Becoming a Bitcoin broker is one of the easiest ways to make money from the leading cryptocurrency, irrespective of its price. It is unsurprising, then, that many are searching for a beginner’s guide on how to become a bitcoin broker.

After all, the global adoption of Bitcoin is still in its infancy. Many individuals who do not know how the cryptocurrency market works would prefer to gain exposure to Bitcoin through a broker instead of a traditional cryptocurrency exchange.

Table of Contents

If one could become a bitcoin broker, they would realize massive profits and, at the same time, play a part in this financial revolution. If you are that person, then read on.

Who Is A Bitcoin Broker?

Generally, a broker buys and sells financial instruments like gold, shares, etc., on behalf of others. However, a Bitcoin broker is essentially an agent or business that buys Bitcoin or sells Bitcoin to its clients. They often do so in exchange for a profit representing a percentage of the trade amount.

For instance, a Bitcoin broker may sell 1 BTC at £13,600, even though its market value stands at £13,400. They pocket the excess value as profit minus any amount spent on facilitating the trade. Similarly, they may buy 1 BTC from sellers at £13,700 even though the market value stands at £13,900. The excess amount represents their profit when they sell the BTC.

A new BTC broker's profit margin may be meagre at the business's initial stage because people would be scared to commit significant funds to an agent with little or no reputation. However, with consistency in providing excellent brokerage services and the continued widespread interest in Bitcoin, you could be making huge profits running into millions of pounds annually.

Why People Need a Bitcoin Broker

There are so many reasons why people may choose to use a Bitcoin broker instead of the traditional buy-and-sell functionalities available on a crypto exchange. Here are some of them

- A Bitcoin broker, especially one that offers large OTC buy and sell, is ideal for customers seeking to liquidate significant amounts of Bitcoin.

- In some cases, Bitcoin brokers also enable low-value transactions. For instance, users can buy as little as $5 worth of BTC which may not be readily available on exchanges.

- A Bitcoin broker typically offers more payment options. For example, Bitcoin brokers on a P2P platform can enable multiple payment options (PayPal, Wise, Adcash, Airtm, etc), sometimes including cash transactions.

- A Bitcoin broker is a desirable option for users in countries where governments restrict access to cryptocurrency. Brokers operate at the P2P level and thus do not leave any trails for surveillance agents.

How To Become A Bitcoin Broker

Many think they need a lot of capital before starting a Bitcoin brokerage business. Interestingly, running a standard Bitcoin brokerage business does not require much money, as you can always start on a small scale.

As a small-scale brokerage, you are a direct point of contact between clients. You can buy BTC from sellers or sell directly to buyers while earning a small profit (usually a tiny spread) from each trade. However, with a large-scale brokerage, the idea is to have a platform where anyone can buy or sell bitcoin instantly. The latter approach is more automated and requires more capital to set up.

Starting a Small Scale Bitcoin Brokerage

This section will provide a step-by-step guide on how you can become a small-scale Bitcoin broker. We understand that not everyone has the financial capacity to run a large Bitcoin brokerage business.

As stated earlier, a BTC broker is responsible for buying and selling the asset on behalf of other people. Starting on a small scale does not make you less of a Bitcoin broker. As a matter of fact, what is required for you is to effectively buy and sell the asset for clients while building your reputation and gathering funds for expansion.

Steps To Starting A Small Bitcoin Brokerage

-

Step 1: Choosing A Business Name

You may not consider this an essential criterion when starting your brokerage business, but it is as vital as every other step.

Your business name or profile name is your customers' first impression of you. If the business name is compelling, it could lead to increased patronage and vice versa.

You may also be thinking long-term about the business, and you do not want a situation where after you have established a profitable brokerage business that has attracted several clients, you opt to change the business name along the line.

-

Step 2: Choosing A Location For Your Business

After selecting a business name, the next step you should consider is where you plan to operate.

One essential factor you should consider when selecting your business location is the regulatory demands within the jurisdiction. Nobody wants their business to be slammed with regulatory charges at its early stage, which could lead to a premature demise.

If the location you intend to operate in is hostile to cryptocurrencies in general, you should relocate to a friendlier region, which would support your business growth.

-

Step 3: Obtaining a Legal License (if Applicable)

With the crypto industry gaining traction recently, regulators globally have shown increased interest in its activities. Research any legal requirements for operating a Bitcoin brokerage in your business location and obtain any necessary approvals.

-

Step 4: Source Where To Get The Bitcoin

Once you have gotten the license, you need to get into the real deal of bitcoin brokerage service. This is when you start buying and selling the cryptocurrency to others.

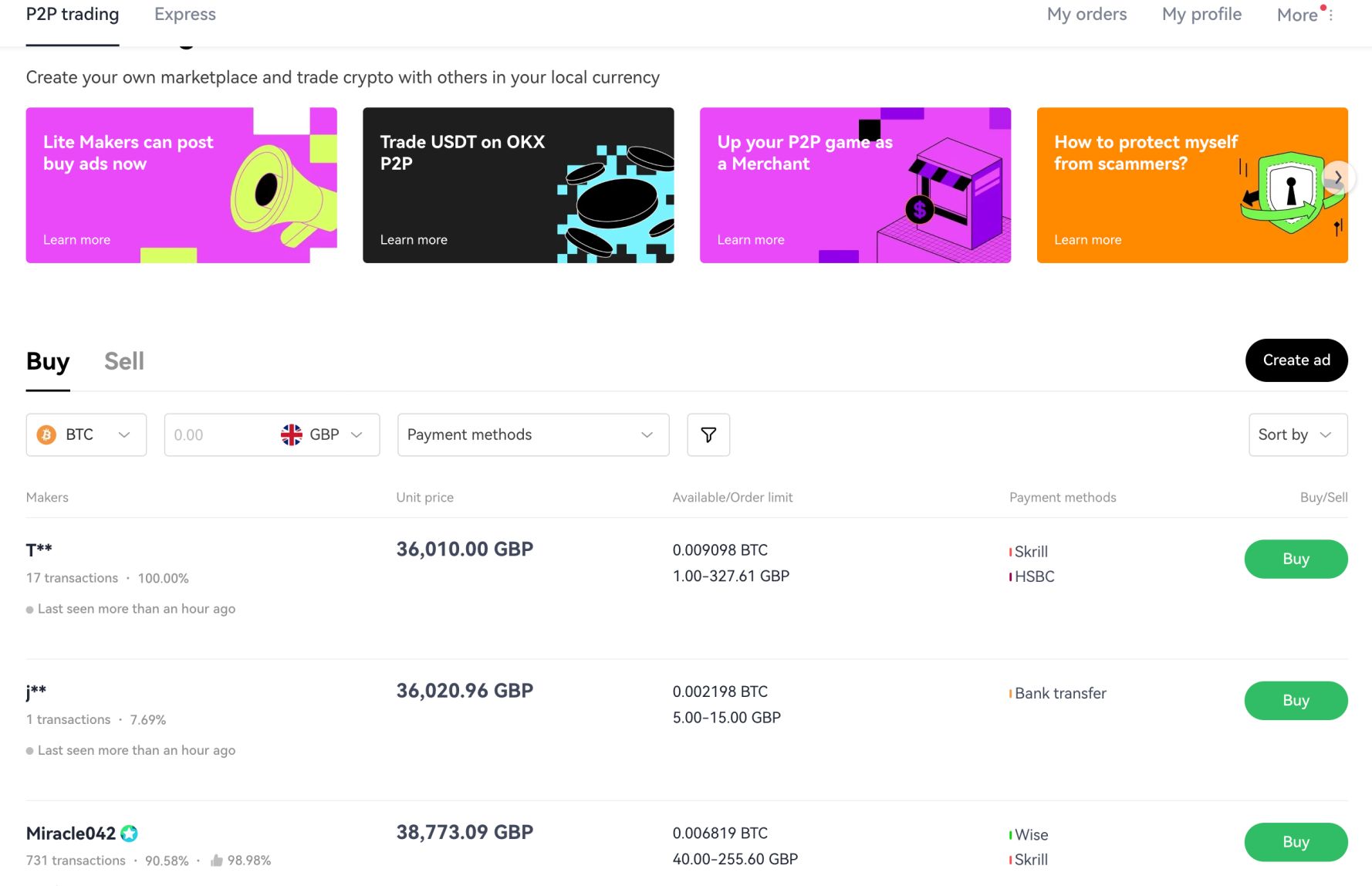

You can register and become a broker on established Bitcoin brokerage platforms like OKX, Bitget, eToro, and others. These platforms are peer-to-peer (P2P) Bitcoin brokerage services that bring buyers and sellers together to facilitate trade.

However, since these brokerage firms have many sellers and buyers, you should conduct due diligence about a user before starting the transaction to avoid being scammed.

A one-time click on a user's profile will show the person's reputation on the platform. Avoid transactions with users who have little or low credibility scores.

You can also get people outside these platforms to buy and sell their BTC at fair rates.

-

Step 5: Set up an Offline Wallet

Since your work will require holding clients’ bitcoins at some point, you must create an offline or cold-storage wallet like Ledger to guard against hackers.

You can invest in a hardware wallet like Trezor or Ledger and transfer any bitcoins you won’t use for a while to the address.

For a hot wallet that you can use on the go, you can use self-custodial mobile wallets like Coinbase Wallet, Trust Wallet, Coinomi, Atomic Wallet, etc.

Additionally, ensure maximum security features on your wallet and exchange accounts. Google's two-factor authentication (Google 2FA), which adds an extra security layer, is compulsory,

-

Step 6: Embrace Effective Marketing

You need the business to be seen by clients. Please, do this by advertising it in the best way you can. You can run ads for the company on popular social media platforms like Facebook and X (formerly Twitter). You can share the message on online forums. You can also hire crypto social media influencers to promote your business if your budget allows it.

Starting a Large-Scale Bitcoin Brokerage Platform

Now that you know what it takes to establish a small Bitcoin brokerage firm, let us delve into how to set up a large-scale enterprise.

-

Step 1: Choose a Location and Business Name

Remember, your business will have to operate from a given location, and the legal requirements will always negatively or positively influence your operations.

You should choose a location that has friendly crypto regulations. Note that a larger Bitcoin brokerage differs from its small contemporary, and the rules applicable to the former would be more tasking.

Furthermore, your business name should try to convince customers to use the platform. You can review the names of top cryptocurrency brokers or exchanges to get a perfect idea for your business.

-

Step 2: Raise Funds

Operating a large cryptocurrency brokerage requires sufficient funding. You’ll need it for the primary set-up, acquiring a regulatory license, and finding the right customers for the business.

You do not want to run low on funds after starting the business. Such a mistake will negatively impact the business' success, so you must gather sufficient funds before starting the business.

You can raise funds from your purse, close friends, family, and venture capital firms as you grow.

-

Step 3: Find a Brokerage Technology Provider

After raising substantial funds, it is time to go into the technicality of the business.

Your platform should have a unique internet-based domain where potential clients can get their business done in a few clicks. Thus, acquire and set up a domain that matches your business name chosen in step one.

Additionally, you need to partner with a trusted Bitcoin brokerage technology provider to set up an easy-to-use platform convenient for everyone.

While some providers may require a higher fee, you should conduct a market survey searching for an operator that offers a good service at an affordable rate.

-

Step 4: Connect With Existing Bitcoin Exchanges

It is hard for a new Bitcoin brokerage platform to convince investors since it has only executed little or no trade. Before opting to use a platform, most clients thoroughly review their previous transactions to check their liquidity profile.

Connecting with an established exchange will boost liquidity and entice more users. Your brokerage technology provider can connect your platform to source liquidity through an API connected to leading exchanges like Binance, Kraken, etc.

-

Step 5: Partner with Fiat Payment Processors

You will need to set up a channel to receive and settle fiat payments from your customers. This can be a headache if you reside in a country where banks are not crypto-friendly.

Most crypto businesses find it easier to partner with challenger banks or small-scale financial institutions with fewer customers. They are more likely to onboard crypto users and often offer a competitive pay structure.

You will also need to partner with debit and credit card payment processing companies to support as many fiat gateways as possible. This way, users can adopt other alternatives to facilitate payment when an option fails.

-

Step 6: Implement Adequate Security Measures

At a time when the cryptocurrency industry reports an increasing number of breaches, specific security measures need to be taken to deter hackers from compromising your brokerage platform.

In recent times, hackers have stolen large amounts of funds and information from reputable exchanges due to negligence on the operators' part.

You may be new, but you can do better by collaborating with established crypto security firms to provide the best security measures for your platform. The action could be by offering security advice or implementing advanced security tools.

Either way, investors need to be convinced that their information and funds are safe with you.

-

Step 7: Choose A Custodial Provider

A custody provider helps provide secure storage for your bitcoin, especially as the amount you transact with clients grows. There is no need to bother about the technical aspect of private key safekeeping when companies can provide such services at little cost.

At the moment, there are only a handful of reliable crypto custodians in the market,

- BitGo

- Xapo

- Coinbase Custody

- Gemini Custody

Choose a custody provider that offers a quality custody solution at a lower management fee.

-

Step 8: Launch a PR Campaign

Once your platform is operational, you must inform the world about your business.

Budget funds to run ads for the business on established cryptocurrency publications, podcasts, YouTube channels, etc. Alternatively, you can use large media companies like Cointraffic and Coinzilla to streamline your PR efforts.

You can offer discounts as welcome bonuses to lure potential traders. Also, consider setting up a referral program to reward early users for helping your business grow.

-

Step 9: Set up a Customer Service Desk

The essence of customer service is to address customers' complaints and inquiries whenever the need arises. The effectiveness of your customer service will determine the success or failure of the business.

Unlike most financial markets, the crypto market works on a 24/7 basis, and you might want to consider establishing a customer service unit that is up and running throughout the timeframe.

-

Step 10: Obtain Regulatory Approval

Depending on your business priorities, this may be the next step after registering your business. Research the regulatory requirements to operate a crypto brokerage in your jurisdiction. In the UK, for instance, the Financial Conduct Authority (FCA) mandates registration for crypto businesses and issues a license to approved companies.

Conclusion

In this article, we highlighted a complete step-by-step guide on how to become a Bitcoin broker. You can become a small or large-scale crypto broker depending on your financial capacity.

Regardless of your decision, it does not make you any less of a Bitcoin broker. You should begin your brokerage business on a small scale to gain the needed experience, which would be useful should you choose to expand.

usdt

usdt xrp

xrp