Binance USD (BUSD) is the third largest stablecoin by market capitalization, trailing only Tether (USDT) and Circle USD (USDC). BUSD is approved by the New York State Department of Financial Services (NYDFS) and issued in partnership with blockchain company Paxos.

Table of Contents

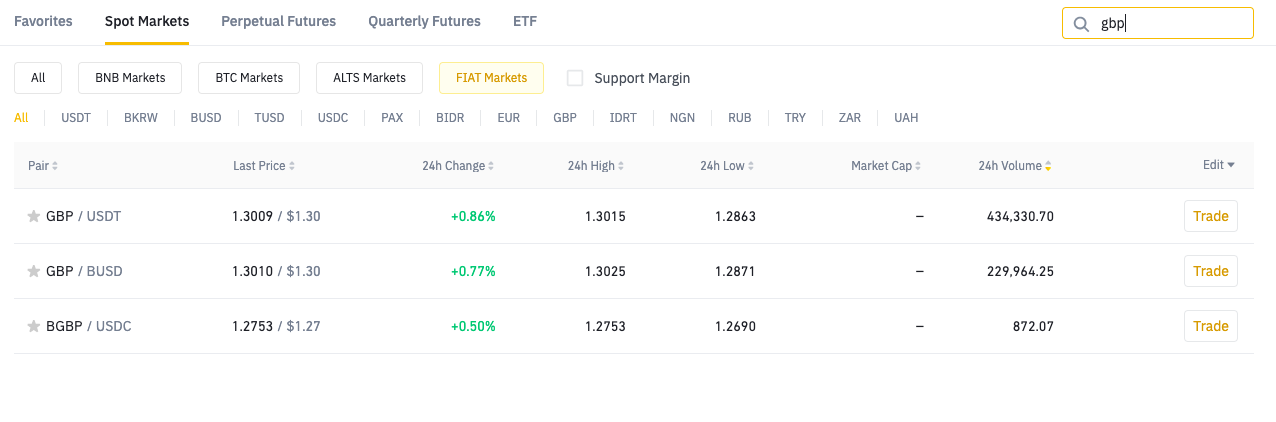

Where can I buy Binance USD (BUSD) in the UK? Of course, on Binance exchange. You can buy directly with a debit card, ACH, or your USD balance. Alternatively, you can find BUSD trading pairs under the Markets tab.

How to buy BUSD

There are two main exchanges where you can buy this stablecoin: Binance and Paxos. Here is a detailed guide on how to buy BUSD on Binance:

- Create an Account. In order to trade on any exchange, including Binance, you first need to register an account.

- Verify your Account. After you create your account and verify your email, you will need to verify your identity by submitting a copy of a government-issued photo ID. It is a required step because you are going to deal with stablecoins and fiat currency.

- Deposit money. This step depends on your selected payment method:

- If you want to use BTC or ETH, you need to deposit them from your private wallet to the exchange (Go to Funds -> Deposit)

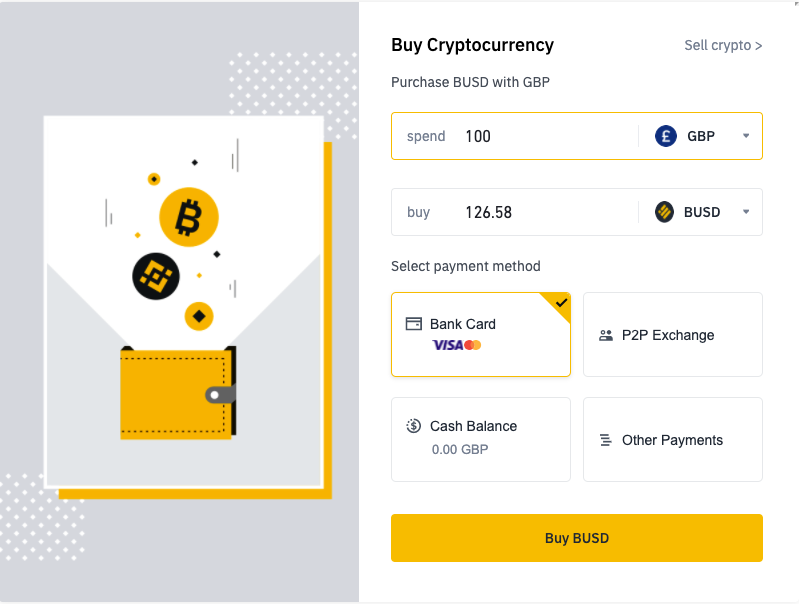

- If you want to buy BUSD with GBP, then you can wire transfer your pounds in advance.

- If you are going to use your debit/credit card, you can skip this step and proceed to the next step.

- Open Order. Open the Markets tab, select the desired pair, and click on the Trade button. Enter all the required details, select the type of order, and submit your request.

It will be completed immediately if you select a Market order type. If any other type, it may take some time. So don’t worry if you still have an open order after an hour. Once the price drops to the limit you set, Binance will process the order.

Benefits of using BUSD on Binance

- A zero maker fee promotion for all BUSD pairs traded on Binance;

- Several lending products at Binance where BUSD can be deposited to earn interest of as much as 10% annually;

- BUSD can be used as collateral for borrowing on Binance Margin Trading;

- BUSD can also be used as cross collateral on the Binance Futures platform;

- Binance has introduced 300 different BUSD trading pairs, including trading against the Chinese Yuan (CNY), Russian ruble (RUB), and Great Britain pound (GBP);

- The Binance platform has introduced a feature that allows users to instantly convert from several other stablecoins to BUSD on a 1:1 basis without fees. This stablecoin conversion feature can be used with TUSD, USDC, and PAX.

- Many cryptocurrency exchanges support BUSD and offer some trading pairs for the stablecoin.

Where to store BUSD?

Once your order is completed and you can see the BUSD on your account, you probably want to move it to a secure wallet. It is not ideal to store money on an exchange for a long time.

The platform may suffer a security breach or downtime issues that result in you being unable to transfer your coins. Thus, it is often best to take self-custody of purchased coins.

Since the BUSD token is available as ERC-20 and BNB Chain-native tokens, you can transfer the coin to any other wallet that supports the Ethereum and BNB Chain networks. You can use any free wallet or purchase one of the hardware wallets such as Ledger Wallet to store your BUSD tokens.

Ledger Nano S Plus

Ledger Nano S Plus is a widely-used hardware wallet developed by the French company ledger. It is a compact USB device based on a smart card.

To activate the Nano S Plus, you need to connect it to the computer via the USB cable. If you choose the option to create a new wallet, you will need to confirm the PIN code. You must remember the PIN code because you will need it each time you want to access your Nano S Plus.

Pros

- The setup is pretty simple and straightforward.

- Ledger Nano S Plus supports a vast variety of coins.

- Integrates with a large number of software wallets.

- It is a very affordable hardware wallet (£69), given the high-security features.

- The entire recovery process can only be done from the device without even connecting it to a computer.

- Ledger Nano S Plus Features Ledger's secure chip technology.

- Pretty inconspicuous looking since it resembles a simple pen drive. Plus, it is pretty lightweight, so can be easily carried around.

Cons

- The device is not open-source hardware.

- The recovery sheet can be stolen or replicated if enough care isn’t taken.

Ledger Nano X

The Nano X has superior security thanks to the use of two chips. It also has a Bluetooth feature that will allow users to use the Nano X with their phone, or laptop, without the need for a wire.

The most significant difference between Nano X and Nano S Plus is that the former can hold multiple cryptocurrencies at once. With the Nano S plus, users had to manually install and remove apps to use a particular wallet. However, users can install multiple crypto wallets in Nano X at the same time.

While the setup is mostly similar to Nano S, the pros and cons reveal that the more expensive device (Leder Nano X costs £136) offers more advanced functionalities.

Pros

- The setup is pretty simple and straightforward.

- It has Bluetooth functionality, making it easier to use on the go.

- The entire recovery process can be done from the device without even connecting it to a computer.

- It features Ledger's secure chip technology.

- Pretty inconspicuous looking since it resembles a simple pen drive. Plus, it is pretty lightweight and can easily be carried around.

- Allows multiple apps and coins to function at the same time on the wallet.

Cons

- Not open-source hardware.

- The recovery sheet can be stolen or replicated if enough care isn’t taken.

- The UI could be a little difficult to understand for newcomers.

F.A.Q

What is Stablecoin?

Stablecoins are digital assets designed to mimic the value of fiat currencies like USD or EUR. They allow users to cheaply and rapidly transfer value around the globe while maintaining price stability.

Is there any difference between cryptocurrency and stablecoin?

Yes, there is.

Cryptocurrencies are excellent from a technological standpoint. However, the fluctuations in their value have ultimately rendered them highly risky investments and not ideal for making payments. By the time a transaction settles, coins can be worth significantly more or less than they were at the time the sender transferred them.

While it is different from stablecoins, the latter see negligible price movements and closely track the value of the underlying assets or fiat currencies they emulate. As such, they serve as reliable assets amid volatile markets.

The most popular kind of stablecoin is directly backed by fiat currency with a 1:1 ratio. A central issuer (or bank) holds an amount of fiat currency in reserve and issues a proportionate amount of tokens. We also call these fiat-collateralized stablecoins.

For instance, the issuer may hold one million dollars and distribute one million tokens worth a dollar each. Users can freely trade these as they would with tokens or cryptocurrencies; at any time, the holders can redeem them for their equivalent in USD.

Examples of the best-known stablecoins include tether (USDT), trueUSD (TUSD), Gemini dollar (GUSD), and BUSD coin by Binance.

What is BUSD?

BUSD is a fiat-backed stablecoin maintaining a peg with the US dollar.

BUSD is a U.S.-regulated stablecoin, fully backed by U.S. dollar fiat reserves: 1 BUSD = USD 1.00. BUSD offers faster ways to fund your trades and is acceptable as a medium of exchange, value storage, and payment method across the global crypto ecosystem.

Binance created BUSD with the intention of improving the decentralized finance ecosystem through the use of a frictionless global network that allows digital assets to add accessibility, flexibility, and speed to transactions.

Issuing company Paxos mints BUSD tokens on the Ethereum Network as an ERC-20 token backed on a 1:1 basis by fiat reserves that are held in U.S. bank accounts. However, Binance USD tokens are also accessible as BEP-2 and BEP-20 tokens on BNB Chains. While Paxos manages the ERC-20 integration, Binance issues Binance-pegged (wrapped BUSD tokens) accessible on their native networks.

Additionally, BUSD has been one of only three stablecoins thus far approved by U.S. regulators, with the other two being GUSD, issued by Gemini Trust Company, and PAX, also issued by Paxos.

Binance USD is transacted on the Ethereum and BNB Chain networks in the same manner as any other token. However, any user looking to redeem their BUSD can send the tokens to a Paxos-controlled address via the Ethereum network where the tokens will be burned, and the corresponding fiat currency amount transferred from the Paxos reserve account to the user’s bank account.

Summing Up

If you need to buy BUSD coins, you should go to the Binance exchange, where you can easily buy them using multiple payment methods. Once you acquire your new stablecoins, don’t forget to move them to a reliable wallet like Ledger Nano X to keep your coins safe.

usdt

usdt xrp

xrp