NFT tokens (Non-Fungible tokens) is the latest buzzword in the cryptocurrency industry. Some of these tokens have reportedly sold for millions of dollars, and industry experts are tipping it to be the ‘next big thing.’

Table of Contents

If they are going to be the ‘next big thing’ or have the potential to do so, it makes perfect sense for you to understand what NFT tokens are and how they work.

This article dives into non-fungible tokens, explaining their use case, why they are valuable, how you can make money off them, and the advantages and disadvantages associated with them.

What is an NFT token?

A non-fungible token (NFT) is a special kind of cryptographic token used to represent a unique asset. The idea is to give the holder exclusive and verifiable rights to the asset represented by the token. Simply put, even though many kinds of NFT tokens exist, only one individual could own one type of NFT.

The term “non-fungible” means that you cannot exchange one NFT for the other. Unlike fiat notes, where you can repay a £10 loan with a different £10 note from the one you received, NFTs are not exchangeable for other NFTs.

However, you can buy and sell NFTs for Ethereum’s native token, Ether (ETH), or any other coin used for the marketplace where traders list them.

The whole idea of an NFT won’t make sense if you do not know about collectables. Essentially, many refer to NFTs as crypto-collectables.

So, what are collectables?

Collectables refer to any item or object that the collector deems as valuable and perhaps willing to pay money to acquire. They may not necessarily have a monetary value or be rare. For instance, people buy and store collectables such as art, rare stones, comic books, trading cards, in-game items, and historical value objects.

The idea with NFTs is to bring collectables into the blockchain, making it easier for people to acquire and exchange them. By putting collectables on a blockchain, users can verify that the item is unique, and anyone else can trace the entire history of the NFT to prove ownership.

How does it work?

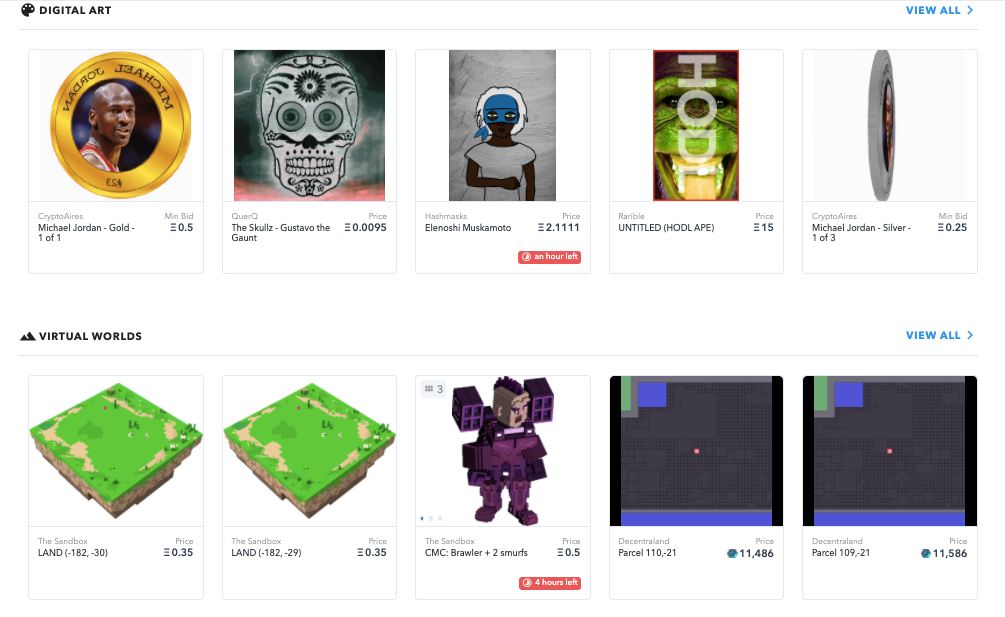

Anyone can create non-fungible tokens using the ERC-721 standard on the Ethereum blockchain or any other network that supports the issuance of non-fungible assets. Some tools let you create an NFT easily, for instance, OpenSea, Rarible, and MintBase.

The NFT is usually minted using an Ethereum address and linked to a work-of-art produced by the issuer. This work could include graphic files (PNG, JPEG, etc.), 3D files, audio files (MP3, AAV.), etc.

Following the minting, the issuer can list it on a marketplace like OpenSea. For influencers and other platforms, they can sell or gift it to followers. There are many different use cases for NFTs, which we will dive into in more detail next.

What can NFTs be used for?

Collectables

NFT tokens fittingly bring the idea of collectables to the digital world and embrace the concept of digital scarcity, which Bitcoin pioneered.

Influencers, cryptocurrency exchanges, and related businesses can issue unique tokens to commemorate special events. Recipients can then hold these tokens are memories or possibly resell them on marketplaces.

An excellent example of such collectible tokens are the CryptoPunks NFTs issued by Larvos Labs in 2017 for free to users. Many tokens are now being resold for millions of dollars and remain one of the most valuable crypto collectibles to date.

Gaming Economies

Game developers often build exclusive assets into their applications and bar users from transferring them to other players. For such an economy, bringing these assets to a blockchain is an advancement, allowing both players and game developers to manage them transparently.

Digital Identity

Reducing identity theft cases has always been heralded as one of the most prominent use cases for blockchain technology.

NFTs bring that use case to life since it allows users to link real-life information such as educational and health credentials to a token. Such a peg would increase uniqueness, privacy, and transparency for others who may need to use such information later.

Asset Tokenization

Distribution of real-world assets such as real estate or building structures could be done with NFTs representing each individual’s ownership of the property. These tokens are almost eternally verifiable evidence of the transaction and can be transferred upon repurchase of the property.

Why do they have value?

As noted earlier, people used to buy and store collectables such as art, rare stones, comic books, trading cards, and historical value items before the advent of NFTs. The market for art collectable items alone is worth roughly $37 billion.

Although these assets may not seem valuable to others, the collector often has a form of attachment to the item that they’re willing to put down money on the table for it. Additionally, some NFTs can be resold for a higher price later if someone desires to have the same item because of its uniqueness.

Pretty much the same way people believe that Bitcoin and fiat currencies are exchangeable for money, NFTs are valuable because someone sees them.

NFT case studies

NFTs have been around perhaps for longer than you think. Here are some remarkable case studies.

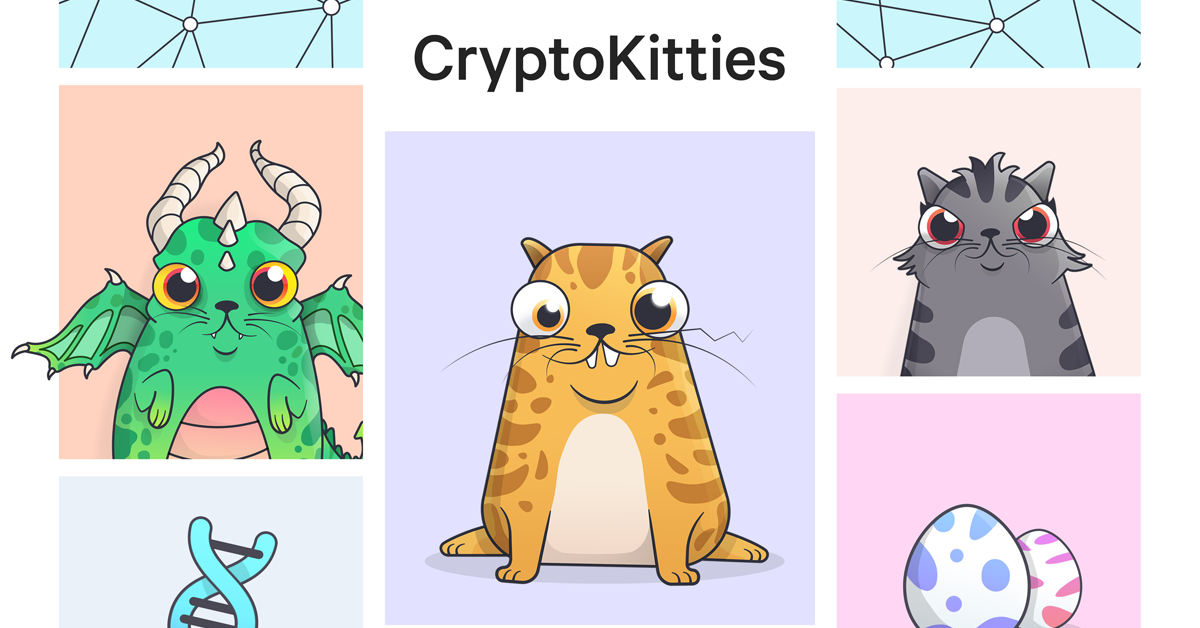

Crypto Kitties

Crypto Kitties is an Ethereum-based game that allows users to buy, breed, and exchange virtual cats. It was one of the earliest demonstrations of blockchain for a non-currency use case.

Each cat (represented by an NFT) has features such as colour and is unique to each user on the platform. No two cats on the platform are the same or exchangeable for the other, giving users the chance to breed individual cats and sell them to others.

In September 2018, someone paid $170,000 for the most expensive Crypto Kitty, while the total amount spent on these virtual cats runs into millions of dollars. At one point, the increased usage of Crypto Kittie’s platform clogged up the Ethereum network, and fees skyrocketed.

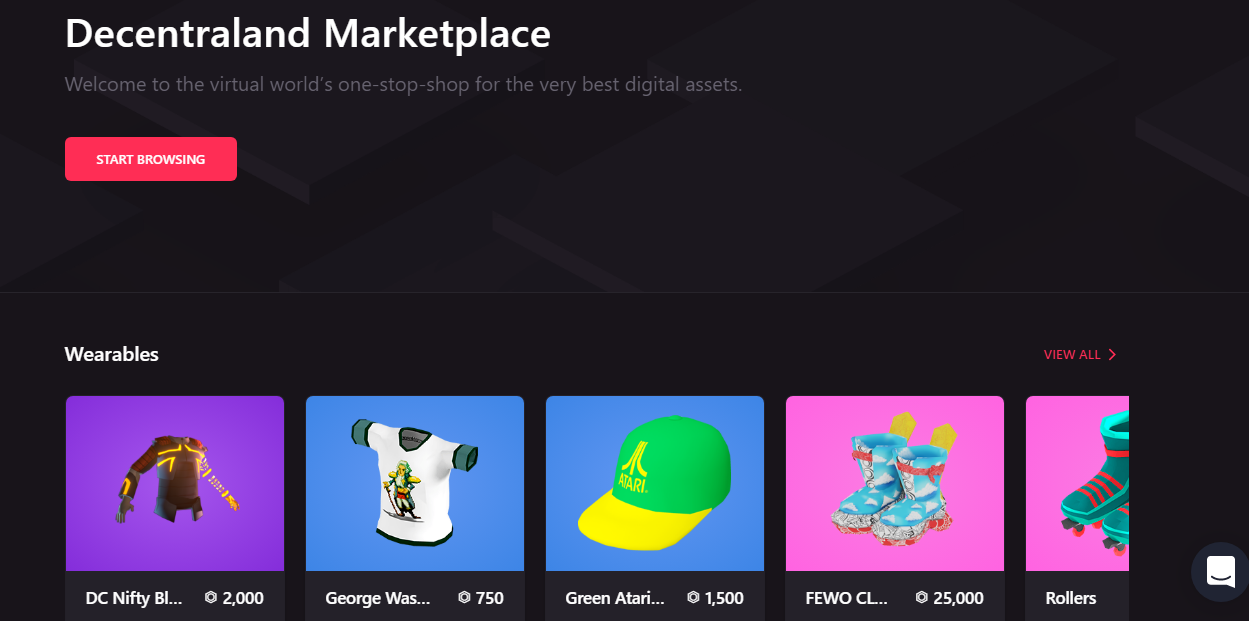

Decentraland

Founded in 2017, Decentraland is another virtual reality world built on Ethereum. The idea is to let users own, develop and exchange virtual lands and other unique NFT items.

The Decentraland marketplace is where users can sell NFTs that they acquire while playing the game. Available NFT tokens include wearables, virtual land parcels, and estates. Users pay for the items using the project’s native token (MANA).

CryptoPunks

Larva Labs created 10,000 unique cryptocollectible characters in 2017, setting the tone for what came to be known as the ERC-721 standard for creating NFTs on the Ethereum blockchain.

Given it preceded other blockchain collectables and initially released for free, many NFT enthusiasts regard “Punks” as the original NFTs. Punks can be quite pricy, with one selling for as much as $2 million earlier this year.

NFT in DeFi

Decentralised finance (DeFi) is the umbrella term for applications that let users earn, borrow, and lend crypto assets. The DeFi corner of the industry exploded in 2020 and coincided with the rise of NFTs.

Hence, some DeFi projects adopted NFTs for different purposes. Here are two prominent examples.

Yearn Finance

Yearn Finance lets DeFi investors optimise their yields. The protocol launched an insurance product dubbed Y.insure, with the primary appeal being the use of NFTs to represent the insurance policies that investors buy for their crypto assets.

Yearn Finance developers created these tokens with the ERC-721 standard, and users could redeem them at the end of the insurance period.

PanCakeSwap

PanCakeSwap is a decentralised exchange protocol built on Binance Smart Chain. The DeFi project issues NFTs to incentive users on the platform and increases engagement. The initial distribution of 600 NFTs included tokens redeemable for CAKE, the project’s native token.

How to make money with non-fungible tokens (NFTs)

There are essentially two ways to make money with NFTs.

Minting and Issuing NFTs: If you’re an influencer or artist, minting and issuings NFTs to your followers can be an excellent way to earn more income, especially with the hype around the industry. Sites like Rarible and SuperRare offer tools for anyone to mint and sell NFTs.

Crypto influencers reported earning thousands of dollars from selling NFTs inspired by the artwork or photographs.

Trading NFTs: You can also make money from buying and selling NFTs on popular marketplaces like OpenSea and Nifty Gateway.

While NFTs are not directly exchangeable, some increase in price, making it a potential asset to hold and flip later for a higher price. Additionally, you can follow crypto projects that issue NFTs that are redeemable for crypto or able to sell on a marketplace.

If you want to participate in NFT early releases and drops make sure you don't miss any events by subscribing to the NFT Calendar.

The future is NFTs

Speaking about the company’s decision to acquire the NFT marketplace, Nifty Gateway, in 2019, Gemini CEO Tyler Winklevoss wrote:

“Over time, we believe that both real-world and digital collectibles will migrate onto blockchains in the form of nifties.”

There is a big chance that the prediction does come true, and NFTs become the standard for real-world collectables. To date, roughly people have traded £220 million worth of NFTs according to data from Nonfungible.com.

It is easy to imagine the future adoption of these tokens for art, DeFi, games, sports, Metaverse, and other utilities, thus boosting its market value.

Will famous athletes, celebrities, and companies eventually bring their artwork to the blockchain? If that happens, then the future will be bright for this corner of the crypto industry.

Advantages and disadvantages of NFT

Advantages

- NFTs have the edge over real-world collectables since users can use the blockchain to verify their authenticity or trace it back to the original creator.

- NFT marketplaces’ presence allows the buying and selling of these assets in a decentralised manner and without a third-party. This essentially lowers the cost of investors.

- NFTs are set to solve the inflation problem facing in-game assets, allowing developers to manage these digital economies effectively.

- These tokens support real ownership since buyers immutably gain access to the assets. Neither the immutably gain access to the purchased assets. The issuer cannot revoke this ownership for any reason in the future.

Disadvantages

- The decentralised networks on which developers build NFTs are not user-friendly. This is a critical barrier to mass adoption since most of the targeted audience for these products know little to nothing about blockchain.

- NFTs are not divisible like bitcoins or other currencies. Although this trait is desirable to collectors, it doesn’t support inclusion and sometimes inflates assets’ price.

- The whole future of collecting NFTs hinges on the next generation, placing value on these items and being willing to pay higher amounts for them. Except in cases where the collector has a personal attachment to the article, investing in an NFT could be a speculative and risky investment.

Conclusion

NFTs are turning out to be an exciting offshoot of the crypto and blockchain industry. This article explained how NFTs work, existing use cases in DeFi, and the advantages and disadvantages of NFT tokens.

In the end, one will have to wait and see whether NFTs live up to the hype and become a significant part of the future collectables market. The potential is there, though, and tracking the growth could be an exciting trend to watch.

usdt

usdt bnb

bnb