Key takeaway: Starling Bank in the UK does not currently allow direct buying, selling, or holding of cryptocurrency through its platform. The bank has imposed restrictions on transactions identified as related to crypto exchanges, which means certain payments or transfers to platforms may be declined. However, users can still gain exposure to digital assets by funding accounts on regulated crypto exchanges such as Bitpanda, a trusted, FCA-registered platform known for its strong security measures, instant deposits, and access to over 500 digital assets, including Bitcoin, Ethereum, and tokenised ETFs. Bitpanda provides a compliant and transparent route for Starling users to engage with crypto safely while remaining within UK financial regulations.

In this guide, we explore how to help you make sense of Starling’s crypto restrictions and show you exactly how to work around them safely. You’ll learn what Starling’s policy really means, the limits to watch out for, and how to fund a regulated exchange account the right way.

Can You Buy Crypto Directly with Starling Bank?

You cannot buy cryptocurrency directly through Starling Bank as it does not provide crypto trading, storage, or payment services within its app. This means you can’t purchase digital assets like Bitcoin or Ethereum straight from your Starling account. However, you can still use the bank for buying crypto indirectly by transferring funds to regulated exchanges that accept deposits from Starling customers. This allows you to stay within the bank’s guidelines while accessing the crypto market through trusted third-party platforms.

What is the Starling Bank Policy on Crypto Transactions?

Starling Bank has adopted a restrictive policy toward cryptocurrency transactions as part of its broader financial crime prevention framework. The bank no longer supports payments to or from crypto exchanges (even when dealing with FCA-registered exchanges), so customers cannot use their Starling debit cards or bank transfers to fund or withdraw from platforms involved in digital asset trading. The bank describes crypto-related activity as “high risk,” referencing concerns about fraud, money laundering, and regulatory uncertainty in the sector. As a result, any transaction identified as connected to a crypto exchange or wallet provider is likely to be blocked or declined.

How to Buy Crypto with Starling Bank: 6 steps

- Create a Bitpanda Account

Visit Bitpanda’s official website and sign up for a new account. Once registered, verify your email to activate your account. - Complete Identity Verification (KYC)

Bitpanda, as an FCA-registered platform, requires Know Your Customer (KYC) verification. Upload a valid photo ID (such as a passport or driver’s license) and complete the facial verification process. - Fund Your Bitpanda Account via Supported Bank

Since Starling Bank does not process payments to crypto exchanges, you cannot transfer money to Bitpanda directly. Instead, fund your Bitpanda account using another supported UK bank account, or deposit through third-party payment options like Skrill or PayPal. - Add GBP to Your Bitpanda Wallet

Once you’ve transferred funds from your alternative account or payment provider, your Bitpanda GBP wallet will reflect the deposited amount. - Buy Cryptocurrency on Bitpanda

Navigate to the “Trade” section, select your preferred cryptocurrency, such as Bitcoin, Ethereum, or Solana, and confirm your purchase using the GBP balance in your Bitpanda wallet. - Secure and Track Your Investment

After purchase, your crypto assets will appear in your Bitpanda portfolio. You can choose to keep them in Bitpanda’s secure wallet or transfer them to a private wallet for additional control.

Fees and Costs When Buying Crypto with Starling Bank

Bitpanda includes its trading fees directly in the price displayed when you buy or sell cryptocurrency, known as the premium. For most cryptocurrencies, the premium ranges from 0.00% to 2.49%, while Bitcoin has a fixed rate of 0.99%. Depositing or withdrawing fiat currencies, including GBP, is free when using any of Bitpanda’s supported payment methods. The platform also does not charge custody or holding fees for storing your digital assets. However, when transferring crypto from Bitpanda to an external wallet, you’ll need to pay a standard blockchain network fee. This fee isn’t set by Bitpanda but depends on network activity and the specific cryptocurrency you’re sending. While the built-in premium makes transactions transparent and easy to understand, keep in mind that there may still be a small difference, known as a spread, between the price shown on Bitpanda and the current live market rate.

eToro charges a flat 1% commission on all cryptocurrency trades, applied both when you buy and when you sell. This fee is already factored into the displayed market price, ensuring full transparency at checkout. There are no deposit fees for supported currencies. However, a $5 withdrawal fee applies to every fiat withdrawal made from USD investment accounts to external bank accounts. For users operating in GBP, a currency conversion fee is charged when converting between GBP and USD, 1.5% to 3.0%, depending on the payment method used. If an account remains inactive for 12 consecutive months, eToro applies a $10 monthly inactivity fee. Transferring crypto between your main eToro trading account and the eToro Money Wallet incurs a 2% transfer fee. When sending crypto to external wallets, only the applicable blockchain network fees are charged.

Gemini’s fees depend on how you trade and the payment method you choose. On the standard Gemini app, instant buy and sell transactions have a total fee of about 1.49%. However, users on the ActiveTrader platform enjoy lower, volume-based maker-taker fees that range from 0.00% to 0.40%, depending on trading activity. Depositing funds via bank transfer is free, but using a debit card comes with a higher fee of roughly 3.49%. Withdrawals to UK or international bank accounts through standard transfer methods are usually fee-free, though wire transfers may attract a flat fee of around $25. When withdrawing crypto to an external wallet, network fees apply; these are paid to blockchain validators and vary depending on network congestion. In addition, Gemini provides institutional-grade custody services that include advanced security and insurance coverage, which involves an annual storage fee of around 0.40%, though regular retail users are not charged this fee.

Most Common Ways to Deposit From Starling Bank to Crypto Exchanges

Bank Transfers Through Alternative Accounts

The most reliable option is to use a secondary bank account or traditional banks like Barclays, which allows crypto-related payments. You can transfer funds from your Starling account to this secondary account and then use it to deposit into your preferred crypto exchange.

Third-Party Payment Providers

Regulated payment processors such as Skrill, PayPal, or Wise can act as intermediaries. You can move money from Starling to these platforms and then fund your crypto exchange wallet from there, if the provider supports crypto transactions.

Funding Regulated Exchanges Like Bitpanda

Some FCA-registered exchanges, including Bitpanda, accept deposits via standard bank transfers and alternative payment networks. Although Starling may block direct deposits, you can initiate a transfer through an intermediary account or service supported by Bitpanda.

Peer-to-Peer (P2P) Transfers

Certain exchanges offer peer-to-peer marketplaces where you can buy crypto directly from verified sellers using payment methods compatible with Starling’s transfer system. This approach requires careful verification of the counterparty but can be a practical alternative if done through secure, FCA-compliant platforms.

Using Fiat-to-Crypto Gateways

Another route is to use fiat on-ramp services, which allow users to buy crypto using supported debit cards or external bank accounts. You can fund these gateways indirectly from your Starling account via an approved payment intermediary before completing the crypto purchase.

What is Starling Bank?

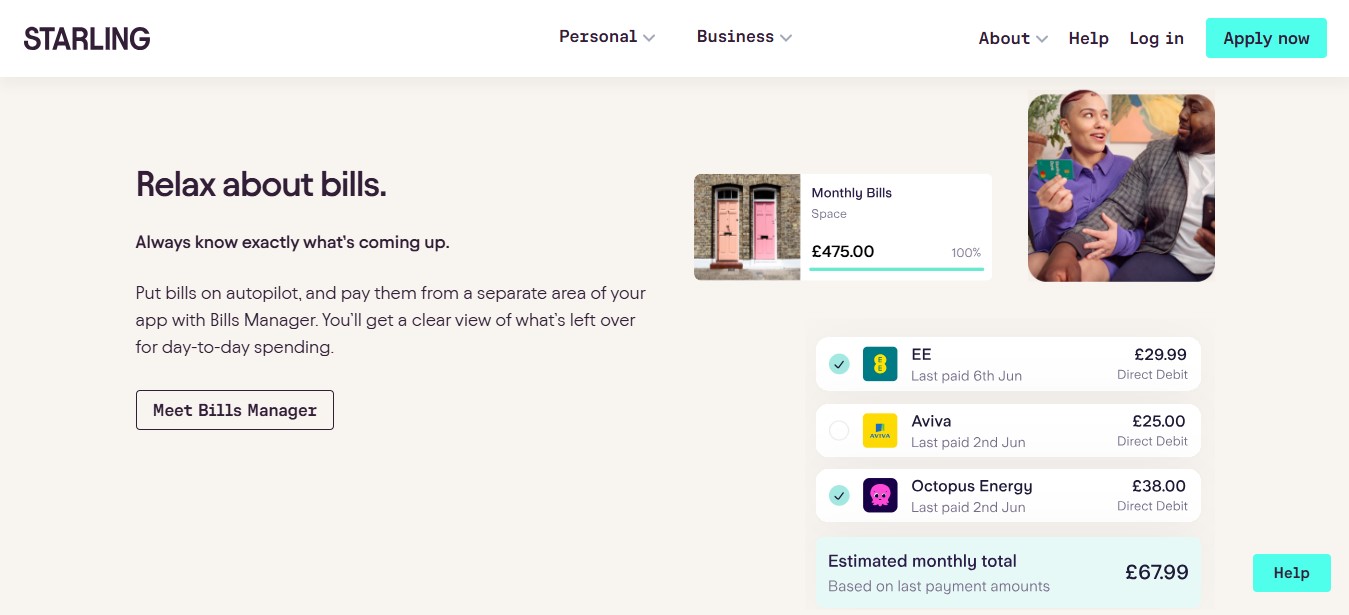

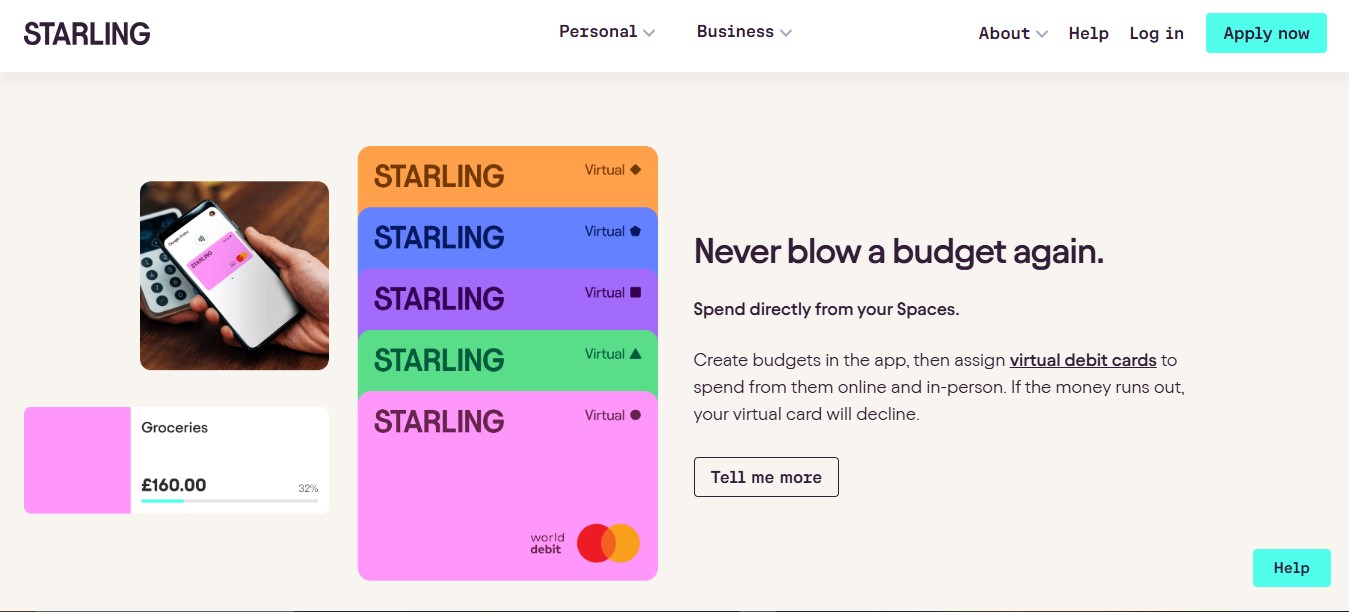

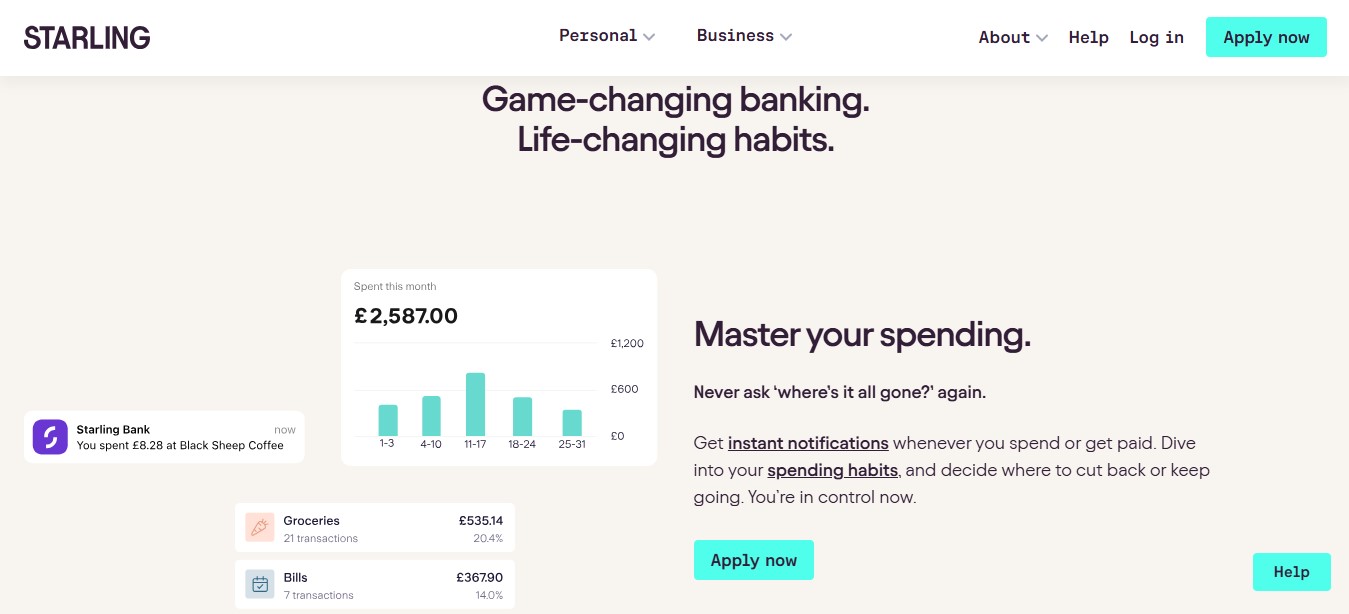

Starling Bank is a UK-based digital bank founded in 2014 by former Allied Irish Banks COO Anne Boden. It operates entirely online with no physical branches, offering a mobile-first banking experience designed for individuals, joint account holders, and businesses. The bank is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), ensuring that customer deposits are protected under the Financial Services Compensation Scheme (FSCS). Starling provides a wide range of financial services including current and savings accounts, overdrafts, personal and business loans, and foreign currency transfers. Recognised for its user-friendly app, real-time spending insights, and low fees, the bank has become one of the UK’s leading challenger banks with over four million customer accounts and billions in deposits. Although it has expanded its operations to include limited business in Europe, it remains headquartered in London and operates independently, without a US parent company. Despite its innovation in digital banking, users cannot buy crypto directly with Starling Bank, as it prioritises security and compliance by restricting transactions linked to crypto exchanges.

How Crypto-Friendly is Starling Bank?

Starling Bank provides a simplified and efficient digital banking experience, with instant payment alerts, seamless account management, and solid security tools. However, its stance on cryptocurrency remains restrictive, as it does not permit direct transfers or payments to crypto exchanges.

FAQs:

Which Crypto Exchanges Work Best with Starling Bank?

Among the available options, Bitpanda stands out as the most compatible exchange for you to invest in crypto using your Starling Bank account. It is FCA-registered, supports instant GBP deposits through approved intermediaries, and provides a transparent, secure environment for trading over 500 digital assets with full regulatory oversight.

Can I Use My Starling Debit Card to Buy Crypto?

You cannot use your Starling debit card to buy cryptocurrency. The bank blocks transactions linked to crypto exchanges as part of its anti-fraud and compliance measures. Currently, no form of Starling Bank allows crypto purchases, whether through direct card use or linked exchange accounts.

How Long Does it take to Buy Crypto with Starling Bank?

The time required to buy Bitcoin with Starling Bank or any other crypto depends on the funding route used. When transferring funds through an alternative UK bank or regulated payment provider, the process often takes one to two business days. Once the exchange account is credited, purchasing and confirming your crypto transaction usually happens instantly.

Conclusion

This guide has shown that while you can’t buy crypto with Starling Bank directly, you’re not completely shut out of the game. You just have to take a smarter route. By using FCA-registered exchanges and approved funding methods, you can still move money from Starling, make your first crypto purchase, and stay fully compliant.

usdt

usdt xrp

xrp