“Alt season” is one of those slang new crypto investors will come across. If you’re going to diversify your portfolio and invest beyond Bitcoin, then you need a clear understanding of what alt-season is. This knowledge positions investors for the profit-making opportunities often associated with altseasons.

If that sounds like something you’re interested in, then let’s dive right in!

Table of Contents

What does the Altcoin season mean?

Altcoin season (alt season for short) is a time in the crypto market when alternative coins tend to outperform the leading cryptocurrency, Bitcoin. Alternative coins, or altcoins, is a term generally used to refer to any cryptocurrency that isn’t Bitcoin.

Any period in the market where most altcoins outperform Bitcoin is referred to as an alt-season. This is usually marked by the Bitcoin dominance ratio dropping lower than before the season's start.

What Is the Bitcoin Dominance Ratio?

This refers to the size of Bitcoin’s market cap in relation to all other cryptocurrencies (altcoins.)

For instance, if the entire crypto market cap is £1 trillion, and Bitcoin’s market cap is £600 billion, then Bitcoin dominance will be at 60%, while altcoins will stand at 40%. In a typical altcoin season, altcoins bite into Bitcoin’s share of the entire crypto market cap.

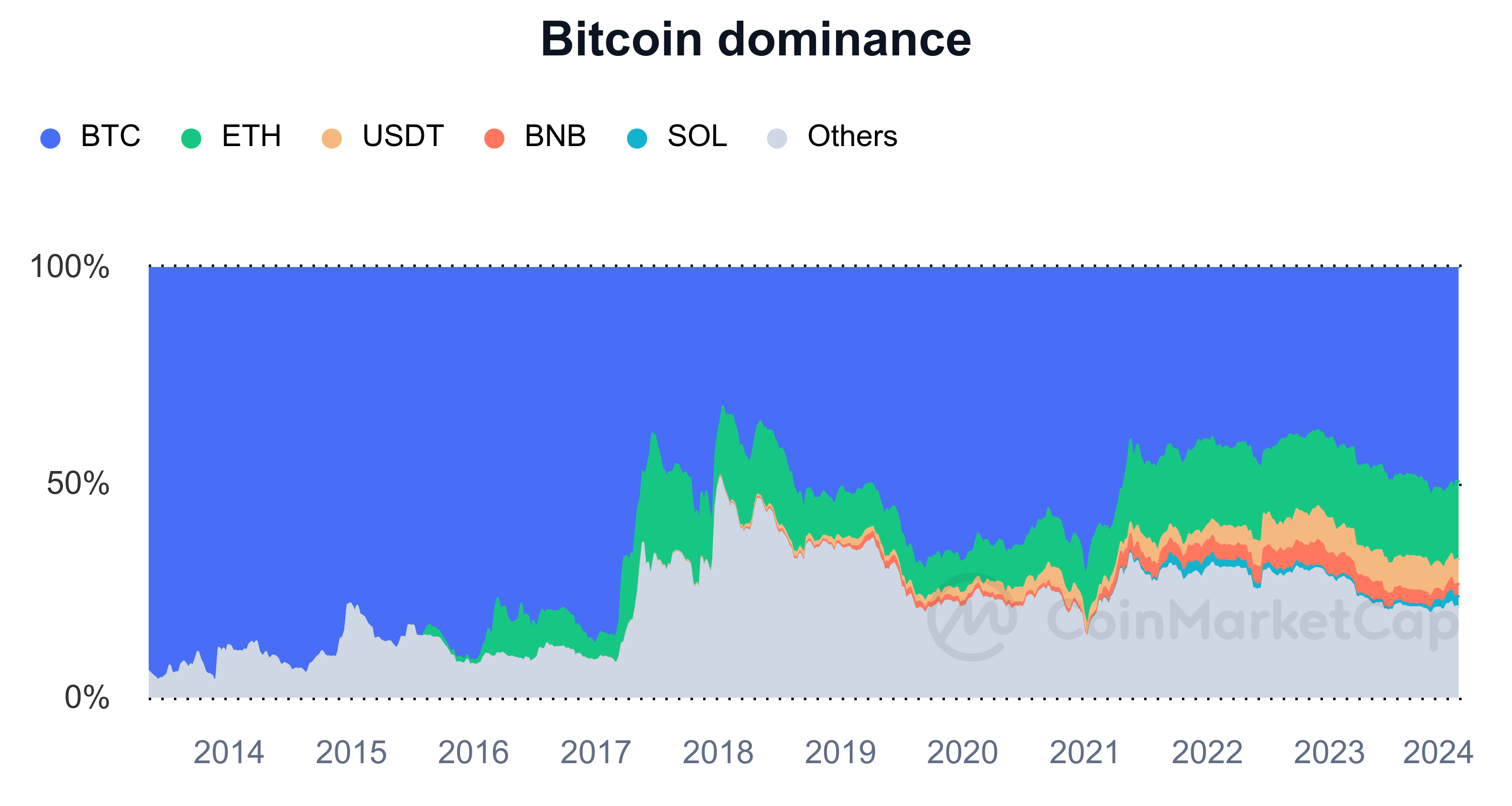

The chart below shows how Bitcoin’s dominance has trended since late 2013 (Bitcoin is displayed in blue). During mid-2017 and early 2018, when Bitcoin’s dominance fell as low as 39%, altcoins contributed a larger share of the overall market cap. We also observed a similar trend between late 2020 and mid-2021 when Bitcoin's dominance ratio dropped from 70% to 41% In both instances, the value of altcoins grew significantly as investors rotated profits from their Bitcoin investments into altcoins.

Many experts argue that calculating Bitcoin’s dominance ratio vs. altcoins is fundamentally flawed. While Bitcoin has a fixed supply, there is no limit to the number of cryptocurrencies and tokens that startups can create. For instance, while there were only a few ten thousand cryptocurrencies in 2020, the number proliferated to over one million coins within the next two years. The ease of creating these new coins means that Bitcoin’s dominance will likely shrink as more altcoins launch.

Meanwhile, no one can pinpoint how long an altseason lasts. It could range from a few weeks to months and, maybe in the future, last for years. At the end of the alt-season, the profits made by investors tend to flow back into bitcoin, and the bitcoin dominance gradually recovers.

What Causes Alt Season?

Altseasons are typically caused by any new trend in the cryptocurrency industry that leads to the launch of many new projects. For instance, in 2017, the rise of initial coin offerings (ICOs) provided a new avenue for startups to raise funds even when they had no working product. At the time, there were roughly 4000 cryptocurrencies, with their value sucking Bitcoin’s dominance levels.

Many new projects entered the market, with prices soaring and the alt market having a blistering run. As things turned out, though, over 90% of projects that launched that year turned out fraudulent. Many late investors lost their money, contributing to a 2018 bear cryptocurrency market.

Fast forward to 2020, the rise of decentralised finance (DeFi), non-fungible tokens (NFTs), and play-to-earn games, led to the creation of even more cryptocurrencies. The idea behind DeFi is to provide financial products that run independently of a central administrator. New coins are being created to power such products, with some projects having 2-3 tokens for their community.

The frenzy got even more serious during the 2020-2021 bull market as the advent of memecoins led to the creation of hundreds of thousands of cryptocurrencies, including Shiba Inu (SHIB) and Floki (FLOKI). The memecoin culture has carried on and has become an ever-present trend in the cryptocurrency space.

As a result, more than two million cryptocurrencies now exist, and Bitcoin’s dominance has hovered between 40% and 60% in the past few years. Many altcoins have also gained considerable market share over the same period, keeping up with Bitcoin's growth.

Meanwhile, although there have also been periods of peak altcoin performance throughout the industry’s history, altcoin prices remain correlated mainly to Bitcoin. Any sharp increase in Bitcoin prices often has a similar effect on altcoins, albeit not simultaneously. Also, any rapid decline in Bitcoin’s price takes a toll on the market, with alts shedding more gains.

How to know altseason is coming

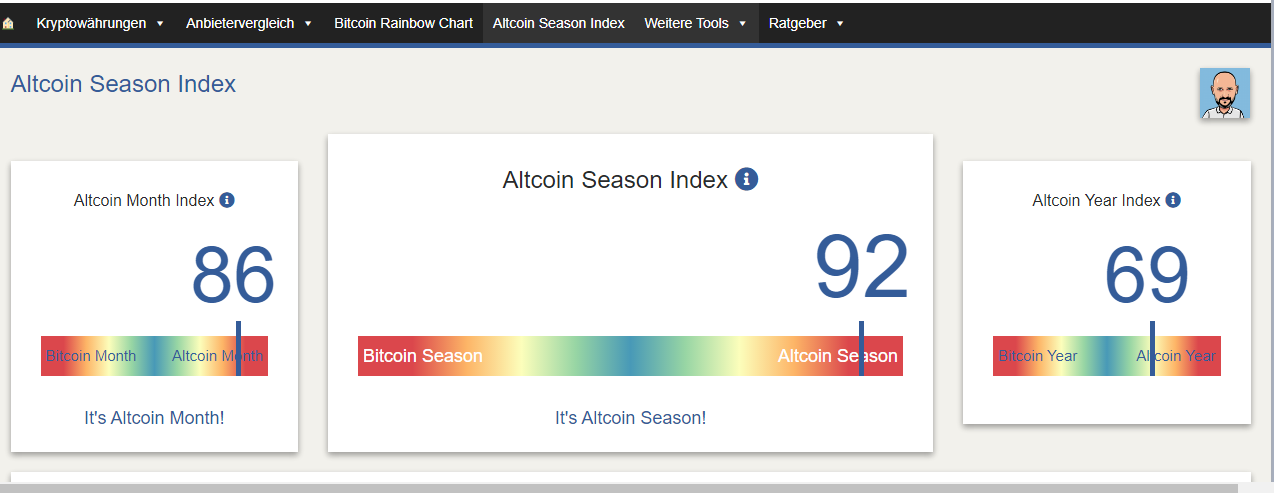

There is no perfect indicator of an incoming alt-season. However, Blockchain Center provides a tool for gauging market sentiment and determining whether the market is in Bitcoin or alt-season.

(Source: Blockchain Center)

The tool defines an altcoin season as a three-month period where 75% of the top 50 coins perform better than Bitcoin.

Industry observers also believe that the following signs theoretically confirm that an alt-season is around the corner:

- New Trends: As noted earlier, the emergence of trends that accelerate the creation of many new coins can cause Bitcoin’s dominance to shrink and many of the newly launched altcoins to grow in value.

- Large Cap Altcoins Gain: When prominent altcoins such as Ether (ETH), Solana (SOL), and Binance Coin (BNB) gain more in price than Bitcoin, it could be considered an indicator that value might as well flow to other altcoins, thus kicking off an alt-season.

- The decline in Bitcoin Dominance: Historically, a bullish market performance for Bitcoin often ends with a period of gains for altcoins as soon as BTC takes a break. This trend is usually a result of new investors pouring money into altcoins while thinking that Bitcoin is expensive and that altcoins still have a large room to grow.

Hence, any steady and gradual decline in Bitcoin’s dominance indicates that alt season is around the corner.

Is it altseason right now?

It was indeed altseason at the original time of writing this article in 2021. Bitcoin’s dominance dropped from 69.1% in late December 2020 to 49% in April 2021 and eventually hit its bottom at the 40% level in

Within the said period, many altcoins, including Ether (ETH), Binance Coin (BNB), Cardano (ADA), Solana (SOL), Uniswap (UNI), and Compound (COMP) returned over ten to twenty-fold gains for investors. Dogecoin (DOGE) jumped over 6000% percent, and many altcoins mimicking the meme-cryptocurrency also saw similar returns.

However, the market eventually retraced, and the alt season ended. The massive gains turned into losses, with most altcoins losing over 80% of their value at the market peak. Most altcoins have remained at such depressed price levels with only a handful poised to ever recover above their previous highs.

How to make money in the altcoin season

There is a saying that “proper preparation promotes proper performance.” Hence, the best way to make money in the altcoin season is to prepare before it arrives. One can do this by conducting extensive research on new altcoin projects and trying to find one with strong potential.

While that might seem difficult, certain indicators can help you find the best ones to invest in before the alt-season. For instance, you can prioritise investing in altcoins that have a strong development team, a working product, and a loyal community. A simple way to gauge this metric is to go through the project's Github page and social media communities to monitor engagement.

Meanwhile, altcoins, linked to cryptocurrency exchange platforms, often tend to perform well in an altseason. This is because these platforms onboard more users during peak market performance. Additionally, they can afford to fund new use cases from the revenue they generate from their business.

You can make money by simply buying and holding solid altcoin projects before or just after an altseason kicks off and then selling them later for a profit. Another approach is to actively trade the assets and reduce exposure to coins that have already delivered massive gains during the alt-season. Alternatively, you can wait until the end of the alt-season to buy coins cheaper in preparation for the next uptrend.

Previous Alt Seasons

December 2017 – January 2018

Many new coins launched near the peak of Bitcoin’s epic run in 2017, thanks to Ethereum’s smart contract functionalities. Investors hot off the heels of massive gains from Bitcoin, while others, fearing they missed out, jumped into the altcoin market. Many alts hit new all-time highs that they’d never revisit until 2021 (off the back of Bitcoin completing a 100% recovery to its previous all-time high).

At the peak of the early 2018 alt-season, Bitcoin’s dominance dropped as low as 37.84%.

December 2020 – May 2021

This was perhaps the longest alt-season to date ever recorded. It followed nearly the same pattern as 2018, with many new coins launching and hitting record highs in weeks and months. Some of the biggest winners included memecoins such as Dogecoin and Shiba Inu, which joined the rank of most popular cryptocurrencies by market capitalization.

During the run, Bitcoin’s dominance level dropped from over 70% to 40%. However, the leading cryptocurrency eventually rebounded in the coming year as the hype for altcoins evaporated, and many popular crypto projects such as FTX, Three Arrows Capital, and Celsius failed.

It is worth noting that the above examples are the most extended altseason periods. However, there have also been “mini-alt seasons,” including in May 2018 and April 2019.

Conclusion

The “alt season” concept will likely continue as the crypto market matures. There will be periods when alts outperform Bitcoin and a time when the leading cryptocurrency roars back to reclaim an outsized share of the market.

Over time, though, one might expect Bitcoin’s dominance to wane, at least to an extent. This is especially because of the numerous coins flooding the market, and there is no limit to the number of coins and tokens being created.

However, what is sure, at least for the foreseeable future, is that Bitcoin will always represent a significant share of the crypto market, and then there will be “alt-seasons” for those who know how to use it to their advantage.

usdt

usdt bnb

bnb