After learning about why Bitcoin matters, the next question that new investors must answer is how much to invest in Bitcoin.

Table of Contents

Wait!

We hope you already know that you can buy less than 1 BTC, which is another point where prospective investors find confusing. Although 1 BTC is currently above £10,000, you can purchase lower than £5 worth of BTC, which may be around 0.0001 BTC.

Now that we cleared that little confusion let’s look at some of the things you should consider before choosing how much to invest in cryptocurrency.

Factors to Consider When Deciding How Much Bitcoin to Buy

Investment Objectives

Your investment objectives are certainly the first things to consider when it comes to Bitcoin. The reason is not far-fetched. If your goal with investing is to get rich within a few months or a year, then you might want to reconsider adding Bitcoin to your portfolio.

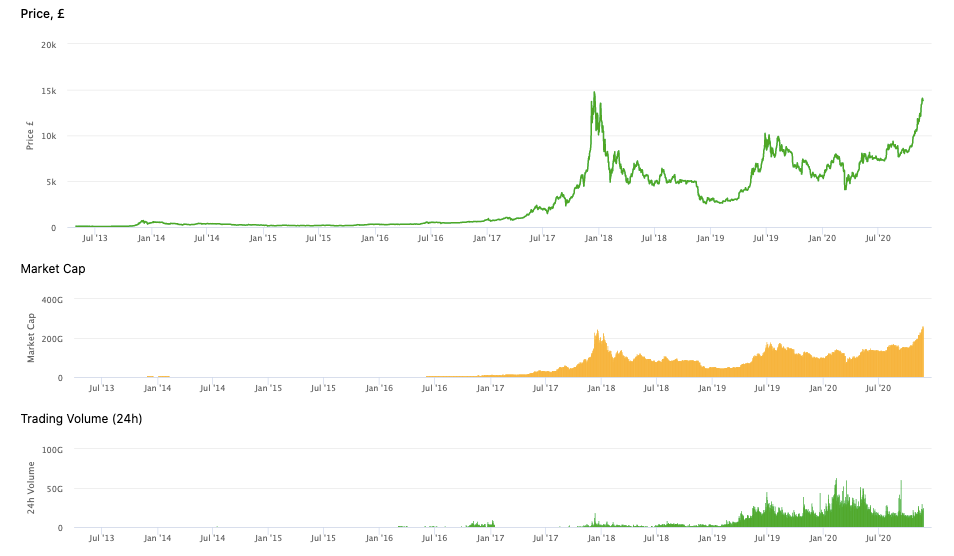

Bitcoin’s historical chart shows that although the cryptocurrency almost always rises in the long-term, it can be subject to high volatility in the short-term, just like other assets.

Bitcoin All-time Chart (Source: BitCourier)

A case in point was 2018 when the cryptocurrency moved from an all-time high of around £15,000 to a mere £2800 at the end of the year. Since then, however, the price has seen steady growth, despite hitting a few although road bumps such as the COVID-19 pandemic-led market crash in March 2020.

The point?

Bitcoin is ideal for those who have long-term investment objectives and maybe not-so-friendly to those seeking short-term gains.

Risk Appetite

If you can already read the handwriting on the wall, then you probably know by now that Bitcoin isn’t for the faint in heart. Its price can go north and south within the twinkle of an eye, and you don’t want your heart rate to suffer from the same wild fluctuations.

Masayoshi Son, the CEO of the Japanese company, SoftBank once admitted to being distracted by watching the Bitcoin price movement after he invested around $200 million. Guess what, he eventually sold it out at a heavy loss.

Therefore, we recommend that you only put in an amount you can afford to lose so that you don’t lose sleep over the Bitcoin price. But, if you have a large capital at your disposal and a healthy risk appetite, you may decide to increase your exposure and then deal confidently with whatever comes next.

Market Timing

Like every other asset, the Bitcoin market has its cycles called bull and bear market. A bull market is a period in time when the price of the asset keeps going up, while a bear market is a period when the price keeps dropping.

A piece of common investment advice is to buy an asset as low as you can and then sell as high as you can. To achieve such a favorable outcome, you do not need to buy the asset when its price is at a record high.

With Bitcoin, for instance, investors who bought in at the 2017 top near £15,000 have had to wait three long years for prices to rebound to those levels. Contrarily, does who bought in at any point during the 2018 bear market took in much profit throughout the past two years.

Therefore, you must consider the market cycle when deciding how much to invest in Bitcoin.

Other investors have found it easier to use the dollar-cost average (DCA) strategy to buy a certain amount of an asset irrespective of its current market price. This strategy aims to have a lower entry point and a higher possibility of seeing profits.

For instance, you could decide to buy Bitcoin worth £100 every month irrespective of the market price. Assuming the Bitcoin price stays within £5,000 to £10,000 during the period of your purchases, then your average buy-in price maybe somewhere around £7,500.

That way, you can profit from any substantial upside movement in Bitcoin price.

Tax Implications

It is good to know how jurisdictional tax laws apply to your Bitcoin investment. We dedicated a full article to explain how Bitcoin Taxes work in the UK and suggest that you read it if you’re just getting started.

There are unique tax implications associated with Bitcoin trading profits, investment profits, cryptocurrency received as payment for goods and services, and assets acquired from an airdrop or network split.

Understanding local tax laws on Bitcoin investing will help you decide whether or not you can handle it and to get it right straight out the door. If you do, then you’re certain to have a good time with Bitcoin without stepping on the toe of regulators.

Successful Bitcoin Investors and How Much They Invested

While many people have lost or gained more money investing in Bitcoin, let’s review some successful Bitcoin investors and how much they invested.

1. Cameron and Tyler Winklevoss (Gemini Exchange founders)

Amount Invested: $11 million in 2013.

Current value: Over $1.4 billion.

2. Kingsley Advani (CEO of Allocations.com)

Amount Invested: $34,000 in 2017

Current Value: Over $1 million

3. Tim Draper (Venture Capitalist)

Amount Invested: $19 million in 2014

Current Value: $548 million

Note: These values fluctuate over time and do not necessarily mean that all Bitcoin investors eventually profit. All the factors we considered above played a part in determining how much these persons made off their initial investment in Bitcoin.

Final Thoughts on How Much Should You Invest in Bitcoin.

Every investor must decide how much to invest in Bitcoin since there is no maximum or minimum bitcoin investment.

The good thing about Bitcoin is that every investor eventually profits or loses in proportion to the amount invested. A 5% increase means a £5 increase for someone who invested £100 and a £50 increase for someone who invested £1000.

Strategies such as dollar-cost averaging provide an excellent opportunity for investors to maximize their returns in the long-term without getting too exposed or trying to time the market.

Conclusion

If you ever asked yourself, how much should I invest in Bitcoin? We do believe you have the answer now. How much bitcoin to buy depends on your risk appetite, investment objectives, the market cycle, and willingness to comply with tax regulations. How much does it cost to invest in Bitcoin? It all depends on you, and we’ll leave you to decide.

usdt

usdt xrp

xrp