GBP Deposit Methods for First Direct Bank

- Faster Payments (Bank Transfer)

This is the most reliable and widely accepted option. You can transfer GBP from your First Direct account to a registered crypto exchange, such as Bitpanda, using the Faster Payments network. Deposits are usually processed within minutes, although transactions are monitored for crypto-related activity and must fall within the bank’s £2,500 per-transaction and £10,000 rolling 30-day limits. - Debit Card Payments

Some FCA-registered exchanges accept debit card deposits linked to your First Direct account. While this option gives convenience and near-instant deposits, the bank may occasionally block transactions it identifies as high-risk or associated with unregulated crypto platforms. To avoid disruptions, always use well-known, UK-regulated exchanges. - Third-Party Payment Providers

Platforms like Wirex, Skrill, or MoonPay can act as intermediaries between your bank and the exchange. These services allow you to fund your crypto purchases indirectly while maintaining compliance with UK financial standards. However, fees may be higher compared to bank transfers. - Open Banking Payments

Some exchanges now support Open Banking, which gives you access to connect your First Direct account without risks and make direct verified transfers through the exchange’s interface. This method is fast, compliant, and often has a lower likelihood of transaction rejection.

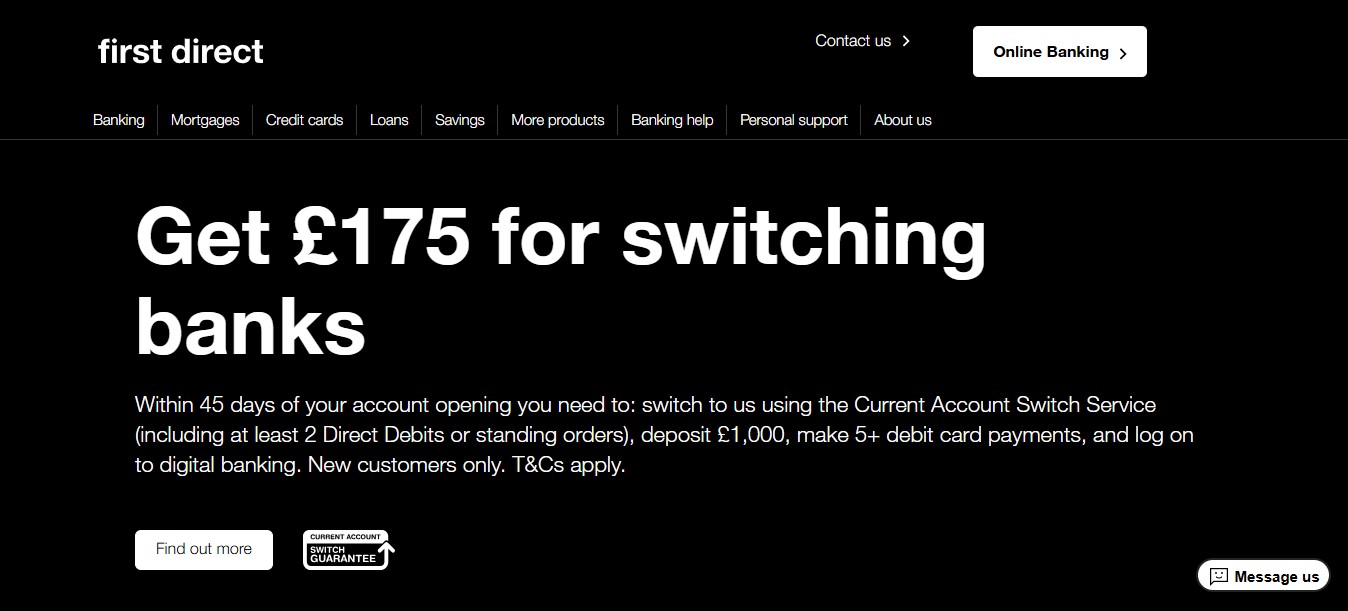

What is First Direct?

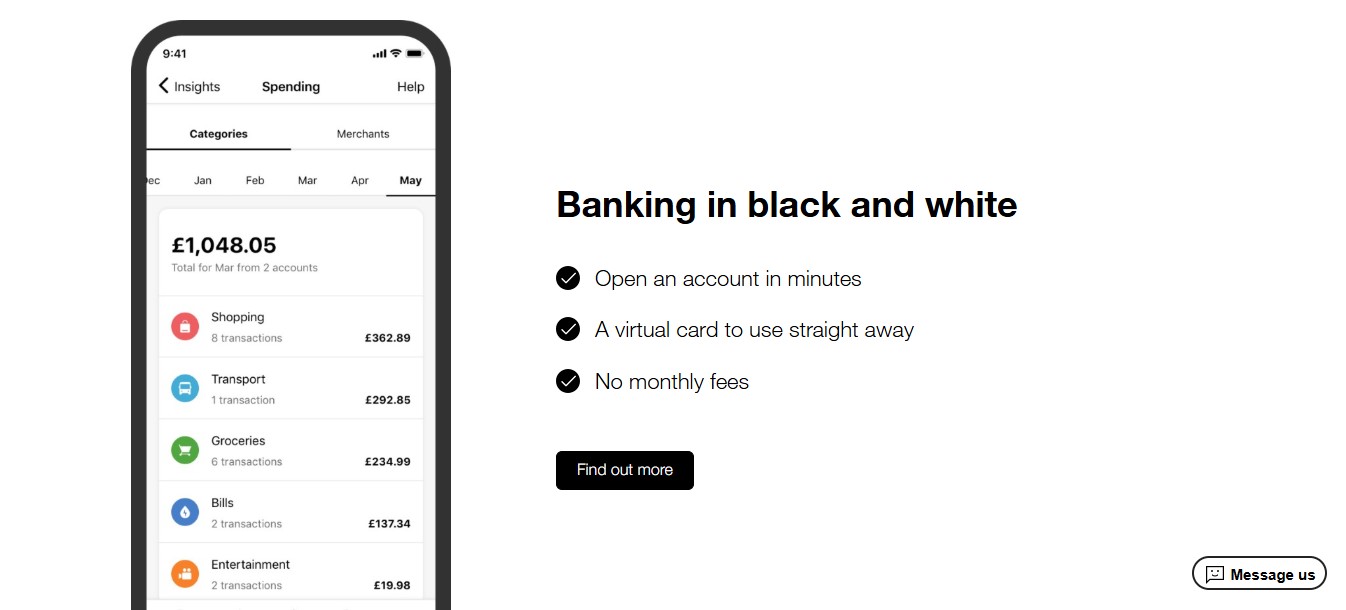

First Direct is a UK-based retail bank owned by HSBC UK Bank plc, part of the global HSBC Group, one of the world’s largest and most trusted financial institutions. Launched in 1989, it made history as the UK’s first bank to operate entirely without physical branches, offering 24/7 phone and online banking at a time when most banks still relied on in-person services. That bold move set the tone for what First Direct has become today: a fully digital bank built around simplicity, convenience, and exceptional customer service.

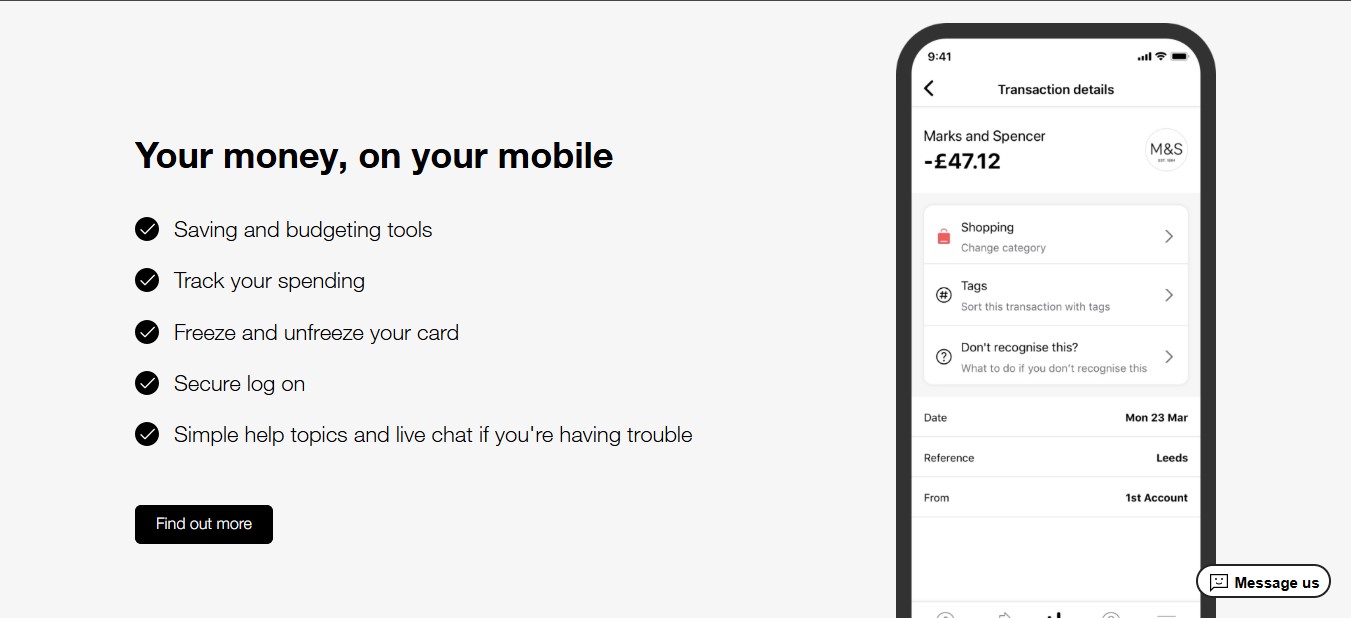

The bank offers everything you’d expect from a modern financial provider, which includes: current accounts, savings, loans, credit cards, and mortgages, all managed seamlessly through its website, mobile app, or UK-based contact centre. Even without a single branch, First Direct continues to rank among the highest in the UK for customer satisfaction, thanks to its personal support and user-friendly digital tools.

Being part of HSBC, a global banking powerhouse with operations in over 60 countries, gives First Direct the financial strength and regulatory backing of a major institution while keeping its own identity as a nimble, customer-first bank. Today, it serves more than 1.4 million UK customers, many of whom choose it for its reliability, transparency, and commitment to making everyday banking simple and stress-free.

Conclusion

Buying crypto with First Direct Bank in the UK may not be straightforward, but as this guide has shown, it’s far from impossible. With a clear understanding of how the bank’s restrictions work and which exchanges are approved, UK users can take part in crypto trading without breaking any banking or regulatory rules. FCA-registered exchanges such as Bitpanda and eToro make it possible to move funds from your First Direct account, stay within transaction limits, and trade in a way that aligns with UK financial standards. What this means for you is control and convenience, as you don’t need to switch banks or rely on questionable platforms to get started. You can still use your First Direct account for crypto-related payments and benefit from its dependable service and strong consumer protection. By following these steps, you can buy crypto with First Direct in the UK, without the guesswork, the risks, or the hassle.

usdt

usdt xrp

xrp