After missing out on Bitcoin’s 300%+ gain last year, many outside investors are looking for a reliable guide on getting started with cryptocurrency.

There are tons of articles on the internet claiming to be the ‘ultimate’ guide, and we even read through some of them while preparing this beginner’s guide to cryptocurrency. However, any expert would tell you that the crypto industry is so broad that you won't have all you need in one blog post.

Table of Contents

So, we’ll not call this article the ultimate guide to cryptocurrency. But, we promise that it will be the simplest that you can get to understanding what this crypto stuff is all about and how you can start investing.

Ready? Let’s dive right in.

Cryptocurrency Definition

Cryptocurrency is a term coined from two words, cryptography and currency. It refers to a digital form of money (currency) protected and issued by computer codes (cryptography) so that no one can create counterfeits of it.

In simpler terms, a cryptocurrency is just a form of digital money that lives on the internet. You can send and receive it, but no physical copies exist anywhere like you have a dollar or Euro bill.

Also, unlike the Dollar, Euro, or British Pounds controlled and issued by a central bank, there is no central bank for any crypto coins. The developers write everything into the code, and anyone can verify how many units are in circulation and which wallets hold them.

Bitcoin is the first cryptocurrency ever invented. An unknown person or group shared the plan for how it would work in 2008 and launched the network with the support of a few programmers in early 2009.

Today around 7000 cryptocurrencies exist, and even central banks are rumoured to be working on their version of digital currencies.

So, what’s so special about money that you can’t touch?

Well, there are a few things.

First, Bitcoin showed it was possible to create money that would live only on the internet, and not be controlled by any government or corporation.

Additionally, bitcoin had a fixed supply (21 million coins), meaning that its value could increase if more people adopted it both as a form of money. When people started to buy and sell goods and services with bitcoin, each unit’s price started to go up.

Hence bitcoin became useful as a means of exchange, and as a speculative asset.

Many cryptocurrency networks that exist today offer these two properties of bitcoin but do not boast the popularity of the leading cryptocurrency. Some also provide additional features, such as faster settlement, and allowing applications to be built on top of them.

To summarise this section, it’s worth noting that there are two main reasons why most people dive into cryptocurrencies. Either to use it as a means of payment or exchange or as a speculative investment asset.

Types of Cryptocurrencies

We mentioned earlier that over 7000 cryptocurrencies exist right now, remember? Well, the truth is that not all of them qualify to be called cryptocurrencies. Perhaps, going through the classification below will help you understand why we said so:

Cryptocurrencies: Cryptocurrencies are coins that have their digital ledger where transactions between users are recorded. This ledger is also known as the blockchain, and recorded transactions are almost irreversible.

Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Polkadot DOT), Cardano (ADA), Binance Coin (BNB), VeChain (VET), and some other coins qualify to be called cryptocurrencies. They have their ledgers and are mostly not controlled by a single company.

Crypto Tokens: We noted earlier that some ledgers allow developers to build applications on top of them. In most cases, most of these applications create their crypto token to enable users to send and receive transactions.

So, because these tokens are created on another blockchain or ledger, we simply refer to them as tokens, not cryptocurrencies.

Uniswap (UNI), Nexo (NEXO), Chainlink (LINK), Compound (COMP), and Aave (Lend), are perfect examples of crypto tokens.

Stablecoins

The value of both cryptocurrencies and tokens fluctuate based on their current market demand and supply metrics. However, another class of tokens called stablecoins aims to solve the price fluctuation problem.

They are usually pegged to a fiat currency like the dollar or Euro at a 1:1 ratio. For instance, the most popular stablecoin, Tether (USDt) is pegged to the US dollar. So, one unit of it is always equal to 1 USD.

The goal of stablecoins is to let crypto users send payments without worrying about the price of their asset dropping in the process. Investors can also buy into stablecoins to preserve their investment value if there’s a price drop or increase.

Other popular stablecoins include USD Circle (USDC), Gemini Dollar (GUSD), Dai (DAI).

Where to Buy Coins?

Whether you’re going to use a cryptocurrency for payments, or as an investment, you’ll need to buy some first. Hence, we’ll review in this section some of the places where you can buy coins for the first time.

Exchanges

Cryptocurrency exchanges are the most popular venues for buying cryptocurrencies like Bitcoin. You can pay for your purchase using a credit or debit card, a bank transfer, or other payment channels supported by the platform.

If you live in the UK, you can check our list of the top cryptocurrency exchanges for customers in the region. Alternatively, you can check if any of the platforms listed below are available for users in your location.

Most Popular Exchanges

- Gemini (here you can find detailed Gemini review)

- Coinbase

- Binance

- Kraken

- Bitfinex

- Luno

The process of creating an exchange account typically involves, signing up, providing your personal information as part of a KYC measure, and setting up security measures. Once you’re done, you can proceed with making a purchase or depositing funds that will let you do so. We’ll cover these in more detail in the next section.

Bitcoin ATMs

At the time of writing this article, over 14,000 Bitcoin ATMs exist in 71 countries globally. These machines let anyone use their credit or debit card to buy bitcoin or any other cryptocurrency supported by the vendor.

The process of buying is almost as straightforward as deposit or withdrawing money via a traditional ATM. The slight difference is that you’ll need to provide a Bitcoin address where the purchased funds would be sent.

You can check out CoinATMRadar to locate the closest Bitcoin ATM in your jurisdiction.

Buying Your First BTC on Binance

Binance is one of the most popular cryptocurrency exchanges, and we chose them for this guide because they offer a variety of payment methods, and channels to buy bitcoin. They also support a wide range of cryptocurrencies, a feature that comes handy for anyone looking to diversify their crypto portfolio.

Let’s work you through buying your first units of bitcoin on Binance:

Step 1: Create an Account on Binance.com

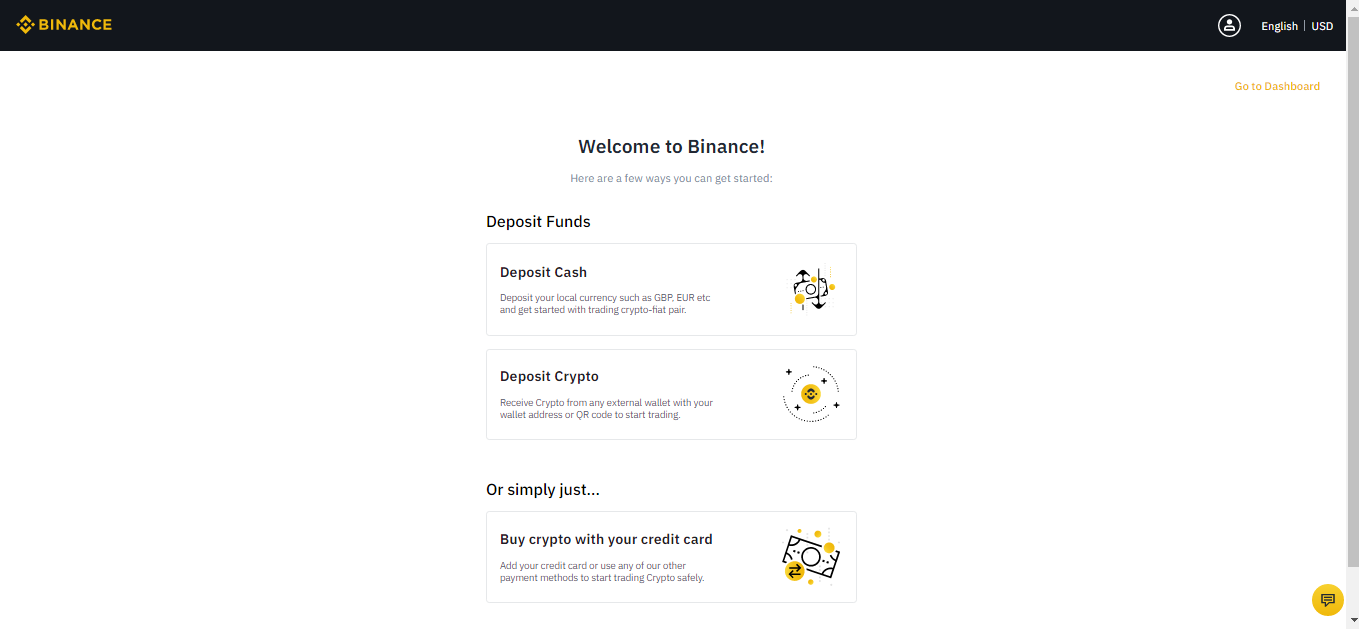

Insert your email address and make a strong password. Enter the confirmation code sent to your email to complete the registration. After you confirm your registration, you will see the screen below.

Select the buy with a card option.

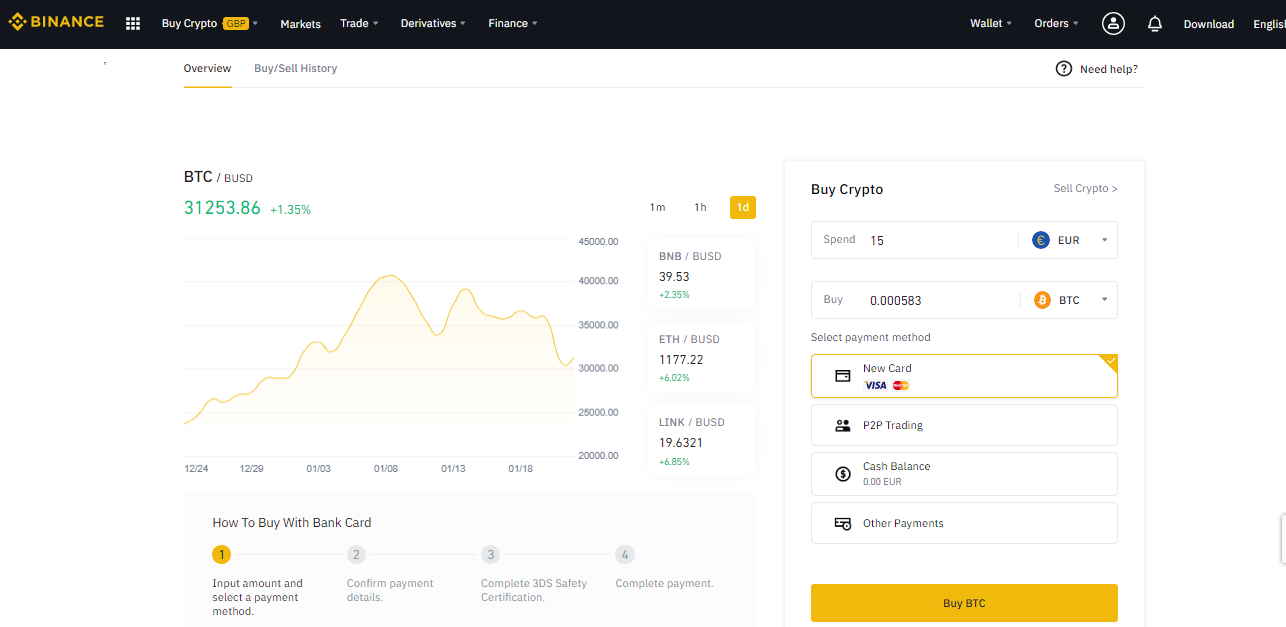

Step 2: Buy with a Credit/Debit card.

Choose your local currency and enter the amount you want to spend. Binance will automatically show you the equivalent in BTC or any other cryptocurrency you select. Make sure that the payment option is in New Card, then Click Buy BTC.

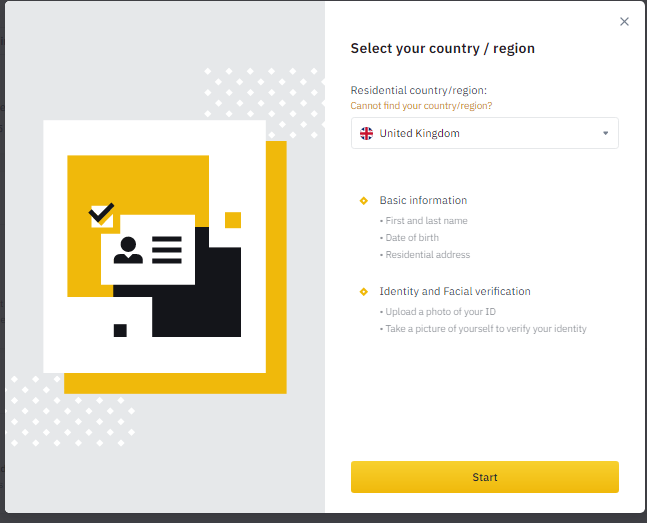

3. Complete the Identification Process

Fill in your country, and other required information such as:

- Full names

- Date of birth

- Address

- Proof-of-identity document (Passport, Driver’s License, National ID card).

- A selfie with a paper that has Binance and the registration date written on it.

4. Complete the Purchase

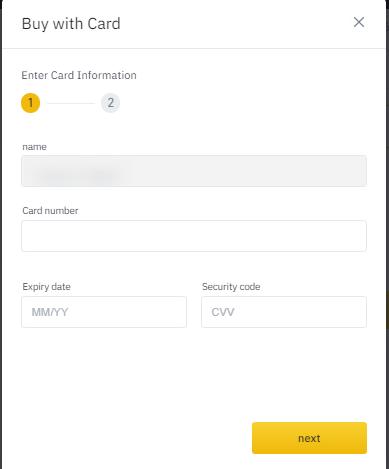

If the verification process is successful, Binance will redirect you to the purchase page for your earlier transaction, prompting you to enter your card details. If the redirect didn’t happen, you could go back to their Buy page to start the transaction again.

Enter your card details, confirm the order details and complete the transaction.

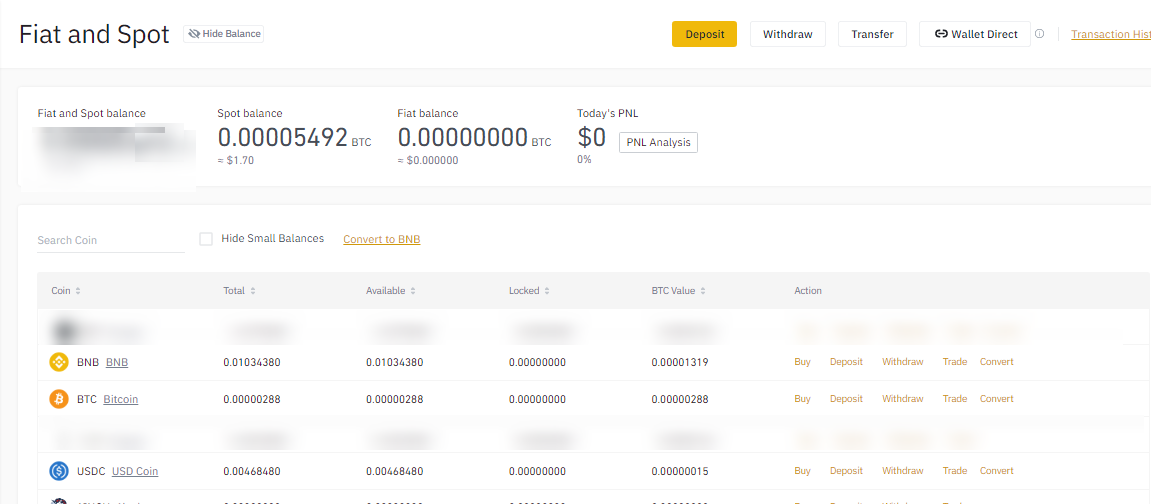

5. View the purchased BTC on your account.

Once Binance processes the transaction, they will add the purchased BTC to your account. Congrats! You just bought yourself some BTC. On the top right of the website, go to Wallet > Fiat and Spot to view your BTC balance.

You will also notice the option to deposit or withdraw, and we’ll talk about this a little later.

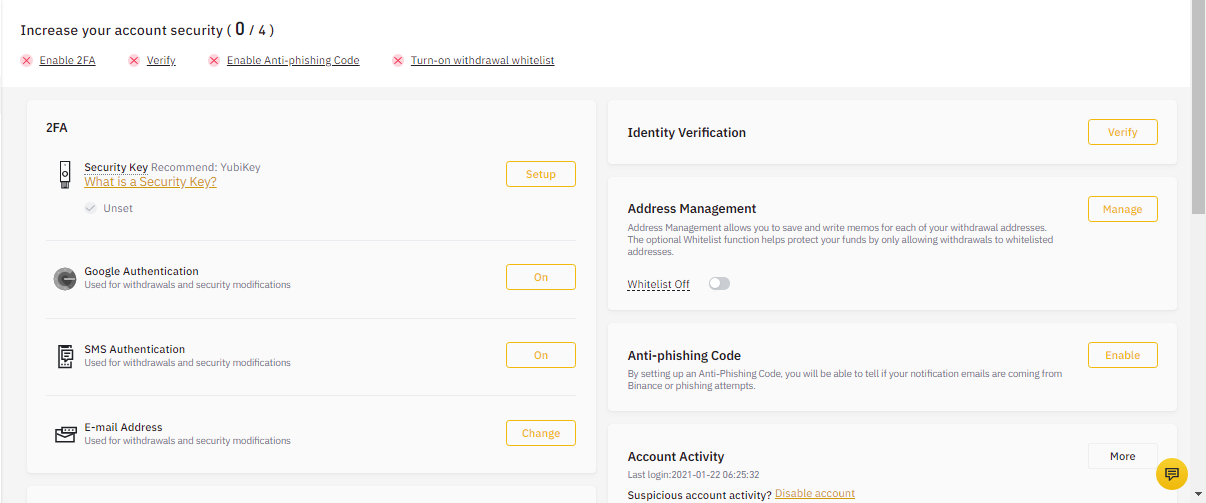

6. Enable Security Features

Go to Profile > Security to enable advanced security features on your account. We strongly recommend two-factor authentication via the Google Authenticator app. You can read this guide from Binance on how to do it.

How to Send Coins

Now that you bought some crypto, you can send it to someone else who accepts it for payments. You can also transfer it to a personal wallet that you hold the keys further to secure your assets (more on this later).

To send cryptocurrency, you need two things:

- A wallet with a balance (you already have this on Binance)

- The recipient address is (a string of letters and text where bitcoins are sent and can be spent from).

You can ask the person you want to send BTC to provide you with their address. If you’re withdrawing to your address, you need to copy it to your device’s clipboard.

Now log back in on Binance and complete the following steps:

- Go to Wallet > Fiat and Spot.

- Find the Withdrawal button near your BTC wallet.

- Enter the amount to withdraw and paste the address you copied.

- Double-check the entered details for possible errors.

- Confirm your withdrawal by completing the security checks. (Note: Binance charges a 0.0005 BTC fee for withdrawals)

- Wait for network confirmation for withdrawn bitcoins to arrive at the address.

Note that withdrawing or sending crypto from Binance is almost the same as with most exchanges. However, this is not the ultimate way to send cryptocurrency since you do not fully control the wallet you have on Binance.

Storing Your Crypto Assets

Now, you know how to buy crypto coins, we need to tell you that storing your cryptocurrency on an exchange or sending it from there is not the best option. Here are some of the best ways to store cryptocurrencies.

Hardware Wallets

A hardware wallet is considered one of the safest places to store your cryptocurrency. The reason is that these devices keep your coins offline and well away from the reach of hackers.

The two most popular hardware wallets on the market are the Ledger Nano S, and Trezor One. You can read our in-depth review of these two devices, to pick which one is best for your portfolio.

Hardware wallets typically provide you with a 12-24 word phrase that you’ll put away in a safe place. In case you lose your device, you can regain access to your funds by entering these words (also called seed-phrase) on another device or even on a mobile wallet that supports wallet recovery.

The best practice is to set up a hardware wallet, and then withdraw funds from your exchange account to the wallet address. This way, you won’t worry about the exchange getting hacked, going offline when you want to transact, and other kinds of third-party risks.

Non-Custodial Mobile Wallets

Mobile wallets come handy as you will not need to be sending transactions from your hardware device often. They are also an excellent alternative to storing funds on cryptocurrency exchanges since they give you control of your funds, and allow for additional functions such as setting your preferred transaction fee, etc.

Popular Mobile Wallets

- Trust Wallet

- Coinomi

- Coinbase Wallet

- Atomic Wallet

How to Set Up a Mobile Cryptocurrency Wallet (Coinbase Wallet)

- Install the wallet from Google Play Store or Apple Store

- Click Create a New Wallet and accept legal terms.

- Pick a username (not available on other wallets)

- Choose Private on the next screen to disable username visibility.

- Enable Fingerprint or PIN authentication.

- Select Backup Now and write down your seed phrase manually by writing it down on paper or use the cloud backup.

- To send funds to your Coinbase wallet, click Receive on the app home.

- Select the coin and copy your address.

- Withdraw funds from your exchange account to this account for regular use.

- You can also send or withdraw from this wallet to your hardware device anytime.

Monitoring Your Portfolio

The most exciting and time-consuming part of investing in cryptocurrency is monitoring your portfolio. Doing so won't have to be a problem if your investment strategy is simply to buy Bitcoin or maybe a few coins and put them away for a couple of years.

However, if you’re going to be an active investor, you’ll need to check prices and your portfolio’s performance regularly or at least, once in a while. You can browse through our list of cryptocurrency portfolio trackers to choose your pick.

Our top pick is BlockFolio because it is available on mobile devices, easy to set-up, and free to use.

If you’re a UK investor and want to check prices in British Pound (GBP), you can use Bitcourier’s coin index which tracks the performance of the 100 largest cryptocurrencies by market cap.

Risks Associated With Investing

Most guides on how to get started with cryptocurrency investing fail to list the associated risks or provide little information about them. So, let’s get it straight. As much as investing in cryptocurrencies can be profitable, investors could also lose all their money within a short time.

Here are some associated risks you must know:

- Volatility

The crypto market is one of the most volatile markets in the world. It is not unheard of for the price of Bitcoin to move by 30% in either direction a single day. The same holds for other coins, and the latter can exhibit even more violent volatile movements.

Therefore, we recommend that you only invest money that you can afford to lose, or at least put away for a long time. This way, you won’t have to worry about the short-term price action. Over the long-term horizon, Bitcoin is almost sure to become profitable for any investor, although we cannot say the same for other cryptocurrencies.

- Exchange Hacks

If you remember what we mentioned earlier about not leaving your coins on exchanges, then you already understand this risk. Exchanges are susceptible to security breaches and other counterparty risks resulting in a loss of customer funds or personal information.

The best way to guard against this risk is to leave on these platforms’ money that you trade actively. Once you make a substantial purchase, you can withdraw it to a non-custodial mobile wallet or your hardware wallet.

- User Error

While crypto-related platforms are usually responsible for large-scale losses, some user errors could also result in significant losses.

Common user errors include sending funds to the wrong address or a different blockchain, storing passphrases online, or failing to log out their exchange accounts when using public computers.

Always double-check addresses before transferring funds. Also, do not store your passwords online or access them via public computers or places. If you must, ensure that you log out, clear cache, and leave no account traces.

Additional Tips for New Crypto Investors

Be Patient

Like any other investment, you need a lot of patience to make profits on your cryptocurrency investment.

Therefore, do not rush to buy Bitcoin simply because the price has gone up or sell because the price has dropped so much.

As we explained in our article on the best time to buy cryptocurrency, the most profitable strategy remains to buy when prices are low, and sell when they go high. Unless you’re purchasing an allocated amount periodically (dollar-cost averaging), it is best to wait for days when the market drops due to negative or other events.

Do Your Own Research (DYOR)

Before you invest in or buy any crypto-asset, spend quality time to research the project. Key metrics to investigate include the project team, number of users, reviews on cryptocurrency blogs, the project milestones, and roadmaps.

Do not base your investment on a friend’s advice, a social media post. Most influencers are paid to promote coins or advise others to buy it because they hold it in their portfolio.

Doing your own research is the best way to find out which coins are worth investing in, and for how long you should hold it.

Invest What You Can Afford to Lose

Given the risks cited earlier, we want to reiterate that you only invest money that you can afford to lose or not need for a long while. The cryptocurrency market is still nascent and could be adversely affected by regulation and other adverse events such as project hack or failure.

Lastly, if you must spend your credit card on buying Bitcoin or other cryptocurrencies, ensure that it is an amount you can conveniently payback, even if prices stay down for a long-time.

Crypto Terminologies for Beginners

Since you’re going to start investing in cryptocurrency, let’s introduce you to some slang and terminologies you need to know.

HODL: This is a knowingly misspelt version of ‘hold’ and used to describe the art of holding crypto investments for as long as it takes for them to become profitable.

FUD: Stands for ‘Fear, Uncertainty, and Doubt,’ and refers to largely misleading news that often affects market prices negatively.

FOMO: Stands for the ‘Fear of Missing Out’ and refers to an often uncalculated investment into an asset simply because the price increased. Its antonym, JOMO (Joy of Missing Out) refers to the joy of failing to buy an asset before the price drops sharply.

Bear Market: A period when the price of assets generally tends to decline. This is usually an excellent time to buy.

Bull Market: A period when the price starts to go up because of new capital flowing into the market. This is usually the best to sell or take some profits off your initial investment.

Conclusion

Getting started with cryptocurrency is an exciting thought. But as many unfortunate investors have come to learn, doing so without proper guidance can result in substantial losses, and even lead some to conclude that crypto is a ‘scam.’

This article sought to provide the best crypto for beginners guide, covering information on how to get into the industry, the risks associated, and tips that every investor must keep in mind.

Hopefully, most of the top cryptocurrencies will live up to the potential embedded in them, and eventually reward early investors, including you.

usdt

usdt bnb

bnb