People who learn about Bitcoin for the first time do so through their friends, a social media post, or the media hype that comes when prices are ‘mooning.’ But getting past the question, “what is bitcoin?” is not something that not everyone does.

Many who took action on bitcoin when they learned about it first, became millionaires. In contrast, some dismissed it earlier as having no future, and now wish that they did otherwise. In either scenario, these investors would have made better choices if they understood what bitcoin is all about.

Table of Contents

This article thoroughly explains what Bitcoin is and how it works. It also reviews its advantages and disadvantages, with the hope of helping potential learners and investors determine whether or not it is worth their time.

Let’s talk Bitcoin now!

What Is Bitcoin?

Bitcoin, as described by its inventor, is “a peer-to-peer electronic cash system.” It is a form of electronic cash that users can send and receive without a financial institution or bank.

You can think of it as a way to send money to your friends without using a bank account or a centralised payment gateway like PayPal. It is just you and your friend transacting, and no one else can stop or reverse the payment.

No such decentralised payment gateway existed before Bitcoin. People who attempted to create such an ‘internet currency’ always failed because such systems cannot prevent fraud or exist without a central authority.

Just bear in mind that Bitcoin was the first truly “internet-native” monetary network not controlled by any central entity or government. If you understand that, then the next part about how it works will probably make more sense.

How Does It Work?

The Bitcoin network is essentially a connection of computers (peers) around the globe running the same software. Anyone can become a peer by installing and running the Bitcoin software on their computer.

You can also install a bitcoin wallet on your mobile device to send and receive bitcoins.

How Are Bitcoin Transactions Recorded?

When people transact money today, they record the transaction in a book or any other kind of ledger kept by the parties.

Similarly, the ledger that records all bitcoin transactions is called the bitcoin blockchain. This ledger keeps a record of which person owns which coins, and updates itself as people transfer coins from one address to another.

In the real sense, bitcoins are just balances on the ledger, and the right to spend it.

Then there is a bitcoin private key (comparable to your ATM pin). This key (a string of letters and numbers) gives a bitcoin user the right to spend coins held at a specific address. If a person loses their private key, they can no longer spend the coins, and it is lost forever if there’s no backup.

A bitcoin address is more like a bank account number or email address you can share with peers and receive money. It is usually an alphanumeric combination, and also available as a QR code.

Since these addresses are not private, other peers can view their balances and transaction history, even though they can’t use this to identify the owner in real life.

How does the network verify that transactions are accurate?

A group of peers called miners does this. Miners are essentially individuals and corporations that purchase and install computers or hardware to verify and add bitcoin transaction records to the blockchain.

When a person sends bitcoins, their transaction is collected with that of other users into a memory pool (mempool). Think of the mempool as a list from where miners select the next transactions to process and add to the bitcoin blockchain.

Every ten minutes, miners select some transactions from the mempool, verify that they are accurate, and bundle them into a block. This block is then added to the existing bitcoin blockchain and marked as confirmed for the users that transferred the bitcoins.

Note that the process of mining isn’t done manually. Instead, the miners set up hardware that executes these operations. Miners are also always in a competition to find a block, and the more computing power they have, the higher their chances of finding a block.

What do miners get as a reward for their role in verifying transactions, and protecting the network? Their reward is what brings new bitcoins into existence.

How Are New Bitcoins Created?

There will only be 21 million bitcoins with 18.6 million BTC already in circulation as per the protocol’s design.

The Bitcoin network issues or mints new bitcoins units as a reward for every block successfully added to the chain. So, the miner that finds and mines the block receives the new coins (called coinbase reward) and fees paid by users for all transactions included in it.

At the time of writing this article, the coinbase reward stands at 6.25 BTC. In other words, 6.25 BTC is minted approximately every ten minutes. That would be the same as 900 BTC in a day, and 328,500 BTC every year.

However, it is vital to note that a periodic halving of block rewards regulates the bitcoin supply schedule. This means that the number of BTC issued per block is cut in two after some time.

According to the Bitcoin code, the supply issued per block is halved every 210,000 blocks or approximately four years. This unique issuance model means that the supply of bitcoins available to the market depreciates as the years go by.

On the other hand, if demand is sustained or increased, then each bitcoin becomes more valuable.

At its launch, the Bitcoin network issued 50 BTC per block. Let’s see how the block rewards have depreciated over time.

- First Halving (2012) = 25 BTC

- Second Halving (2016) = 12.5 BTC

- Third Halving (2020) = 6.25 BTC.

Using the above historical record, one can discern that after the next halving, the rewards issued per block will decline first to 3.125 BTC in 2024, and then 1.5625 BTC in 2028.

Inevitably, the price for each bitcoin has to go up for miners to remain profitable and in business. Many economists believe that the bitcoin halving has largely contributed to the cryptocurrency’s price growth throughout the last decade. It is also believed to be a catalyst behind the four-year price-cycle that often ends at a new all-time high price for the cryptocurrency.

History of Bitcoin

Before the creation of Bitcoin, many programmers had worked on creating an internet-based currency. However, their efforts failed because of two main reasons.

Since the coins being produced were files on individual computers, there was a risk that users could spend their coins twice (double-spending) since other peers didn’t have a transparent record of the transactions.

Simultaneously, users must trust a centralised entity to define the coins’ supply, issuance, and transaction confirmation.

BitGold by Nick Szabo, B-Money by Wei Dai, DigiCash, and HashCash were prominent ‘electronic cash’ efforts that preceded Bitcoin.

Interestingly, Bitcoin’s inventor borrowed leaves from these earlier attempts and even referenced some of them in the Bitcoin explainer document (whitepaper). Bitcoin also greatly improved on them by introducing a fully decentralised system for recording (the blockchain) and verifying transactions (the process of mining).

Who Invented Bitcoin?

Satoshi Nakamoto, an unknown person or group, invented Bitcoin. In other words, they used the above name to communicate with the group of developers that worked on and tested earlier versions of the Bitcoin software.

Based on their communications and subsequent departure, ‘Satoshi’ did not want to be personally identified with Bitcoin, for fear the project fails to meet the goal of being fully-decentralized or shut down by governments.

Governments are good at cutting off the heads of a centrally controlled network like Napster, but pure P2P networks like Gnutella and Tor seem to be holding their own – Satoshi Nakamoto (2008)

Satoshi initially communicated with other developers via an email list, and eventually on the BitcoinTalk forum. Their last message to the community dated Dec 13, 2010, was that “more work” needed to be done to protect the network from DDoS attacks.

Just before their departure, Satoshi also spoke out strongly against an early saga involving WikiLeaks. The whistleblower website wanted to use bitcoin to bypass a blockade by traditional payment systems like Paypal, Visa, and Mastercard.

Satoshi wrote: “The project (Bitcoin) needs to grow gradually so the software can be strengthened along the way. I make this appeal to Wikileaks not to try to use Bitcoin. Bitcoin is a small beta community in its infancy. You would not stand to get more than pocket change, and the heat you would bring would likely destroy us at this stage.”

WikiLeaks later adopted Bitcoin, and since then no one has heard from Satoshi who did not want the ‘infant’ network to face such early exposure. For its part, Bitcoin thrived as a community-led project as the developers continued from where Satoshi left-off.

Key Dates in Bitcoin’s History

October 31, 2008: Satoshi releases the Bitcoin whitepaper to developers on the Cryptography mailing list.

January 3, 2009: The Bitcoin network goes live. Satoshi includes in the genesis block a headline from The Times Newspaper, highlighting plans by the government to bail out banks in the wake of a global financial crisis. The message reads:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

January 12, 2009: First Bitcoin transaction from Satoshi to a late developer, Hal Finney.

February 6, 2009: First bitcoin exchange, Bitcoin Market goes live.

May 22, 2010: Canadian programmer, Laszlo Hanyecz pays 10,000 BTC for 2 Papa John Pizza’s, the first real-world transaction paid for with bitcoin. This date is now marked as Bitcoin pizza day, Those coins worth around $500,000,000 at the time of writing this article.

February 9, 2011: 1 BTC reaches parity with the USD at $1.

November 28, 2012: First Bitcoin halving cuts block reward to 25 BTC as coded into the program.

Key Features of Bitcoin

Decentralisation

The Bitcoin network has remained through to the ethos introduced by its founder and remains the most decentralised payment system and blockchain network. There are approximately 1 million individual bitcoin miners and over 100 million persons invested in or transacting with the cryptocurrency.

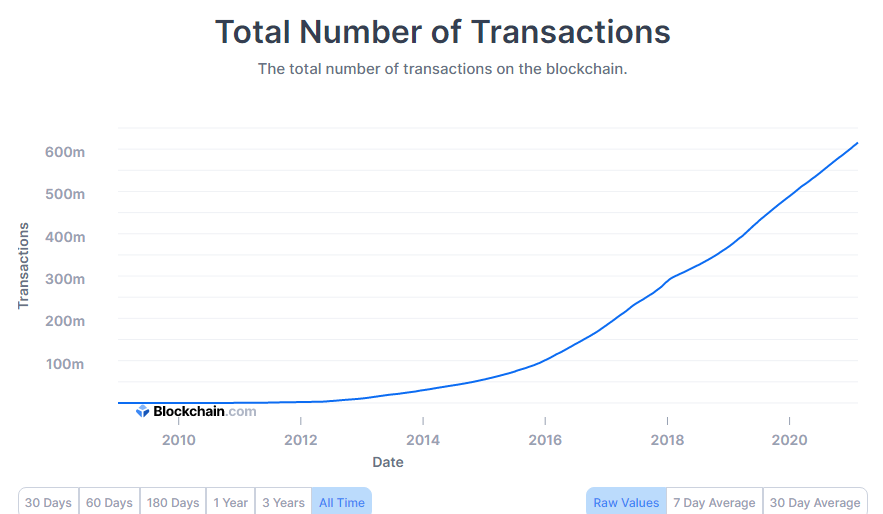

To date, the network has processed over 600 million transactions, all without verified by the decentralised peer-to-peer miners’ community. The network also boasts a 99.98% downtime, not matched by any centralised payment system over the same period.

Censorship-Resistant

It is impossible to confiscate bitcoins since the proof-of-ownership is only a private key that the owner can put away in a safe place, or even memorise.

Individuals’ ability to store wealth, in such a simple, yet powerful proposition has attracted many libertarians to bitcoin. Users can move any amount of bitcoins across borders with more ease than they can move other assets, without worry about a government seizure, etc.

Divisibility

Prospective bitcoin investors often assume that they must buy 1 BTC to get started. However, Bitcoin is divisible into eight decimal places. The smallest unit of Bitcoin is called a satoshi and is worth 0.00000001 BTC.

Satoshi also made provisions in the protocol for possible modifications of bitcoin’s divisibility to even smaller fractions if the need arises in the future. Therefore, one can always buy a fraction of bitcoin. Some exchanges and platforms even allow for $5 purchases, boosting inclusion for anyone who cares to own a piece of the bitcoin pie.

Why are Bitcoins Valuable?

A common argument against bitcoin is that the cryptocurrency has no intrinsic value and is not backed by any government. However, a closer look at the characteristics of existing forms of money suggests that such debates are shortsighted.

Fiat currencies such as the USD and GBP are acceptable forms of money because the governments say they are. Otherwise, cash bills would just be paper with ink printed on it.

Besides having no physical versions, bitcoins already possess the same attributes as money, including being divisible, durable, transportable, and accepted as a medium of exchange for goods and services.

Bitcoins, thus, are valuable because you can exchange them for monetary value. As long as people are willing to accept it as a means of payment, bitcoin is money.

The supposedly missing fraction is that users do not need to trust a government to regulate its issuance as with fiat currencies. Also, they are not based on physical commodities such as gold or silver.

Instead, the Bitcoin principle is based purely on mathematics and openly-verifiable computer code. The vast number of people using bitcoin today trust that it is money, and not just units of coins sitting on a computer.

How Secure is Bitcoin?

The Network

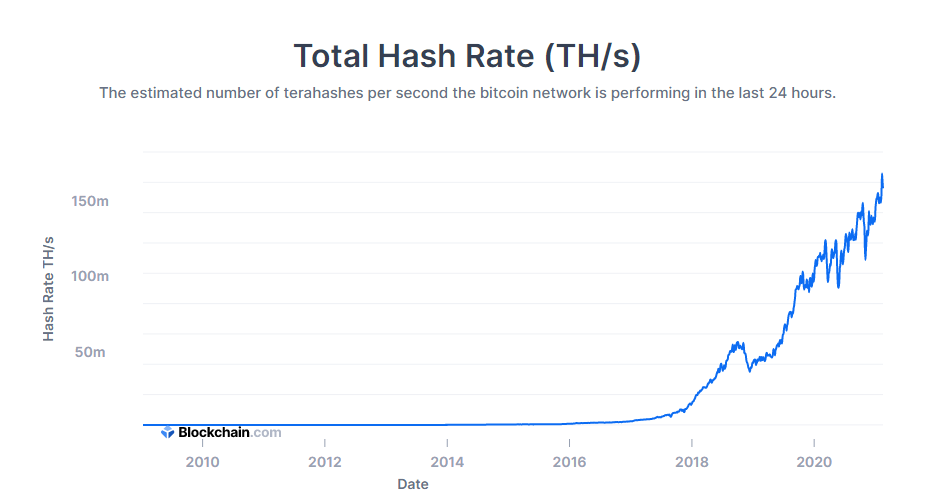

The Bitcoin network is as secure as the amount of computing power (measured in hashes) dedicated by miners to verify transactions, and earn rewards. At the time of writing, the current hash rate stood at 160 million terahashes per second (TH/S) and has moved in the same trajectory as the BTC price.

Recent research estimates that excluding the time and effort in setting up infrastructure, it would take approximately $15 billion to control 51% of the Bitcoin network’s computing power, and thus engineer an attack.

However, the possibility of the honest miners moving over to a new chain at the earliest hint of such an attack, renders the attempt almost futile. The possible market panic created could also cause prices to plunge significantly and create further losses for the attacker.

On the other hand, any intending attacker could for a fraction of $5.5 billion starts contributing honestly to secure the Bitcoin network, and earn rewards for doing so. In simpler terms, Bitcoin’s design to incentivise honest participation makes the network fundamentally secure against attacks.

Personal

The promise of individuals storing their wealth without the need for a third-party comes with significant responsibility. Millions of bitcoins have been lost over the years due to users failing to back up their private key, or storing their bitcoins on an exchange platform.

However, today, both retail and institutional cold storage and custody solutions keep bitcoin holdings 99.9% secure against theft. For individuals, a hardware wallet like Ledger or Trezor has proven effective for securing bitcoins for the long-term.

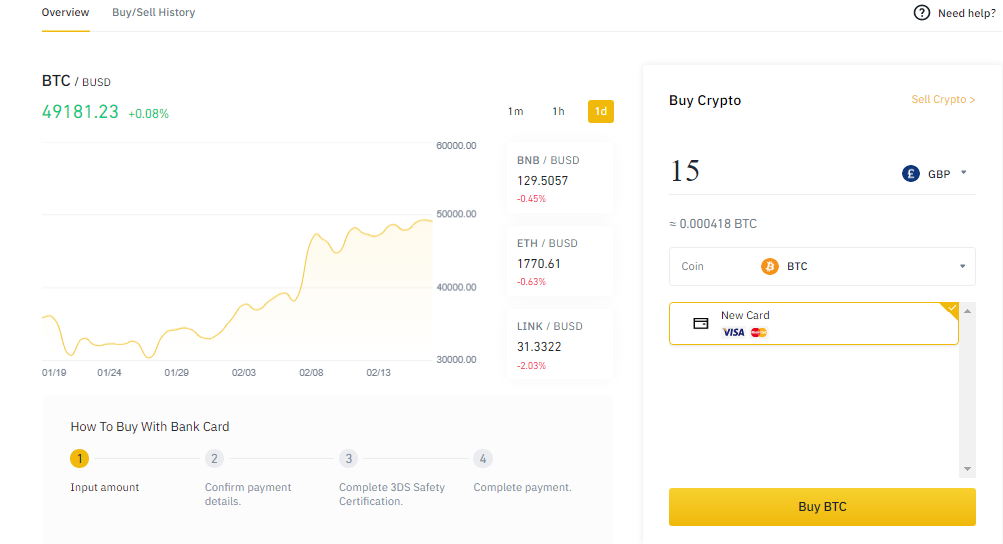

How to Get Bitcoin

Getting Bitcoin today is a lot easier now than it was in its early days. You can buy Bitcoin today using a cryptocurrency exchange or broker service, and complete the payment via bank transfer or a credit/debit card.

After determining how much to invest in bitcoin, you can check our list of reputable cryptocurrency exchanges in the UK to decide which one supports the payment method you intend to use.

Here’s a step-by-step guide on how to get Bitcoin on Binance, one of the most popular cryptocurrency exchanges:

- Register on Binance.com.

- Verify your identity as part of the know-your-customer (KYC) process.

- Go to Buy Crypto and choose your preferred currency from the menu provided.

- Choose the Pay with Credit/Debit card option.

- On the next page, select Bitcoin as the coin to buy.

- Enter the amount to spend, and review the amount in BTC.

- Click Buy BTC and enter your card details on the next page.

- Review the order details and complete the purchase.

- If successful, you’ll find your BTC by going to Wallets > Fiat and Spot.

- Congrats! You just bought BTC and can withdraw to a personal wallet using the Withdraw option and pasting the address on your external wallet.

How is Bitcoin Used?

Bitcoin has two primary use cases:

1. Means of Payment

Bitcoin can be used as money if the transacting parties own bitcoin wallets. This allows for the cryptocurrency to be used as a peer-to-peer version of electronic cash just as Satoshi Nakamoto wanted.

Upon receiving the bitcoins, the recipient can convert them to cash via a crypto-to-fiat exchange. When not intended for immediate use, the sender can store the bitcoins in their wallet, and sell anytime they choose in the future.

Today, many online merchants and businesses accept bitcoin as a means of payment.

Some of these merchants include:

- Etsy

- Bloomberg

- ExpressVPN

- ProtonMail

- Microsoft

- Shopify

- Namecheap

Although most of these companies convert BTC to fiat upon receiving it from customers, others do not. ProtonMail, for instance, confirmed in 2019 that the company doesn’t sell its bitcoin holdings, and “haven’t done so for years.”

2. Speculative Asset

Bitcoin’s limited supply and growing adoption created a speculative use case that is fast eclipsing its function as a means of payment. From near non-existence at the start of the last decade, 1 BTC is worth almost $50,000 in February 2021, yielding massive returns for investors who speculated on its growth.

Data from September 2020 showed that over 30% of the total supply hasn’t moved in three years, while a staggering 60% hasn’t moved in one year.

These dormant holdings undeniably represent the army of investors who buy and hold BTC with the hope of selling them at a higher price in the future. The approach could create a supply shock that sends prices even higher as there are fewer bitcoins on the market for new investors.

Bitcoin Advantages

1. Ideal for Retail and Merchants: Bitcoin transactions are irreversible and do not collect sensitive personal information like traditional payment methods. Thus, merchants can avoid fraudulent chargebacks and the risk of losing customer information to a security breach.

The user also benefits since there is no room for unwanted charges and renewals associated with credit cards, banks, etc. There is also no need for delaying payments because of bank holidays.

2. Final Transaction Settlement: The bitcoin network has facilitated billions of dollars worth of transactions, providing a cheaper and faster alternative to existing payment systems.

While bitcoin transactions could take within a few minutes and days to settle during peak network periods, the settlement is usually final compared to traditional payment networks that work with book balances and settle at a later date.

Improvements such as transaction batching, and the Lightning Network has made bitcoin transactions even faster, cheaper, and ideal for micropayments.

3. Store-of-Value (SoV): Bitcoin’s short-term volatility means it is still far off from being the ideal store-of-value for individuals looking to preserve their wealth. On the other hand, it almost always appreciates in the long-term. This makes it a hedge for individuals and corporations seeking to protect or even earn better yields on their cash reserves.

In the U.S publicly listed companies such as MicroStrategy, Square, and Tesla already hold a portion of their corporate balance sheet in Bitcoin as a hedge against inflation.

4. Censorship-Resistant: Compared to fiat currencies and other assets, bitcoin transactions are more resistant to governments’ influence. Individuals can store their wealth without worrying about a seizure or having their transfers intercepted.

5. Job Opportunities: There is no concise metric for measuring the number of people employed globally by the bitcoin economy. Bitcoin-related businesses include miners, exchanges, ATM operators, fund and asset managers, media companies, wallet developers, etc.

The cryptocurrency market birthed by Bitcoin’s emergence is worth over $1.5 trillion, creating even more jobs in the process as the industry edges closer to mainstream adoption.

Risks Associated with Bitcoin

1. Low Global Adoption: Although bitcoin has achieved a degree of adoption, many people and businesses still do not know about it. They won’t accept it as a means of payment.

Therefore, most users often must convert bitcoin to fiat before they can spend it. While this does prevent people from holding bitcoin, the network needs an increased adoption to reach its full potential.

2. Permanent Loss: Since Bitcoin holders primarily have to safeguard their assets, there is a heightened risk of losing them to human error with little to no chance of ever recovering them.

For instance, there is no way for users who send coins to the wrong address or fail to back up their seed phrase to recover them correctly.

Regarding such a risky situation, Satoshi had said: “Lost coins only make everyone else's coins worth slightly more. Think of it as a donation to everyone.”

Out of bitcoin’s total circulating supply, estimates suggest that around 3-4 million BTC belong to users who have lost their private key. Prospective investors must understand this risk before choosing to invest in bitcoin.

3. Volatility: The price of Bitcoin is highly volatile and may pose significant risks for impatient investors.

BTC moved from an all-time high of almost $20,000 in December 2018 to around $3200 twelve months later. Conversely, the price of Bitcoin more than doubled between December 2020, and February 2021.

Prospective investors can mitigate this risk by only investing an amount they can afford to lose, and also not need to touch for a long time. Meanwhile, experts believe that Bitcoin’s volatile nature will subside as soon as it reaches a certain mainstream adoption level.

4. Criminal Activities: In the early days of bitcoin, drug traffickers on the darknet (an online marketplace for selling illegal goods) adopted it as a primary payment method. Bitcoin was well suited for this purpose because of its pseudonymous nature, and there were no sophisticated tools for tracking these transactions.

Interestingly, research by analytics firm Elliptic mentions that only 0.5% of all Bitcoin transactions in 2019 were used for illicit purchases, suggesting a decline in the use of bitcoin for nefarious reasons.

However, even a fraction of bitcoin used by criminals and money launderers has earned it a bad name in the media and remains one of the significant risks posed by the cryptocurrency.

5. Energy Consumption: The amount of electricity needed to keep the Bitcoin network up and running far eclipses many smaller countries. Critics of the technology often point to this large consumption as proof that Bitcoin is harmful to the environment, and could worsen as the network grows.

At this point, though, it is worth noting that a significant portion of bitcoin mining is done with excess energy from electricity producers and renewable energy sources. Thus the energy effects are less harmful than portrayed.

6. Slow Development: While there has been no shortage of upgrades to improve the Bitcoin protocol, the network’s large community means that large-scale upgrades could take several years to take effect.

This means that newer blockchain protocols can introduce changes a lot faster, although only a few can boast the same level of decentralised ethos that Satoshi built bitcoin on.

Frequently Asked Questions About Bitcoin

Has Bitcoin Been Hacked Before?

No. After over a decade of existence, no one has successfully hacked the Bitcoin network and its protocol. The network has maintained a 99.99% uptime, barring two outages and fixes implemented in its early years. There have also been several upgrades to the Bitcoin software to improve its performance or resolve vulnerabilities reported by developers.

Can’t Someone Buy the Entire 21 million BTC supply?

No. Such a feat is theoretically impossible for many reasons. For one thing, we noted earlier that not all of Bitcoin’s supply is available in the open market.

Additionally, bitcoin’s near $1 trillion global market cap is controlled by demand and supply forces. Any excessive demand could push prices even higher, and even at that, not every user will be willing to give up their holdings.

Is Bitcoin Legal?

Bitcoin is not considered legal tender in any country. Simply put, it is not backed by any central bank or government.

However, many regulators enact regulations to govern the use of bitcoin by individuals and businesses.

For instance, in the United Kingdom, the Financial Conduct Authority (FCA) issues a license to bitcoin-related companies and regulates their operations. Her Majesty’s Treasury has also provided crypto tax guidance for individuals investing in or transacting bitcoin.

Before buying bitcoin, prospective investors must determine what local laws apply to the cryptocurrency and then try to remain compliant.

Conclusion

Getting past the question, “what is Bitcoin?” is a critical step for anyone looking to get involved with this technological breakthrough.

This article answered that question and provided a comprehensive overview of how bitcoin works. It also considered the benefits and risks associated with Bitcoin, as well as frequently asked questions about the network.

Bitcoin has done more than survive throughout the last decade and has the potential to live through the next. It has reached a level of adoption that perhaps its creator could only imagine, and at this point, it would be intelligent to pay attention.

usdt

usdt xrp

xrp